- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Asian Open – FX analysis – USD and yields tumble, risk currencies rally on weak US data

- Home

- News & Analysis

- Forex

- Asian Open – FX analysis – USD and yields tumble, risk currencies rally on weak US data

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAsian Open – FX analysis – USD and yields tumble, risk currencies rally on weak US data

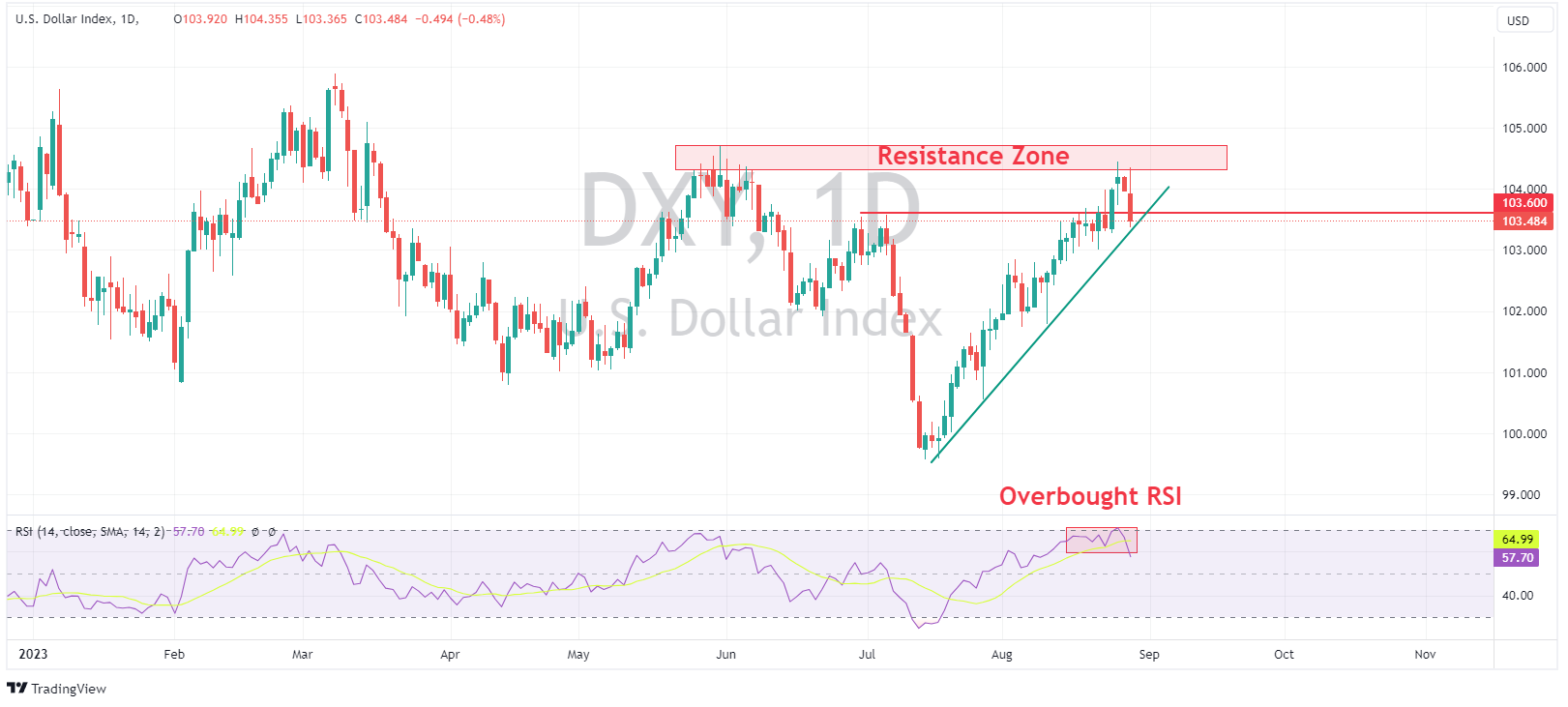

30 August 2023 By Lachlan MeakinUSD was firmly in the red in Tuesdays session, with the US Dollar Index (DXY) having it’s largest drop since mid-July. A rally in DXY during the Asian and early European session dramatically reversed after big misses on the JOLTS report and consumer confidence saw a dovish repricing in rates markets and a risk-on back in charge. Stocks rallied and the Dollar tumbled throughout the rest of the session. DXY hitting lows of 103.36, breaking through the minor R/S level of 103.60 after testing the major resistance zone of the May/June/August highs. DXY now sitting on its upward trendline which has been in play since mid-July, which so far has lent some support. Looking ahead today there will be more jobs data (ADP) and Prelim GDP for USD traders to navigate.

