- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Cryptocurrency

- More downside for major cryptos?

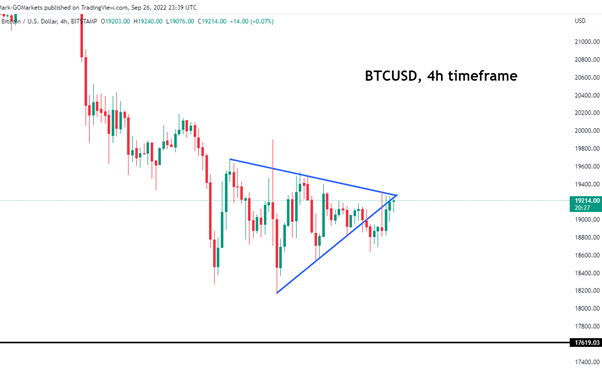

News & AnalysisFollowing the previous Bitcoin analysis (https://www.gomarkets.com/au/articles/economic-updates/bitcoin-usd-technical-analysis/), bitcoin continues to break below pattern after pattern, recently breaking out and re-testing a descending flag pattern on a 4h time frame as seen below:

With the next major support sitting around $17,619, it won’t be a surprise if bitcoin comes down to that area.

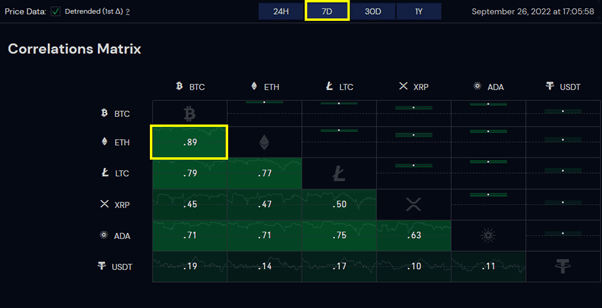

Looking at the correlation between Bitcoin and Ethereum, the last 7 days of price action shows a correlation of .89, which is a positive value that indicates a positive correlation between the two. A positive correlation means that the two moves very similar to one another.

(https://cryptowat.ch/correlations)

(https://cryptowat.ch/correlations) For ETHUSD (Ethereum), making similar patterns to BTCUSD, has also recently broken out of a descending flag pattern, signalling a probable continuation of the 4h downtrend, there is a high probability of ETHUSD reaching the next major support around $1012.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

GO Markets wins in the Global Forex Awards – Retail

GO Markets has won three awards in this year’s Global Forex Awards; Best Forex Fintech Broker - Global Best Forex Trading Support - Asia Most Trusted Broker - Europe The Global Forex Awards recognise forex and related businesses from around the world, “who are pushing the boundaries of innovation in retail forex trading solution...

September 27, 2022Read More >Previous Article

ASX200 resting on a knifes edge

Inflation and recessionary pressures have caused the aggressive sell offs of some of the largest global indices, however so far, the ASX200 or XJO has...

September 26, 2022Read More >