- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Trading the Inflation bumps – The May surprises and what to do with it

- Home

- News & Analysis

- Central Banks

- Trading the Inflation bumps – The May surprises and what to do with it

- Fuel: Prices declined significantly in May, more than offsetting April’s increase. However, they rose again during June to over 200c/l.

- Food: Inflation eased modestly over the year, with restaurant meals and takeaway food prices moderating on weak demand.

- Rents: Returned to the average 0.7% monthly after the temporary rent assistance indexation.

- Clothing & Footwear: April’s unexpected price increase is expected to reverse in May amid ongoing weak retail conditions and the onset of end-of-financial-year sales.

- Electricity: Victoria’s rebates expire, with significant price drops anticipated from July due to new federal and state rebates.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisTrading the Inflation bumps – The May surprises and what to do with it

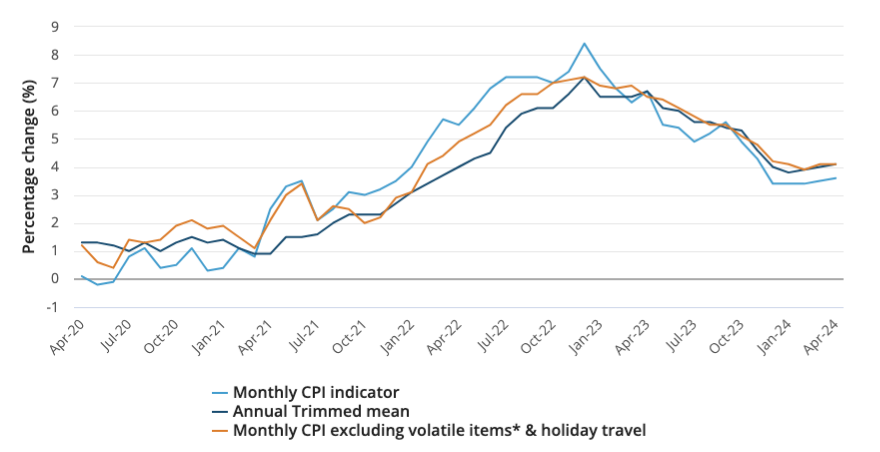

25 June 2024 By Evan LucasThe consensus for the monthly Consumer Price Index (CPI) is for a rise to 3.8% annually in May, the range being 3.6% to 4.0%. This would be the fourth consecutive rise in yearly inflation and would show that not only is inflation ‘sticky’ it could be considered ‘entrenched’

Monthly CPI indicator YoY%

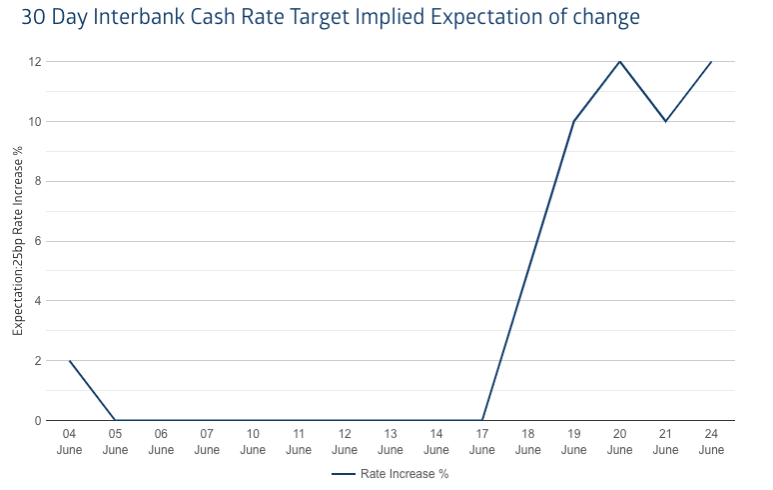

This headline will cause large initial reactions from both the FX and bond markets. Considering the hawkishness in which the governor has spoken about getting inflation back to target inside its 18-month timeframe the market will see this as another confirmation that the August meeting is more than just live but a very probable moving event.

You only have to look here at the 30-day interbank market to see long calls are being made although not at a large scale (yet).

