- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- The Fed, between a rock and a hard place – FOMC preview

- Home

- News & Analysis

- Central Banks

- The Fed, between a rock and a hard place – FOMC preview

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisTodays FOMC rate decision is certainly in play, with recent turmoil in the banking sector caused in no small part by aggressive Fed hikes over the last 12 months, throws a very big spanner in the works of the Feds plan to combat inflation.

Up until a couple of weeks ago a 50bp hike was pretty much fully priced in as the Fed refused to budge on their aggressive rate hiking path, with the statement released at their last meeting indicating that rates would remain “higher for longer” and fully opening the door to more 50bp hikes in subsequent meetings.

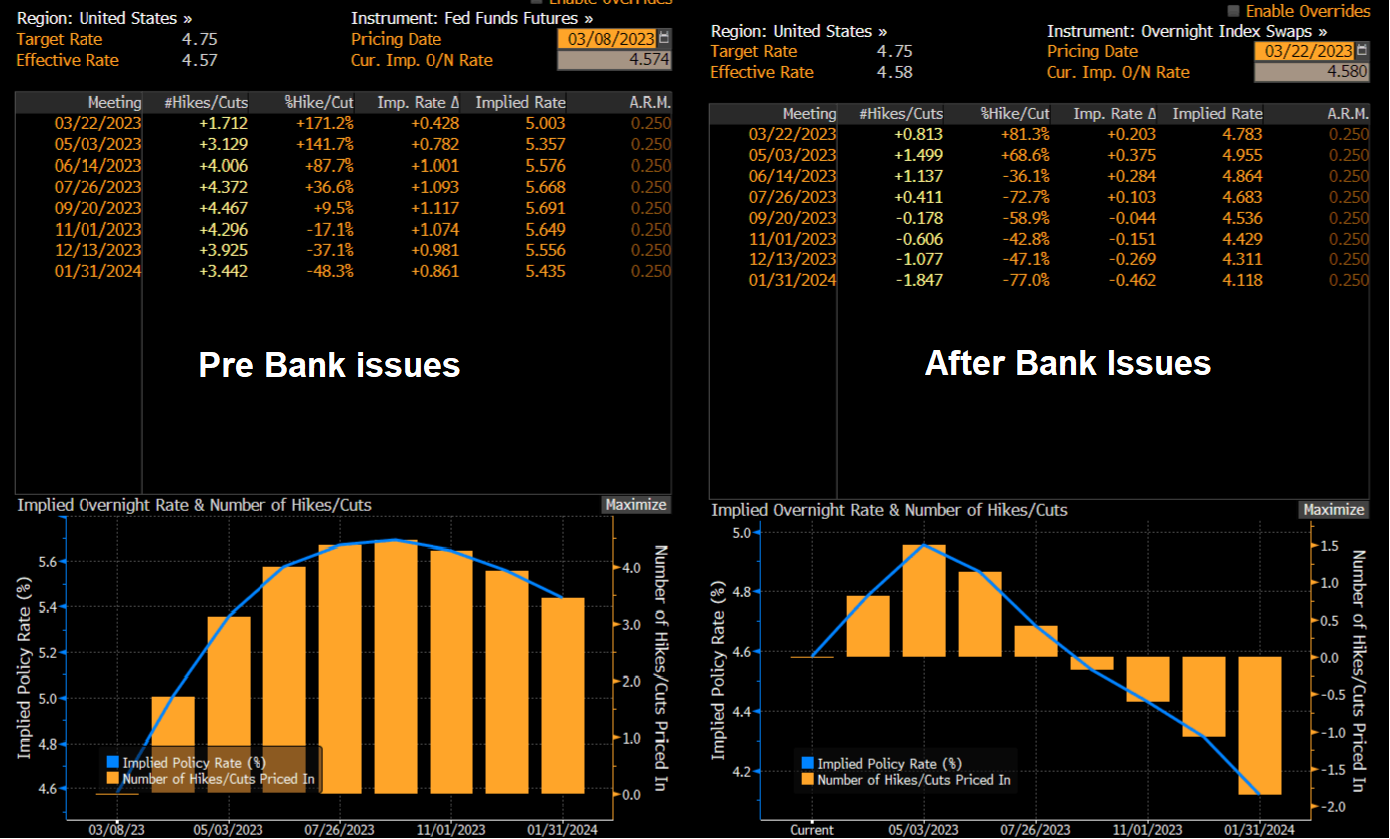

This all turned very quickly on the collapse of SVB, quickly followed by Signature banks and Credit Suisse with markets racing to you reprice rate expectations, with the terminal rate predictions coming down to significantly followed by a series of rate cuts into year end, before these banking issues no cuts were priced in at all until 2024. This dramatic change can be seen in the screenshot below of Pre-Bank issues Fed Fund futures pricing, compared to Fed Fund futures pricing after.

All that said, this sets todays meeting up to be the most pivotal Fed meeting since the start of their rate hiking cycle 12 months ago and will almost certainly see big volatility on the announcement and some possible great trading opportunities.

Let’s go through the 3 likely scenarios as I see them and what reactions in the market we could see.

Dovish- Possible

Against the background of a banking crisis that for now seems contained but could certainly re-escalate. The Fed could also see these banking stresses as de facto tightening of financial conditions and elect to pause rates for now to give the banking sector time to stabilise.

This scenario would see no hike and probably an acknowledgement that inflation was too high and future rate hikes were “likely appropriate” but with the impact of recent events need to be assessed first.

Likely FX Market Reaction

Likely a very fast move down in the USD on the rate decision, followed by volatility as the statement was being digested, the trend of the USD after that will be how dovish the market sees the Feds comments are and clues at further rate moves.

After a hawkish ECB who hiked 50bp last week, this would likely see EURUSD pushing to the resistance zone around 1.08, a dovish statement should see this level hold as support and a further push higher in EURUSD in the coming days.

Neutral/Hawkish – Base Case

