- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Aussie dollar continues Santa rally into 2023

News & AnalysisThe Aussie dollar has been on a tear in recent weeks as a weaker USD and thoughts of a pivot in US interest rate hikes has seen the Aussie bounce from its lows near $0.62. The Australian dollar and economy have benefited from the improved strength in commodity prices such as Gold and Iron ore which are important players in Australia’s economy. In addition, a potential reopening of China and improved economic prospects for the country means that it may be protected in the case of a global recession.

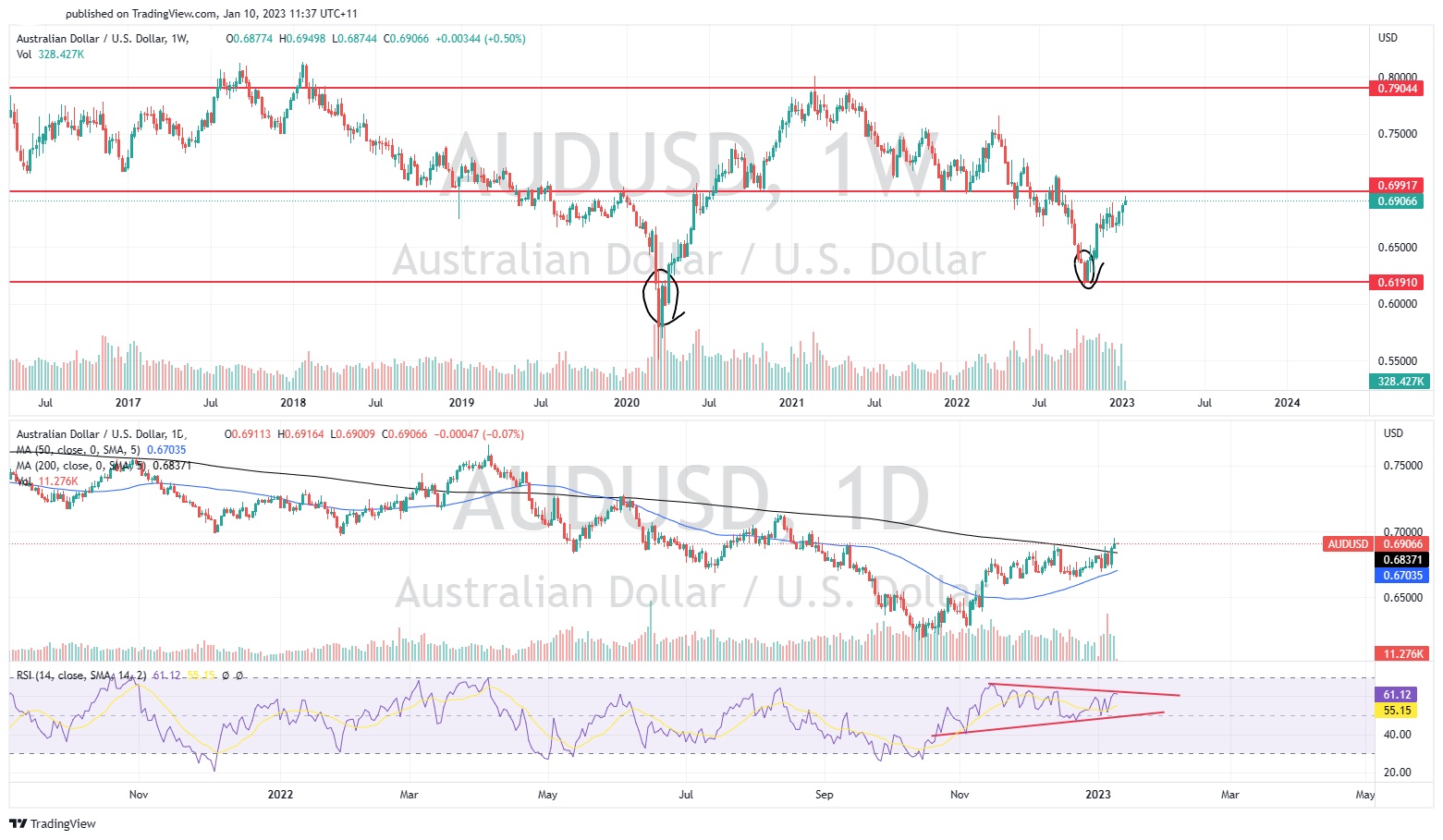

The long-term price action of the AUSUSD is that of a ranging pattern. Since 2015 there has been no consistent trend. The price dropped to near $0.60 during the initial stages of Covid 19 and in October last year. The price has now recovered almost 12% from this October bottom and has shown a strong rejection of the $0.62 zone. The strength of the support can be seen by the weekly buying candle. This is almost identical to the pattern that occurred when the price bounced in 2020 categorised by a long green body and short wick. In 2020, the price then rose to $0.79. This is a reasonable longer-term target especially if the USD continues to weaken. The one concern is the resistance level at $0.70. This level is middle of the range of the pair’s price and could act as a difficult area to profit on the price action. Therefore, it would be best to wait for a confirmation candle either short or long before entering into a position.

On the daily time frame, the price has just risen above the 200-day moving average and the 50-day moving average has begun to trend back upward and potentially cross back above the longer time moving average. This may provide a buy signal if it occurs. The RSI is also consolidating and if it breaks out of its wedge, it may provide an indication of a further move to the upside.

With so much more data to come still relating to inflation data and broader economic data, there may still be some volatility in the direction of the AUDUSD.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

What is going on with Tesla’s share price?

What is going on with Tesla’s share price? Tesla is now one of the world’s most recognisable brands and companies. A leader in technology and pioneer of the electric vehicle space. The company has become a beacon of hope for the charge against climate change and move towards a more a carbon friendly future. At the centre of the company is its ...

January 10, 2023Read More >Previous Article

CHFJPY sees potential bottom and short-term reversal

The JPY had seen some renewed strength after the Bank of Japan finally intervened late in 2022 to widen its target band on its 10-...

January 9, 2023Read More >