- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Charts to watch in the week ahead – AUDUSD, USDOLLAR, GBPUSD

- Home

- News & Analysis

- Forex

- Charts to watch in the week ahead – AUDUSD, USDOLLAR, GBPUSD

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisCharts to watch in the week ahead – AUDUSD, USDOLLAR, GBPUSD

13 November 2023 By Lachlan MeakinLast week’s action in the FX markets was shaped by a pushback by the Fed chair Jerome Powell and assorted other Fed members on markets pricing in a less hawkish Fed going forward. What was seen as a dovish FOMC and a big miss in NFP the week before saw traders piling back into risk assets with traders hoping for a less aggressive Fed, it seemed pushback from Powell and company was inevitable, and pushback we got with a slew of hawkish comments from the Fed chair and his colleagues.

USDOLLAR

Last week’s fluctuations in the USD highlighted the influence of yields as the US Dollar index tracked the US 10-year yield almost tick for tick. Key inflation figures from the US this week will test the Feds recent hawkish narrative with US CPI figures out on Tuesday and PPI out on Thursday. The US dollar index did stage a comeback last week, whether that comeback continues this week will be shaped by these figures one would expect.

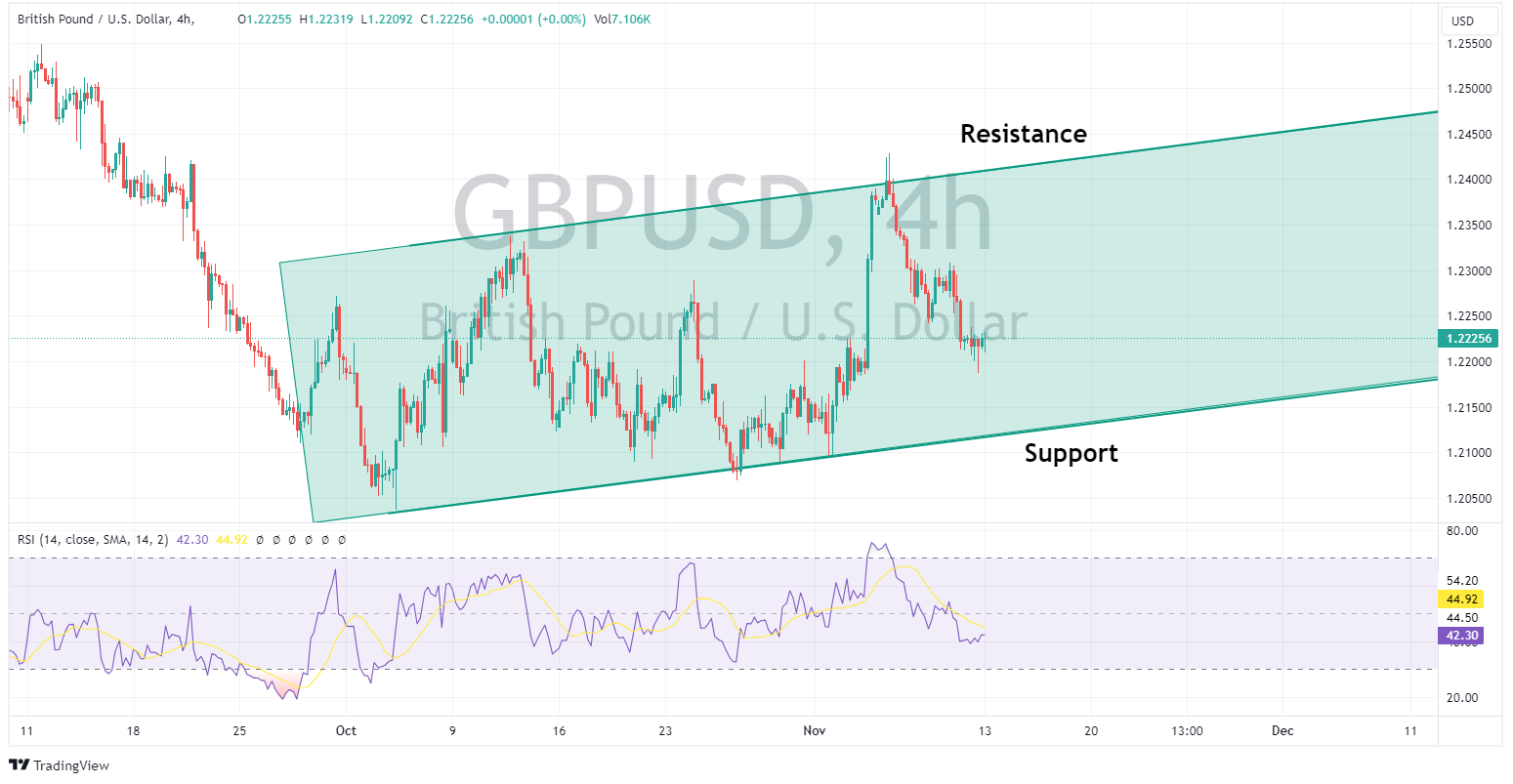

GBPUSD

In the UK the recent hold in rates by the BoE has traders feeling that their rate hiking cycle is done and dusted with market pricing favouring another hold at the BoE December meeting with only a 9% chance priced in of a hike. Sterling traders this week will be watching employment data out on Tuesday, UK CPI on Wednesday and retail sales on Friday. It would take some big beats to move the needle on rate hike expectations, but with limited data left after this week before the banks next meeting, these readings will take on extra importance. GBPUSD has been trading in an upward sloping channel since late September, the levels to watch over these announcements will be support at the lower band around 1.2170 and resistance at the top band around 1.2470.