With a still hawkish ECB, hiking 50bp last week and tough talking from it’s members since, the Fed may feel emboldened to see their fight against inflation as their number 1 priority, albeit at a slower pace than previously communicated to the market.

For the Fed to pause here would almost be an admission of bad policy and would likely shake the market more than the fairly contained bank failures we have seen up to this point.

This scenario, which I think is the most likely will see the Fed hike by 25bp while stating ongoing rate hikes will be “likely appropriate” but also moderating a bit with saying they will be “data dependant”

Inflation wise , I expect language like inflation is still “unacceptably high, but risks are moderating”.

Likely FX Market Reaction

A modest move higher in the USD on the rate decision, markets are pricing in a 85% chance of a 25bp hike, so the up move will be muted. The statement will decide how the USD moves after that, if they do include the language outlined above (unacceptably high inflation, ongoing hike likely) then a push lower in EURUSD is likely, first to test it’s recent support level at 1.0760, a break of that would likely see it head towards the big figure support at 1.07 and liekly range around that level for the remainder of the session.

Very Hawkish – unlikely

The final scenario would be seen as very Hawkish and is probably unlikely against the back drop of recent stress in the financial markets. This would see a 50bp hike with a statement that ongoing rate hikes will be “appropriate”. On inflation “inflation is unnacceptably high, with risks weighted to the upside”

FX Market Reaction

A 50bp hike would see an instant, and large reaction in the USD as markets would have to reprice their whole prediction of the rate curve going forward, this would certainly see the EURUSD gap straight past the 1.0760 support and really test the 1.07 before a retracement as the statement is deciphered, continued hawkishness in the statement would would likely see a strong break of the 1.07 level as well.

Whatever of the 3 possible paths above the FOMC takes, a mixture of them or something completely from left field, the market is sure to see some big volatility, so trade accordingly and be prepared!

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

XAUUSD, GBPUSD, and EURUSD Analysis 20 – 24 March 2023

XAUUSD Analysis 20 – 24 March 2023 The outlook for gold prices remains positive in the medium term. This is because gold prices rose above the 1960 price line before testing the 2000 resistance and then dropped after failing to cross it. Adjust the resting base or sideways to go up to the resistance 2000 again, which is the next target tha...

March 22, 2023Read More >Previous Article

Nike results announced

World’s largest sporting goods company, Nike Inc. (NYSE:NKE) reported fiscal 2023 financial results for its third quarter after the closing bell in ...

March 22, 2023Read More >