- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

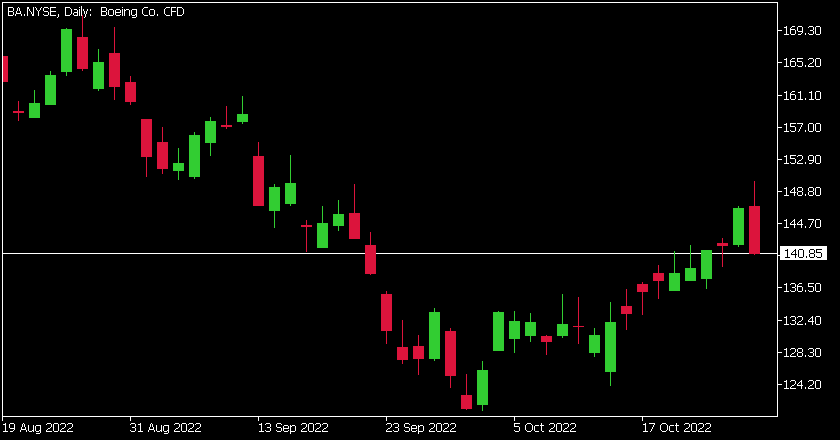

- Boeing’s Q3 results have landed – the stock is down

- Home

- News & Analysis

- Shares and Indices

- Boeing’s Q3 results have landed – the stock is down

- 1 month: +6.50%

- 3 months: -8.95%

- Year-to-date: -29.41%

- 1 year: -31.21%

- Credit Suisse: $98

- Morgan Stanley: $233

- Wells Fargo: $210

- Benchmark: $200

- RBC Capital: $200

- JP Morgan: $188

- Citigroup: $209

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Boeing Company (NYSE:BA) announced Q3 earnings results before the market open in the US on Wednesday.

The world’s largest aerospace company reported revenue that missed analyst expectations at $15.956 billion (up by 4% year-over-year) vs. $17.911 billion estimate.

The company reported a loss per share of -$6.18 per share vs. $0.132 earnings per share expected.

“We continue to make important strides in our turnaround and remain focused on our performance,” Dave Calhoun, Boeing President, and CEO said in a press release following the announcement.

“We generated strong cash in the quarter and are on a solid path to achieving positive free cash flow for 2022. At the same time, revenue and earnings were significantly impacted by losses on our fixed-price defense development programs. We’re squarely focused on maturing these programs, mitigating risks and delivering for our customers and their important missions. We remain in a challenging environment and have more work ahead to drive stability, improve our performance and ensure we’re consistently delivering on our commitments. Despite the challenges, I’m proud of our team and the progress we’ve made to strengthen our company,” Calhoun concluded.

Shares of Boeing took a hit on after the announcement of the latest results. The stock was down by around 3% at $140.85 a share.

Stock performance

Boeing price targets

Boeing is the 147th largest company in the world with a market cap of $83.94 billion.

You can trade The Boeing Company (NYSE:BA) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: The Boeing Company, TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Why you need to be aware of Stop Loss Hunting

Stop loss hunting is frustrating, annoying and can be detrimental to any retail trader. The premise of stop hunting is that large systemised institutional trading strategies know where the average retail trader or most traders will set stop losses and therefore profit off triggering these ‘stops. Their own algorithm will then deliberate...

October 28, 2022Read More >Previous Article

Short term break out on the EURUSD

The EURUSD is showing some signs of a potential short term break out on the daily and 4-hour time price charts. This is largely a technical breakout, ...

October 26, 2022Read More >