- Trading

- Platforms & tools

- Education

- Education

- Resources

- Help & support

- More

News & Analysis

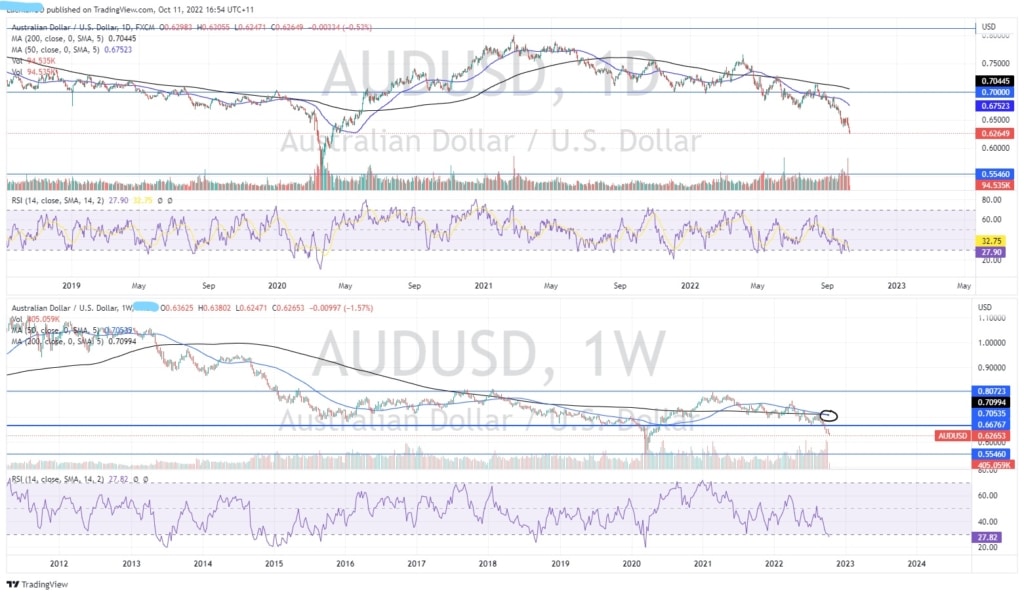

Aussie Dollar breaks through two year price lows

11 October 2022The Aussie dollar has been dropping on the back of global volatility and a lower-than-expected interest rate hike. The AUD has dropped to its two-year lows, and it doesn’t look there is an end in sight. With the AUD already being a risk on currency the fears and pressures from a potential recession are weighing heavily and accelerating the drop.

Chart Analysis

The weekly chart shows just how weak the AUD is particularly concerning and shows that the 50-week moving average has crossed below the 200-week average. This is also known as a death cross and is symbolic of sellers taking control of price. Furthermore, the price is dropping to levels not seen since the height of the Covid 19 pandemic and the GFC before that. The most reasonable short-term target is the Covid lows at 0.55 AUD. It would be difficult to see the price dropping further below that. If the price was to drop further then 0.55 AUD, it would likely need to be on the back of some powerful catalyst. In the short term it doesn’t seem like a powerful catalyst is imminent. Although, with recessionary fears on the horizon a particularly damaging recession may be able to push the AUD lower. The daily chart further enhances just how aggressive the selloff has been. With the 50-day average dropping faster than the 200 days average the price action is worrying. The chart also shows the price in somewhat of a freefall with no immediate support.

Looking forward, with economic data still to come and more rate rises expected by the Reserve bank of Australia, maybe the country’s Central Bank can inject some strength back into the currency. However, at this stage it is fighting a losing battle.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Bank of England gives Funds three days to get books in order

The Bank of England has seemingly turned its back on protecting UK Retirement funds, after initially bailing out these funds who were facing serious liquidity issues in relation to their exposure to Fixed income assets. History As a part of new UK Prime Minister, Liz Truss’s mini budget she outlined big tax breaks for mu...

October 12, 2022

Read More >

Previous Article

Aussie Dollar breaks through two year lows

The Aussie dollar has been dropping on the back of global volatility and a lower-than-expected interest rate hike. The AUD has dropped to its two-year...

October 11, 2022

Read More >