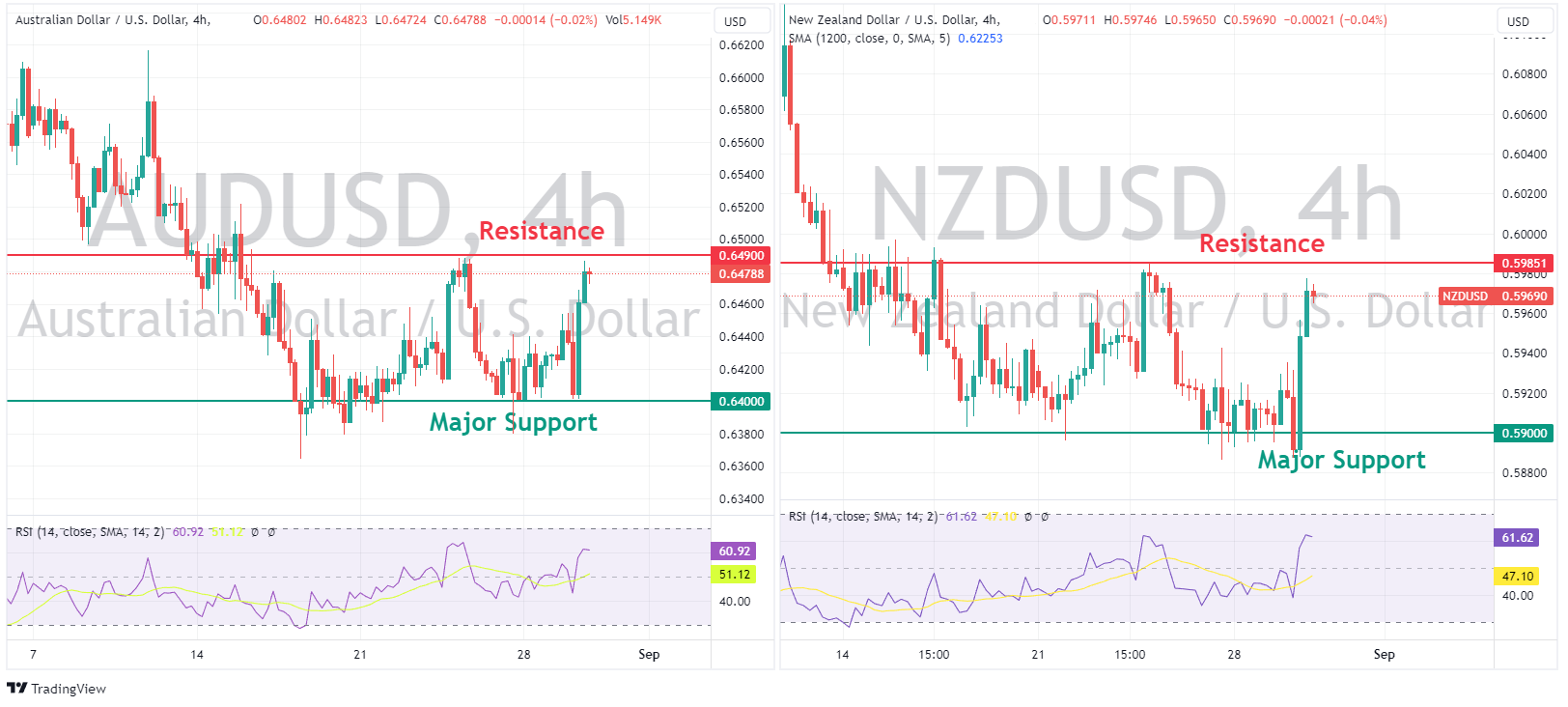

AUD, NZD and EUR were all firmer against the USD. High beta AUD and NZD were the clear outperformers while EUR saw similar gains, all benefitting from USD weakness and a risk-on environment as opposed to anything currency specific. AUD was also given an extra boost by gains in iron ore. AUDUSD hit a high of 0.6487, testing last week’s highs and the resistance just below the psychological 0.6500 level. NZDUSD up to 0.5977 also pushing to the highs of its recent range. Ahead today a pivotal CPI figure out of Australia may see some of these levels tested.

