- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- AUDNZD – Kiwi Returning To The Status Quo

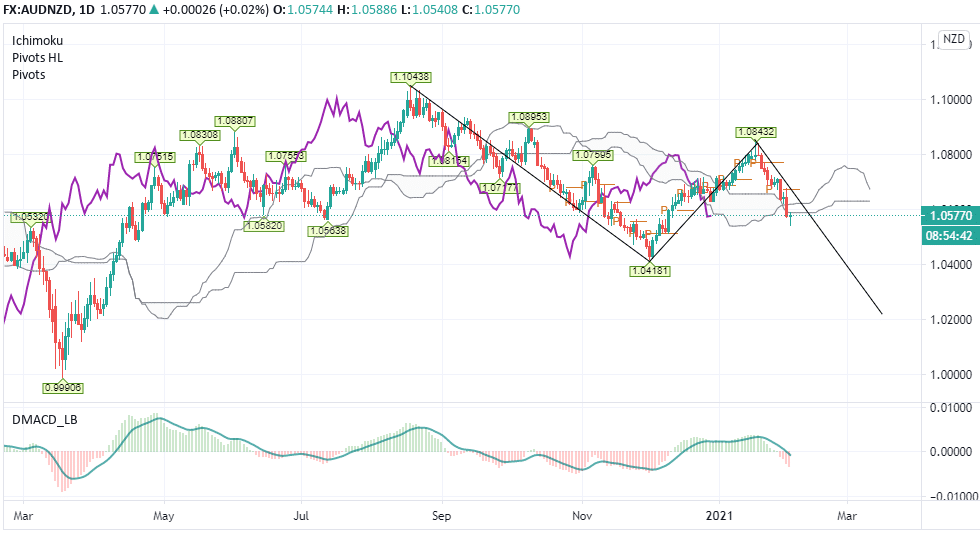

News & AnalysisAUDNZD – Daily

Despite the Australian Dollar having a strong rally towards the end of last year, it appears the New Zealand Dollar is once again regaining the upper hand against its counterpart. New Zealand is ticking many of the economic boxes of late, and from a fundamental point of view, it’s not hard to envisage a return of strength for the Kiwi currency. These boxes include a combination of recent policy updates such as the steering away from negative rates and also how New Zealand has successfully managed the global pandemic thus far.

Using the Ichimoku cloud indicator on the daily timeframe, we see an array of factors contributing to the current downtrend in motion. Firstly, both price action and the longer-term lagging span (purple line) are operating below the cloud, which paints an inherently bearish picture.

Next, the cloud’s thickness located above the current price suggests much resistance to the upside if challenged. That’s not to say it won’t fail, but it could cause problems for those looking to go long. We also see the MACD indicator maneuvering southwards with plenty of space to deepen into further bearish territory.

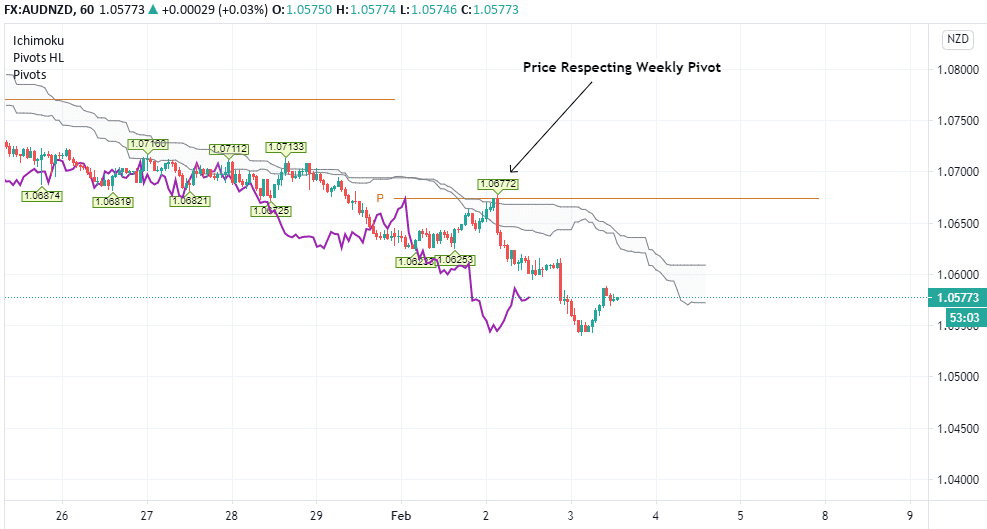

Overall, the longer-term outlook at this stage looks rather bleak for the Australian Dollar. Even shorter-term charts such as the hourly shown below, many indicators replicate the daily snapshot. Interestingly, the price has used the weekly pivot of 1.0673 as resistance, essentially rebounding from this level with pinpoint accuracy.

In terms of potential price targets, longer-term, the pair look set to re-test the previous low of 1.0418, where the AUDNZD began the last rally in December. Additionally, a DiNapoli calculation triangulating the swing highs/lows of 1.10438, 1.04181, and 1.08432 suggests 1.02175 as another possible target.

Should this theory come to fruition, it would bring AUDNZD back towards pre-pandemic levels. Given how well both New Zealand and Australia are dealing with the Covid-19 situation, it seems logical for the price to return to this region.

Sources: Go Markets, Meta Trader 5, TradingView, Bloomberg

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

GBPCAD – G10’s Best Performing Currencies Lock Horns

GBPCAD – Hourly Individually, both the British Pound and the Canadian Dollar have surged in recent trading sessions, appearing relatively strong against their peers in the short-term. With the latest fundamental data suggesting both currencies have benefited from similar economic drivers, it could be tough to navigate a directional bias for GB...

February 11, 2021Read More >Previous Article

Wall Street vs. Main Street

It has been an eventful week over in the United States this week. Some of the major companies, including Microsoft, Apple, Facebook, and Tesla anno...

January 29, 2021Read More >