- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Could the Reserve Bank of Australia hike rates further?

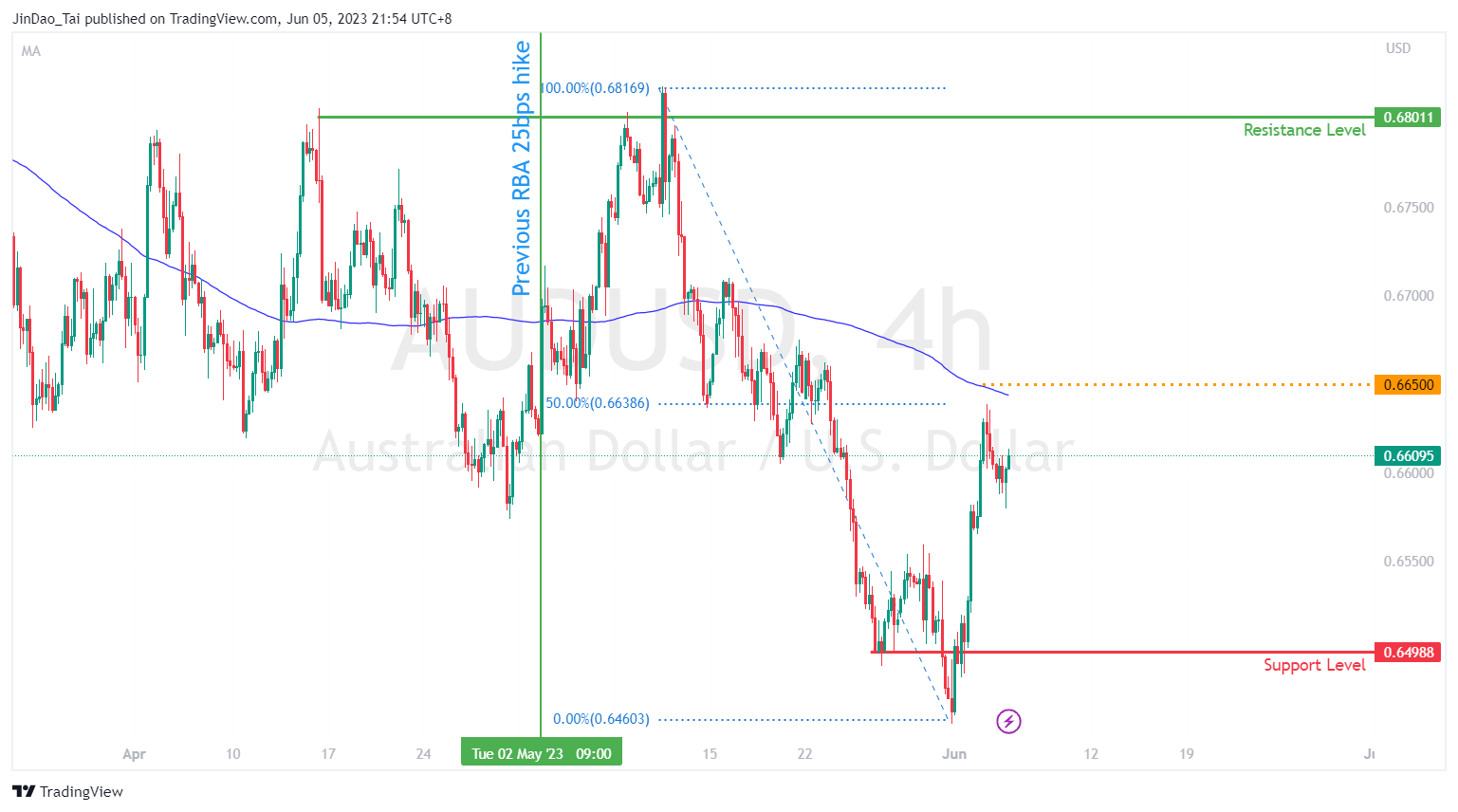

News & AnalysisThe Australian interest rate is currently at 3.85% and the most recent consumer price index (CPI) released at 6.8% which indicates slightly higher than expected inflation growth (expectation was 6.4% with previous data at 6.3%). This puts more focus on the upcoming interest rate decision from the Reserve Bank of Australia (RBA). While further rate hikes could apply added pressure onto the economy as households face increasing mortgage repayments, on the other hand, the series of previous rate hikes have not signaled that inflation growth is likely to slow down sustainably towards the RBA’s target level.

Market analysts are split between a hawkish hold (keeping rates at 3.85% while signaling a possible hike in the 3rd quarter, depending on further data) or continuing with another hike of 25bps to 4.1%.

With the AUDUSD currently trading along the 0.66 price level, a hawkish interest rate decision from the RBA could see the AUDUSD break above the resistance at 0.6650, formed by the 200 moving average. The expected price action could be similar to that seen following the RBA’s surprise decision to hike rates by 25bps at the May meeting.

In this scenario, the AUDUSD could trade toward the immediate key resistance level of 0.68 with further sustained upside likely to depend on the volatility of the DXY.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

AUDUSD Soars on RBA Hike, EURUSD underperforms, CAD, GBP, JPY wrap

USD was firmer on Tuesday amid a light news calendar sparse in any key risk events. The US Dollar index again having a choppy session in a tight range with EURUSD weakness giving the Dollar a tailwind, also helping the greenback was ramped up US growth forecasts from Goldman Sachs and the World Bank hitting the wires. EUR was the G10 underpe...

June 7, 2023Read More >Previous Article

Market Analysis 5 – 9 June 2023

XAUUSD Analysis 5 – 9 June 2023 The overall outlook for gold prices is bearish in the short term. As there was a loss of buying momentum ...

June 5, 2023Read More >