- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Central Banks

- When’s it our turn? A sustainable pivot

News & AnalysisAs we sit here and watch our overseas central bank counterparts move on interest rates. Our central bank gave us a new term, to explain why rate cuts are a long way off in their thinking. This term “sustainably” – that is “sustainably back to target”, “sustainable path”, and a hundred other zingers that basically point out that the central bank doesn’t think we are returning to the target band of its inflation mandate.

Yet despite this language and rhetoric, the movement in the market is – muted, bordering disobedient.

The movement in the AUD has been strong as seen in the chart below. But that is basically down to the news out of China, (which we will come to later) and the US Fed finally pushing the trigger. But domestically – the interbank and bond markets see rate cuts much sooner than the Board does, and if you look at the differentials between the RBA and the rest, there is a strong argument that the uptick in the AUD should be more than has occurred.

What are we missing?

So, what is it that the market sees that the RBA is missing? Or more importantly – what does the RBA see that the market isn’t taking as seriously?

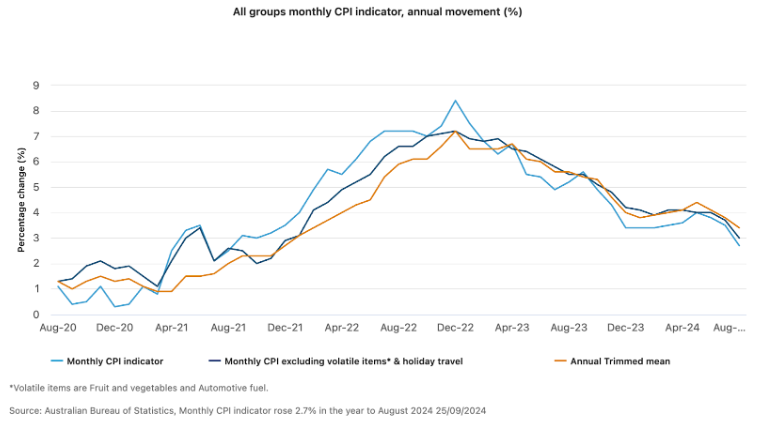

First – we need to really drill into the August monthly inflation read, because there is some reasonable dispute between Board and Market. The headline monthly inflation rate fell to 2.7% and marks the first time in the post inflation era that Australia’s inflation has been back in the target 2% to 3% band. Couple this with its decline from 3.5% in July and 4.0% in June.

Thus, maybe the market has a point as it marks the lowest annual inflation rate since August 2021 and a sharp contrast to the 8.8% peak in December 2022. Which is why a lot are crowing about this chart from the ABS.

This may seem like a positive sign that inflation is under control and is ‘returning’ to a sustainable level, under the hood of the headlines, the data tells a different story.

For example: The monthly index recorded a 0.24% decline between July and August, after a ‘no change’ from June to July. This decline is mainly down to a 0.58% increase in prices last August falling out of the 12-month calculation, so that is a one of and would be transitory and not sustainable.

We are also about to see another technicality happen this month when a similar 0.58% increase from September 2022 drops out. Even if we see a modest 0.2% rise between August and September, the headline inflation rate will likely fall further, potentially reaching 2.3% by September. This is a ‘seller beware’ issue for traders, bears will make a lot of noise about this but the RBA has made it clear here, it’s not for moving.

Next example: the August inflation drop is largely attributed to temporary relief measures. The whopping 14.6% decline in electricity prices in August was a direct result of the federal government’s $300 energy relief measure. The Queensland and WA state governments threw in $1000 and $400 respectively adding further downside in energy inflation. Interestingly enough – since this has been pointed out the government has stated it might make the subsidy ‘semi-permanent’ again this is artificial and something the Governor has stated is transient.

Finally August saw a 3.1% fall in petrol prices due to lower global oil prices – something that is likely to hold true for most of September but the increase tensions in the Middle East over the past week and China properly stimulating itself for the first time in the post COVID world coupled with the approaching Northern hemisphere winter that 3.1% reduction will be quickly returned.

These highlight why the RBA never really pays much attention to headlines month-to-month quarter to quarter as it bounces around randomly. And AUD traders in particular would be prudent to remember this.

Stuck like a fly in a honey pot

The catch with chasing the headline inflation figure is that although it may be back within the RBA’s target band the critical trimmed mean inflation rate, which excludes the most extreme price movers, is not.

The trimmed mean rose by 3.4% over the year to August, down from 3.8% in July and 4.1% in June. Now some will argue that is close to the band, but it’s still significantly above the RBA’s target range midpoint of 2.5% which is seen as the magical ‘sustainable’ point the RBA needs. For more context if we collate the first two months of the September quarter, the calculated annual underlying inflation rate sits at 3.6% even further away from the band and mid-point.

The RBA’s most recent Statement of Monetary Policy forecast expects this to ease to 3.5% by the December quarter. A full 1% above the midpoint illustrating just how stubborn inflation has been to budge.

