- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Bank of England Synopsis

News & Analysis

Thursday the 7th of February saw Bank of England Governor, Mark Carney, stepped back up to the mark to take on a barrage of Brexit related economic questions after giving a speech about the BoE’s stance on their current assessment of the negotiations.

Economy

The speech started not looking so good for the UK economy, with the Governor stating that growth had slowed for the UK in late 2018 and slowed further still in early 2019, however, Carney attributed that to the world economy slowing. He then went on to state that global growth is expected to dip below trend in coming quarters, which will weigh on UK net trade. Governor Carney continued to say that some of this of this slowdown has to be attributed to the uncertainties of Brexit and that these uncertainties could lead to greater-than-usual short-term volatility in UK data.

Speech Key Point Synopsis

Inflation

The Governor went on to talk about CPI inflation and the effect that the sharp fall in petrol prices since November has had, going on further that the Monetary Policy Committee (MPC) judges that as this unwinds, they expect to the CPI Inflation rate rise to the mandated 2% level. Mark Carney went on to say that ‘the weaker near-term outlook is likely to lead to a small margin of slack opening up this year’, meaning that the projected demand growth exceeds the pace of supply growth leading to rising inflation, which could see the inflation rate settle a little above the 2% target.

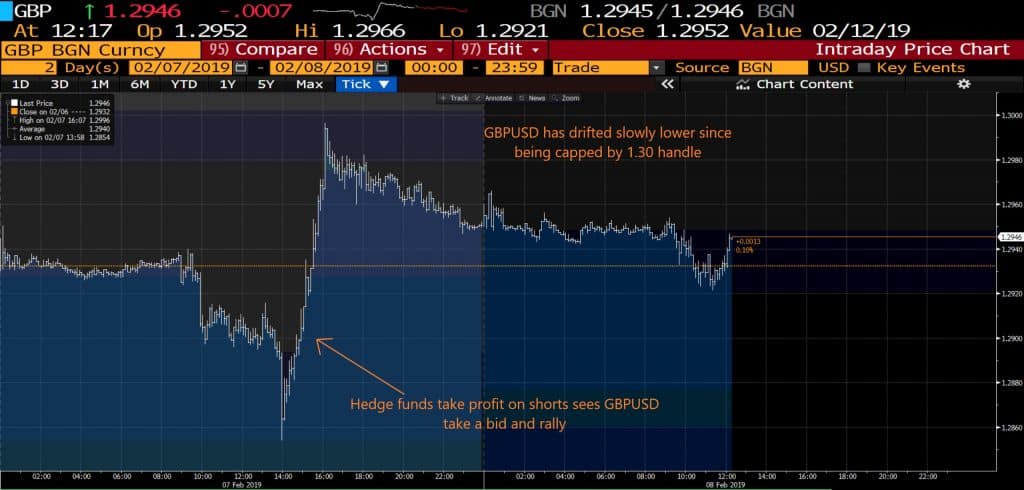

GBPUSD Intraday Chart – Price tumbles as BoE speech commences

As we can see from the intraday chart, as the BoE speech starts, and Governor Carney talks about some of the risks of both Brexit and the Global economic slowdown and the effects of both of these on the UK economy. However, once the speech was over the Q&A section of the meeting things began to turn around for the pair, that is not necessarily completely due to what was being said but also the tone behind it.

The Brexit Impact

Although Governor Carney stated that the UK ‘Economy as a whole is not yet prepared for no deal Brexit’ that doesn’t mean that everybody is stagnant just waiting for a good Brexit deal, the BoE inflation report shows that half of the companies have begun to implement no-deal Brexit contingency plans. Carney also stated that although the ‘Fog of Brexit is causing short term volatility’ the ‘UK fundamentals are solid’. So although some of what was being said could be deemed as negative the follow-up statements from the BoE indicate that the MPC is being very accommodative with their policy and approaching whatever Brexit scenario they are given with the aim to keep inflation low and the UK economy healthy.

2-day GBPUSD Chart shows post-BoE rally as Hedge Funds unwind shorts

The combination here of a central bank prepared to combat whatever is put in front of it alongside what feels like a large amount of Brexit downside risk already priced in is what caused Hedge funds to unwind and take profit on their short positions, which can be seen in the above chart by the rally that directly followed the BoE speech.

Although it feels like some of the Brexit downside risk is priced in currently, the volatility in the GBP crosses is definitely at a high right now, with each Brexit piece of news causing either a sharp decline or a seemingly even sharper rally. Fair to say that GBPUSD will be a staple to keep an eye on for the foreseeable future.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: The Bank of England, Bloomberg

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Reserve Bank of New Zealand – First 2019 Policy Statement!

The Reserve Bank of New Zealand (RBNZ) will make its first interest rate decision for the year 2019. We will see the Press Conference, Rate and Monetary Policy Statement on Wednesday. Market participants are expecting the RBNZ to adopt the same dovishness seen lately by major central banks The Reserve Bank of Australia The Federal Reserve B...

February 12, 2019Read More >Previous Article

Margin Call Podcast – S1 E4: Khim Khor | Executive Director & COO of GO Markets

Khim Khor (Linkedin) is GO Markets’ COO and Executive Director. He started out as a Sales Manager for the Asia business, when this demographic w...

February 6, 2019Read More >