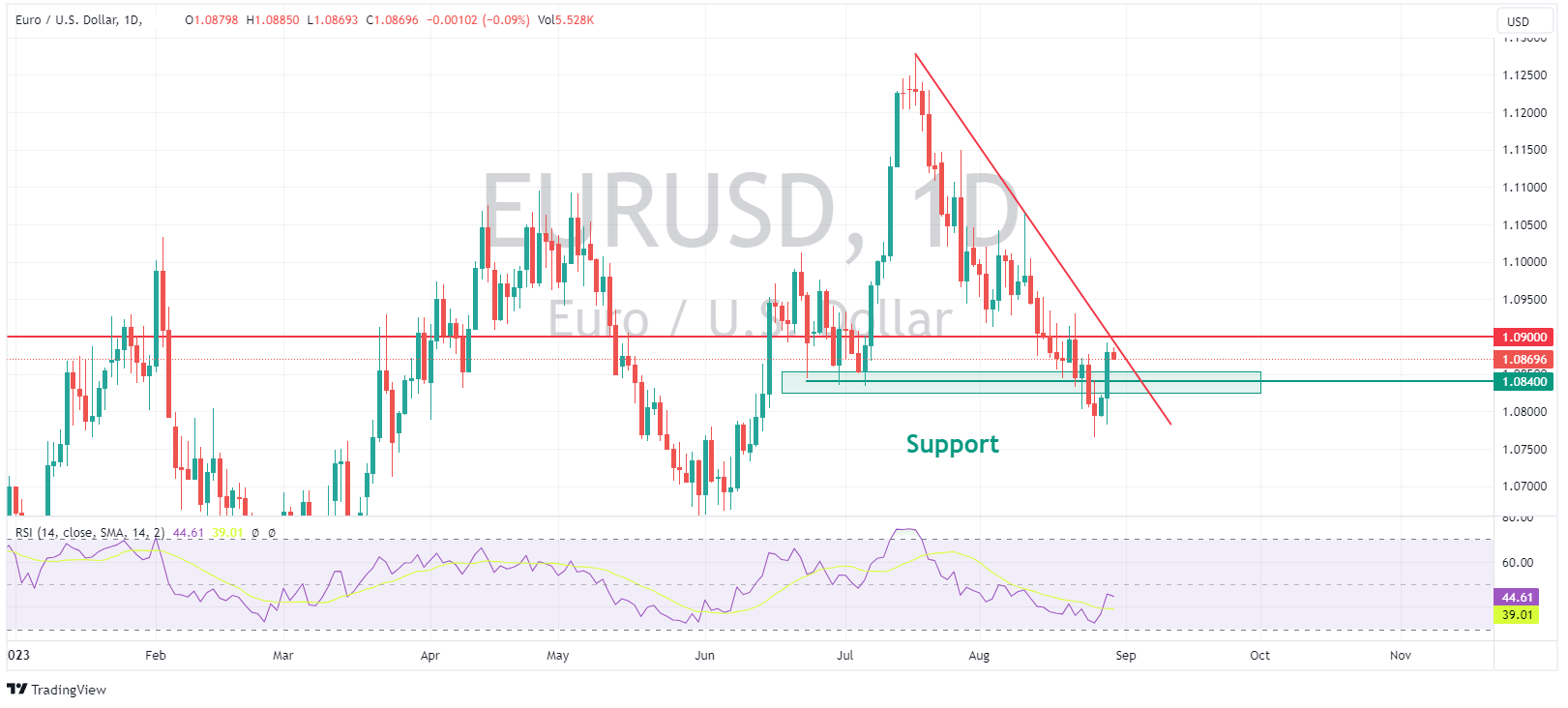

EURUSD hit highs of 1.0891, retaking the support level at 1.0840 and looking to test the big figure at 1.09 to the upside. Eurozone inflation figures out of Germany and Spain released later today will be the main risk events for EUR traders.