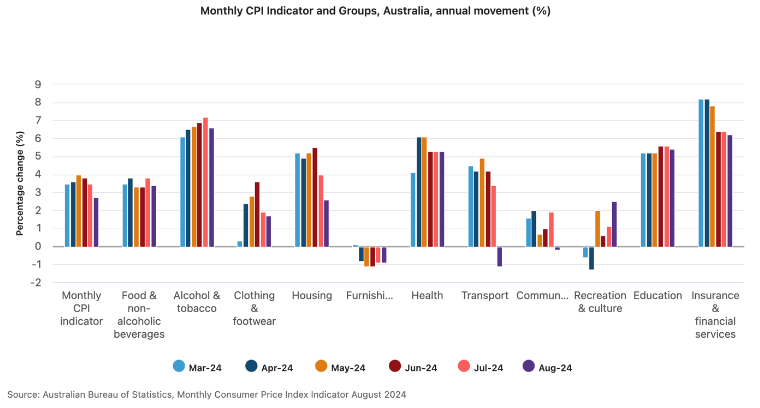

It’s even more of a headache when you look at where the stickiness sits

Have a look at service-based inflation of education, health and financial services – these are all over 5% year on year.

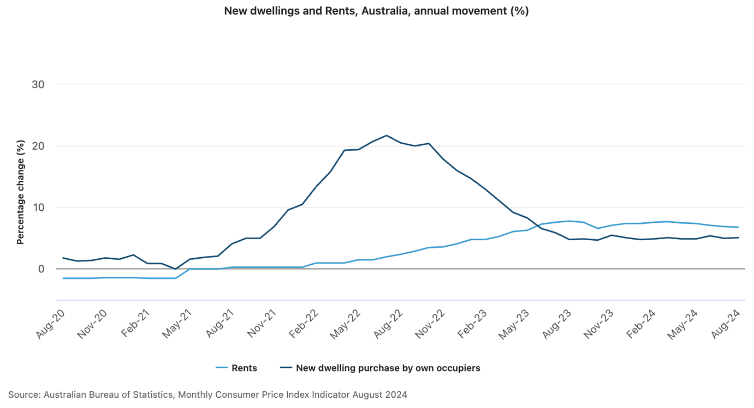

Then have a look at the housing.

Rent increases are still sitting at 6.8%, New dwellings 5.1%. These five things make up more than a third of the total CPI basket. There is nothing sustainable about these figures.

RBA versus the Market

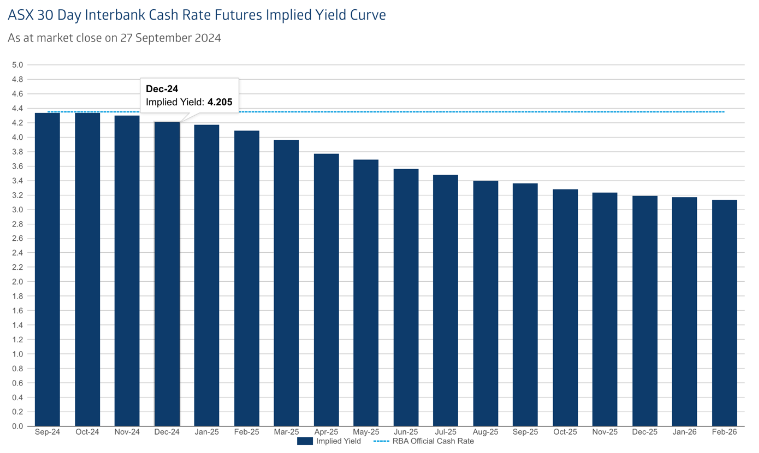

The RBA has been a pain to point out the issues of ‘purchasing power’, that long term issue of cost compounding on themselves and making essentials unattainable in the long run. This old adage is running through our heads: “short term pain for long term gain” thus from our views interest rates are staying on hold for the rest of 2024 as the RBA seems determined to make the inflation rate fall further before acting.

Yet you wouldn’t know it judging by the perception in the market – it is still pricing in a near enough to 75% chance of a rate cut at the December meeting.

How is that conclusion being reached?

If we take what has been stated by the RBA as ‘baseline’ there is next to no information the RBA sees between November and December that would justify a cut especially if they do not cut in November.

The only piece of additional information is the September quarter GDP figures (due first full week of December). If that was to register a contraction and a recession is on the cards then maybe. That’s the only data that could trigger the RBA this year – but considering Government spending in this quarter is so large, the consumer will have had to really bottomed out and retail sales while poor are not that bad.

With this in mind there is a real justification for the AUD to be higher than it currently is. Each time we see another piece of data that is weak but not weak enough should be an upside mover for the currency.

We are not normally ones to fight the market as the trend is your friend, and we are not considering the AUD has moved some 3.8% in September alone. It’s more – we think the upside has more to go as the market realises it under-pricing a more hawkish RBA and it isn’t going to deliver Australian debtholders a Christmas present.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

RBA leaves cash rate unchanged but leaves the door open for future hikes if needed

After 10 hikes on the trot and what will no doubt be a relief for mortgage holders the RBA held the official cash rate at 3.60%. The rate decision was fully priced in by the futures markets , so no great surprise on the actual decision , it’s the accompanying statement where investors look for clues as to future RBA actions that will set the shor...

October 2, 2024Read More >Previous Article

It Is Time – the other side of the mountain

In the words of one of the greatest supporting roles of all-time, this being Rafiki from the Lion King – It is time, (finally). We understand thi...

September 18, 2024Read More >