- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Buying entry forming on EUR/NZD?

News & AnalysisThe EUR has been rebounding strongly on the back of being sold off for much of the year. With inflation at record highs and a cost of living and energy crisis, the currency has become extremely weak, even dropping below parity with the USD. However, in recent week, the EUR has begun putting in a bottom. The ECB last night decided to raise their official rate by 75 bps. which along with a dovish statement caused a sharp drop in the EUR.

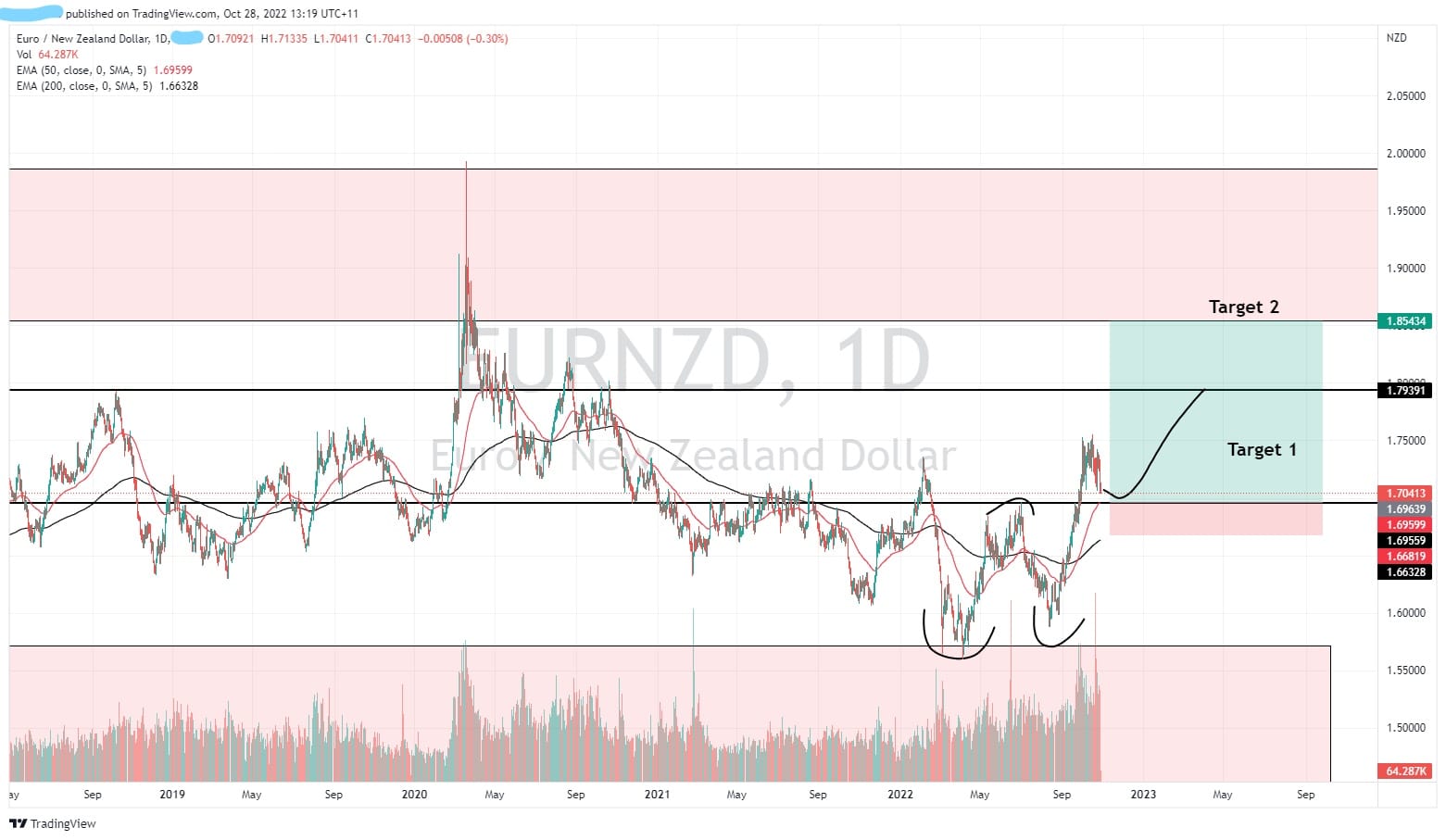

On the weekly chart, the price has largely been in long term range with some exceptions relating to large economic events. Although, the price has been known to spike at various stages of economic volatility. The chart shows that the price has been quite choppy between the range of 1.4000- 1.8500.

The daily chart shows a potential double bottom that has been forming. The two bottoms are near 1.5700 and the neckline at approximately 1.7000. The price already broke through the neckline and is nearly ready to retest the area as support. If the price can bounce off the neckline, it may have a primary target at 1.80, and then a secondary target of 1.8500. Waiting for ether a strong rejection candle or a consolidation near the neckline may provide a significant risk reward of near 3.5 or higher.

With inflation data the ECB still providing important information there may be some headwinds for the EUR as the region continues to deal with inflation.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

What Is the Consumer Price Index (CPI)?

CPI is a globally recognised economic indicator used by many countries to measure inflation and assess changes in the cost of living for their citizens. It evaluates the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, such as food, clothing, rent, healthcare, entertainment, and tran...

November 1, 2022Read More >Previous Article

Why you need to be aware of Stop Loss Hunting

Stop loss hunting is frustrating, annoying and can be detrimental to any retail trader. The premise of stop hunting is that large systemised...

October 28, 2022Read More >