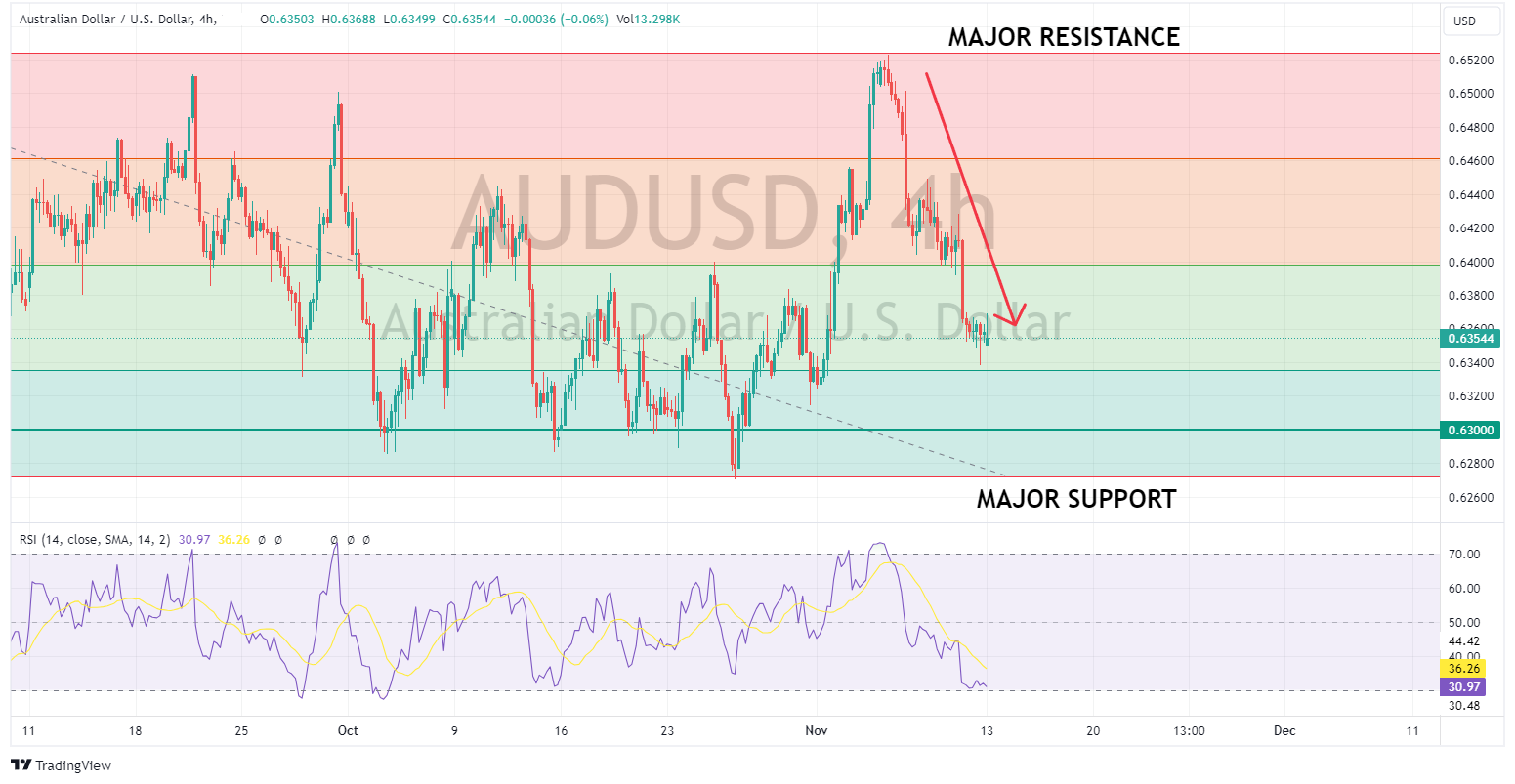

AUDUSD

The Aussie took a beating last week after what was widely seen as a dovish rate hike out of the RBA on Tuesday, AUDUSD had been testing major resistance at 0.6500 before reversing course and crashing down to 0.6340 by the end of the week. AUDUSD is now in the lower half of its 3-month range and finding some support but Chinese industrial production and Australian wage data on Wednesday along with Australian employment data Thursday could see the key support level at 0.63 is in play if these figures miss expectations.

For the full economic calendar please click the link below:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Analysis – AUDUSD and Gold get a boost, JPY spikes on possible intervention.

AUDUSD AUD saw gains to come within a whisker of the key 0.64 level, after hawkish leaning commentary from RBA Assistant Governor Kohler, who noted the decline in inflation is more gradual than previously thought. The Aussie also helped by a weaker USD and improved risk sentiment. The 0.64 level will be key in the near term as the mid-point of A...

November 14, 2023Read More >Previous Article

FX Analysis – USDJPY, and GOLD reaction after a surge in the Dollar

USD rallied strongly in Thursday’s session after a quiet start following dismal demand for US 30 year-treasuries at a scheduled bond auction, seeing...

November 10, 2023Read More >