- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- BoJ Governor Ueda’s first monetary policy meeting

News & AnalysisThe Bank of Japan is due to hold its first monetary policy meeting under new Governor Ueda on the 29th of April 2023. Since his appointment, Governor Ueda has frequently indicated that the BoJ will continue with its current easing stance on monetary policy with targets for long and short-term interest rates. Although headline and core inflation runs above 3% and the 10Y JGB yields have again climbed close to the ceiling at 0.50%, it is unlikely that Gov Ueda would introduce a widening of the Yield Curve Control (YCC) at this meeting.

However, while a lack of action from the BoJ is widely expected, this could still result in a further weakening of the Japanese Yen across the board.

The USDJPY currently trades along the 134 price level, with the upside capped by the 135 resistance level which coincides with the 61.8% Fibonacci retracement level from the longer term. A weakening of the Yen could see the USDJPY break above the resistance level and climb higher toward the next key resistance level at 138. This potential move higher is also signaled by the cross-over on the MACD indicator.

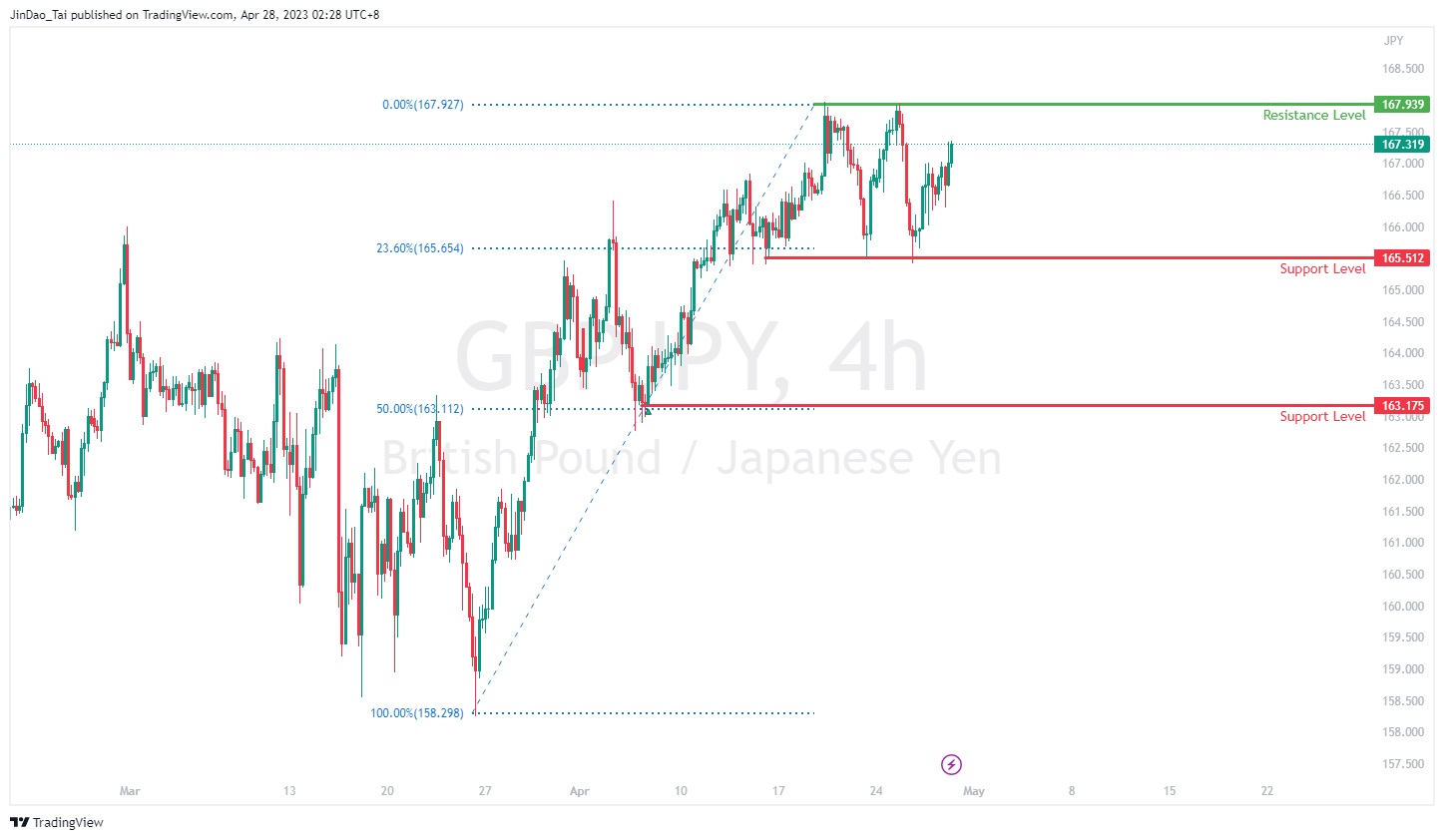

Alternatively, if the BoJ surprises markets by announcing a widening of the YCC or an adjustment to the current monetary policy, this could result in a sharp strengthening of the Japanese Yen. In this scenario, the GBPJPY could reverse strongly from the resistance area of 168 to trade significantly to the downside toward the immediate support level at 165.50 which aligns with the 23.6% Fibonacci retracement level.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Uber beats expectations – the stock is up

Uber Technologies Inc. (NYSE: UBER) announced first quarter results before the market open in the US on Tuesday. World’s largest ridesharing company beat analyst expectations for the quarter, sending the stock price higher. Company overview Founded: March 2009 Headquarters: San Francisco, California, United States Number of emplo...

May 3, 2023Read More >Previous Article

What are jobless claims?

Jobless claims refer to a weekly statistic published by the U.S. Department of Labor, indicating the number of individuals applying for unemployment i...

April 27, 2023Read More >