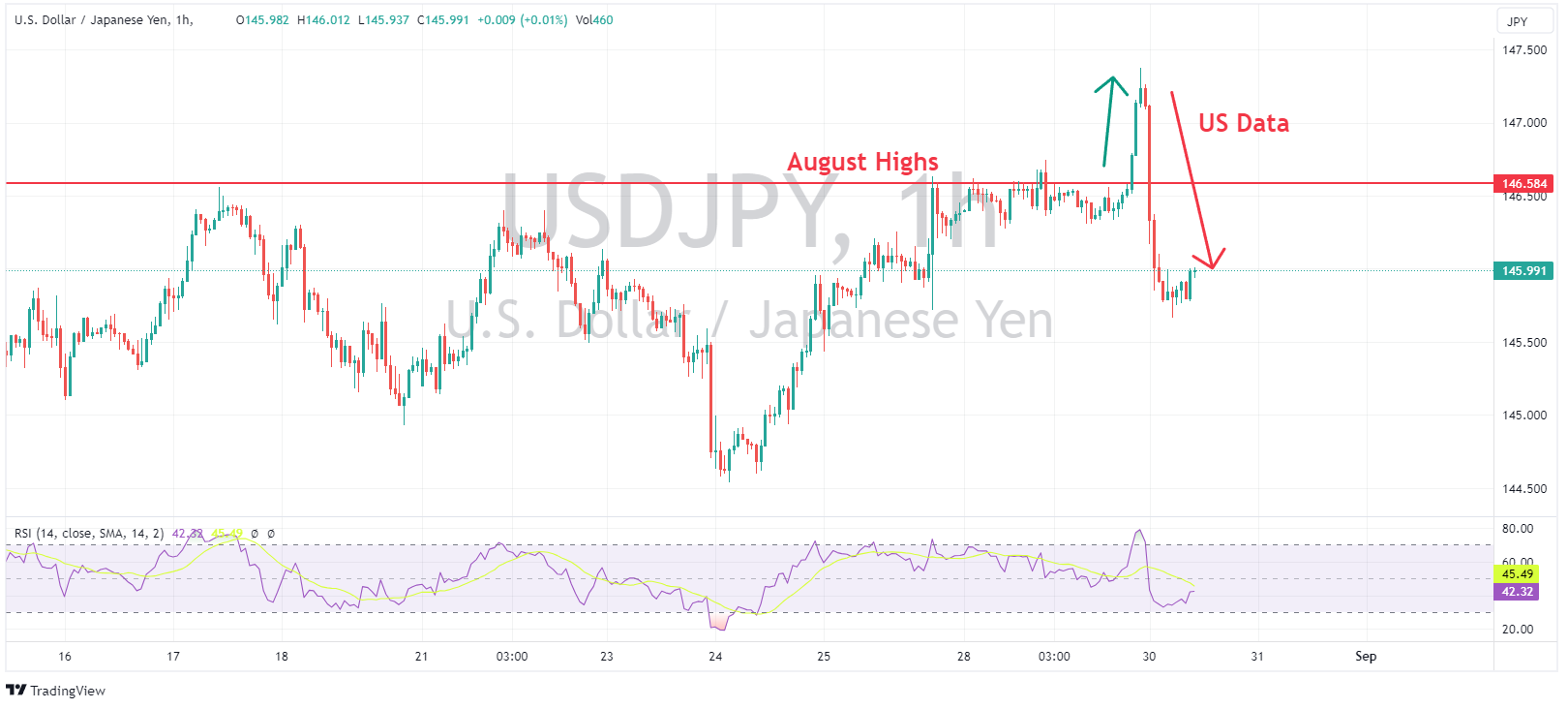

JPY rallied against the USD later in the session on the retreat of US Treasury yields after weak US data. Earlier in the session though USDJPY breached the August highs resistance level to trade up to a high of 147.38 (which was its highest level since November) before the aforementioned weak US data and move lower in UST yields saw a dramatic reversal. BoJ intervention on the Yen still on the back of JPY traders’ minds.

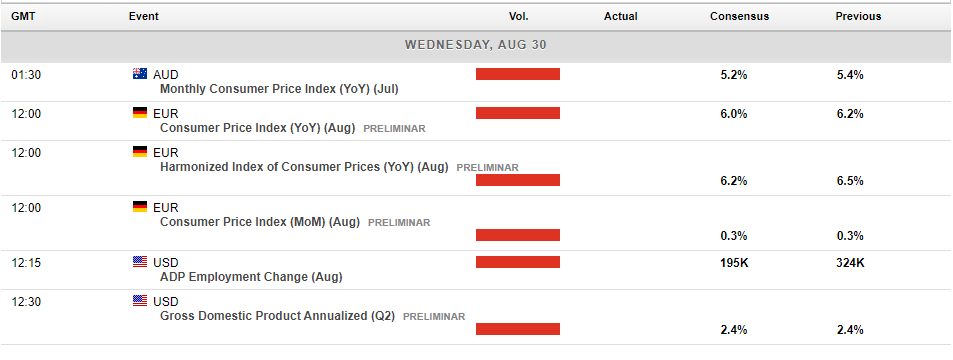

Today’s calendar has some decent risk events likely to cause volatility in FX markets, starting with Aussie CPI, then CPI readings from the Eurozone and topped off with GDP and more jobs data out of the US.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

GO Markets partners with Currencycloud to accelerate access to a global market

GO Markets is pleased to announce our partnership with Currencycloud, the experts in simplifying business in a multi-currency world, to streamline and automate client deposits and withdrawals while benefiting from real-time, API-driven competitive FX rates. By integrating Currencycloud’s APIs, GO Markets can now offer a seamless and cost-e...

August 30, 2023Read More >Previous Article

Look before you leap …FIVE reasons why a low PE Ratio may be a reason NOT to jump in

What is a PE Ratio, and Why is It of Interest to Investors? The Price-to-Earnings (P/E) ratio is a metric that measures a company's current share p...

August 25, 2023Read More >