Since breaking out in late May on signs inflation has become sticky and rate rises rather than cuts are the more likely RBA response in the near term. The pair has become range bound between $0.658 and $0.672.

AUD/USD

Which brings us as to why May might be the last CPI rise before it begins a long slow decline into the target range.

Notable Influences on May Inflation

Firstly, we need to point out that May 2023 has several factors come into play that will create an artificial upside. For example, the expiration of electricity rebates in Melbourne there are several other similar government interventions that also impact in the same way. Then there is the persistent high inflation in sectors like insurance, which will obscure the declining progress being made in market services inflation.

Now we need to highlight that the consensus view is the downward trend will resume in June, consensus forecasting (remembering that there is a lot of data that can shift this ahead of the July 31 release) for Q2 2024 headline CPI sits a 3.6% annually the RBA’s Statement of Monetary Policy (SoMP) is at 3.8%.

Prices were unusually weak in May last year, due to significant drops in domestic travel (-15.5% monthly) and fuel (-6.7% monthly), which together account for approximately 7% of the CPI basket.

Large declines of this nature are not expected to repeat this year. Additionally, rebates and changes to electricity prices as energy rebates in Victoria expire, contrasting with the quarterly payments in other states this explains why consensus has CPI falling post May.

On electricity pricing expectations are for prices to fall by around 20% in July as new rebates are introduced.

Consensus also anticipates a significant drop in clothing and footwear prices, reversing the April increase. The growth in average monthly spending on clothing and footwear shown in the latest credit card data was the lowest for May since the pandemic.

Then you have the seasonal decline in holiday travel and accommodation prices post-school holidays. Put this all together and it should make plain that Wednesday’s CPI monthly read could be a trap for traders.

Why? Yes continued rise in the monthly CPI indicator will be unwelcome news for the Reserve Bank of Australia (RBA). However, the RBA has emphasised that the quarterly CPI release remains the benchmark inflation figure in Australia.

With that being the case – watch for snap back in any bullish moves in the currency. Because although its challenging to predict the trimmed mean CPI based on monthly CPI indicators. Expectations are that core CPI (which can vary significantly from the quarterly trimmed) comes between 0.8% and 0.9% quarterly.

This will be refined post the May CPI but all the same it is likely to be lower quarter on quarter.

If we use the RBA’s latest forecasts the headline rate 1.0% on a quarterly basis (3.8% annually). Trimmed mean CPI is sitting at 0.8% on a quarterly basis (3.8% annually).

These are the keys to trading CPI going forward as the underlying detail will be key.

First break out market services. Watch meals out and takeaway, hairdressing services, insurance, sporting and cultural services, and sports participation.

Then we need to see modest consumer spending growth for discretionary items and an easing in wages growth this would result in further disinflation for market services, which is paramount to getting inflation back into the target band.

CPI Breakdown for May

Category April Weight Annual % Change Monthly % Change Expected Annual % Change Food and non-alcoholic beverages 17% 3.8 0.4 3.1 Alcohol and tobacco 7% 6.5 0.0 6.4 Clothing and footwear 3% 2.4 -2.2 2.1 Housing 22% 4.9 0.5 5.3 Furnishings, household equipment & services 8% -0.8 0.3 -0.8 Health 6% 6.1 0.0 6.1 Transport 11% 4.2 -0.7 5.6 Communications 2% 2.0 0.5 1.7 Recreation & culture 13% -1.3 -3.3 -0.1 Education 4% 5.2 0.0 5.2 Insurance & financial services 5% 8.2 0.6 7.6 CPI Indicator – 3.6 -0.3 3.7 Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Trading the inflation bumps Part 2: Narrow to non-existent

First – let us just say that as we suspected the AUD jolted all over the place on the release of the May CPI – the read was much stronger than consensus and the fallout from the read ongoing. But, and it’s a but, we predicted the AUD’s initial bullish reaction was counted by once again point to the fact parts of the monthly read can be expl...

June 28, 2024Read More >Previous Article

A frightened Hawk – The RBA needs to come clean

We know that this is slightly contrary to the consensus views but we think it needs to be said. The communication from the RBA (Reserve Bank of Austra...

June 20, 2024Read More >