- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Powell indicates higher interest rates to come as Oil jumps again

- Home

- News & Analysis

- Central Banks

- Powell indicates higher interest rates to come as Oil jumps again

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisPowell indicates higher interest rates to come as Oil jumps again

22 March 2022 By Adam KahlbergUS indices were down today as Jerome Powell indicated that the Federal Reserve is going to increase interest rates at a higher and faster rate than currently in place. US equities dropped after Powell’s speech. Ultimately the major indices ended relatively flat by the close of trading. The Nasdaq closed down 0.40% after taking a breather from its recent buying momentum. The Dow Jones was dragged down by Boeing after a 737-plane crash in the mountainous Guangxi region in China. The Boeing share price saw a 5.74% drop on the opening before recovering a little to close the day down by 3.60%. The S&P500 was also choppy as it reacted the Jerome Powell’s speech but finished flat.

The FTSE 100 showed gains as an uplift in commodities supported the index with oil spiking. This provided strength for the UK’s biggest oil companies BP and Shell with both rising by 3%. The FTSE ended the day up 0.51% whilst the DAX was down 0.60%.

Commodities

Brent Crude Oil made a powerful move overnight rising 7.91% to 116.33 USD. This came as European Union officials debated whether to place sanctions on Russia’s lucrative energy sector to pressure the country over its invasion of Ukraine. An embargo on Russian oil similar to what the USA and the UK have done may have drastic implications for the EU in which 40% of its gas is imported from Russia. Natural gas prices also continue to remain in the upper end of their recent price range. Gold remains near its recent support levels ending the day at 1929 USD per ounce.

Cryptocurrency

Bitcoin had a choppy day as BTC/USD ended flat overall. Ethereum was the better performer closing the day with a 1.87% rise. The ETH/USD continues to hold just below the $3000 resistance level.

FOREX

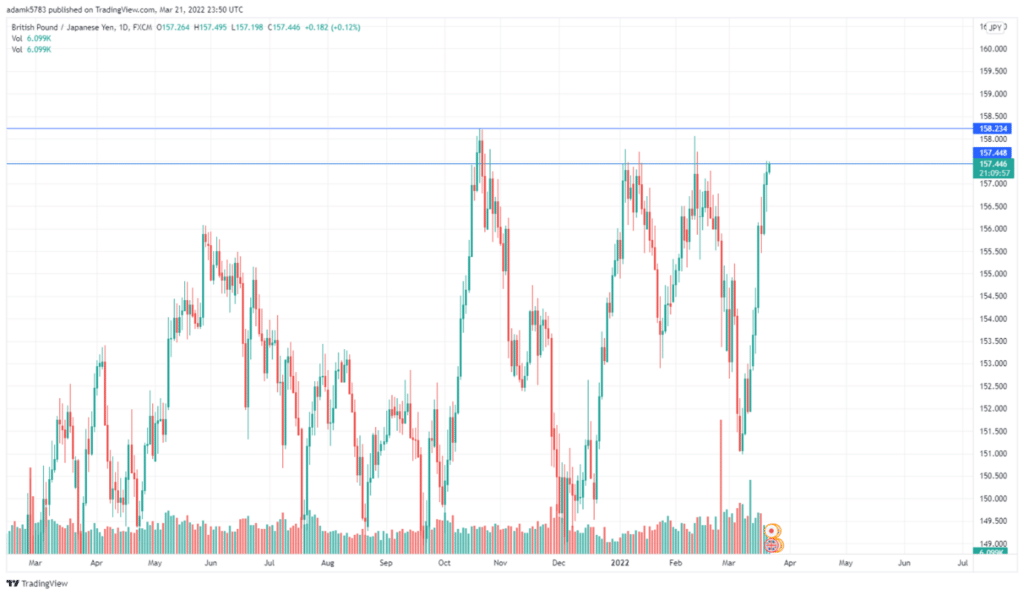

The EUR/USD continued to be rejected at the $1.08 level after the speech from the Federal Reserve spurred USD strength. The AUD/USD has not been able to break through its recent highs of $0.74 as it proved a flat day for the pair after the previous day’s strong moves. The USD has continued its strong move against the JPY as it climbed another 0.27%. The JPY has continued to struggle against most other currencies. The GBP/JPY has closed in on its recent area of support 157.00-158.00 JPY as seen below as it looks to potentially break out.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

US stocks continued moving up overnight with the technology sector outperforming

The US technology sector rose again last night and worked back the losses from the previous day of trading as the market came to grips with the Federal Reserve’s announcement surrounding interest. Tesla was a standout performer and has seen a huge rise in the last week rising more than 20% and rising 7.91% overnight. The Nasdaq moved up 1.95%. Th...

March 23, 2022Read More >Previous Article

Indices finish the week on a high as the technology sector builds momentum

Global indices ended the week on a high as the US indices all recovered some of their recent sell offs. The Nasdaq was the strongest performer risi...

March 21, 2022Read More >