- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FOMC hikes rates but signals pause

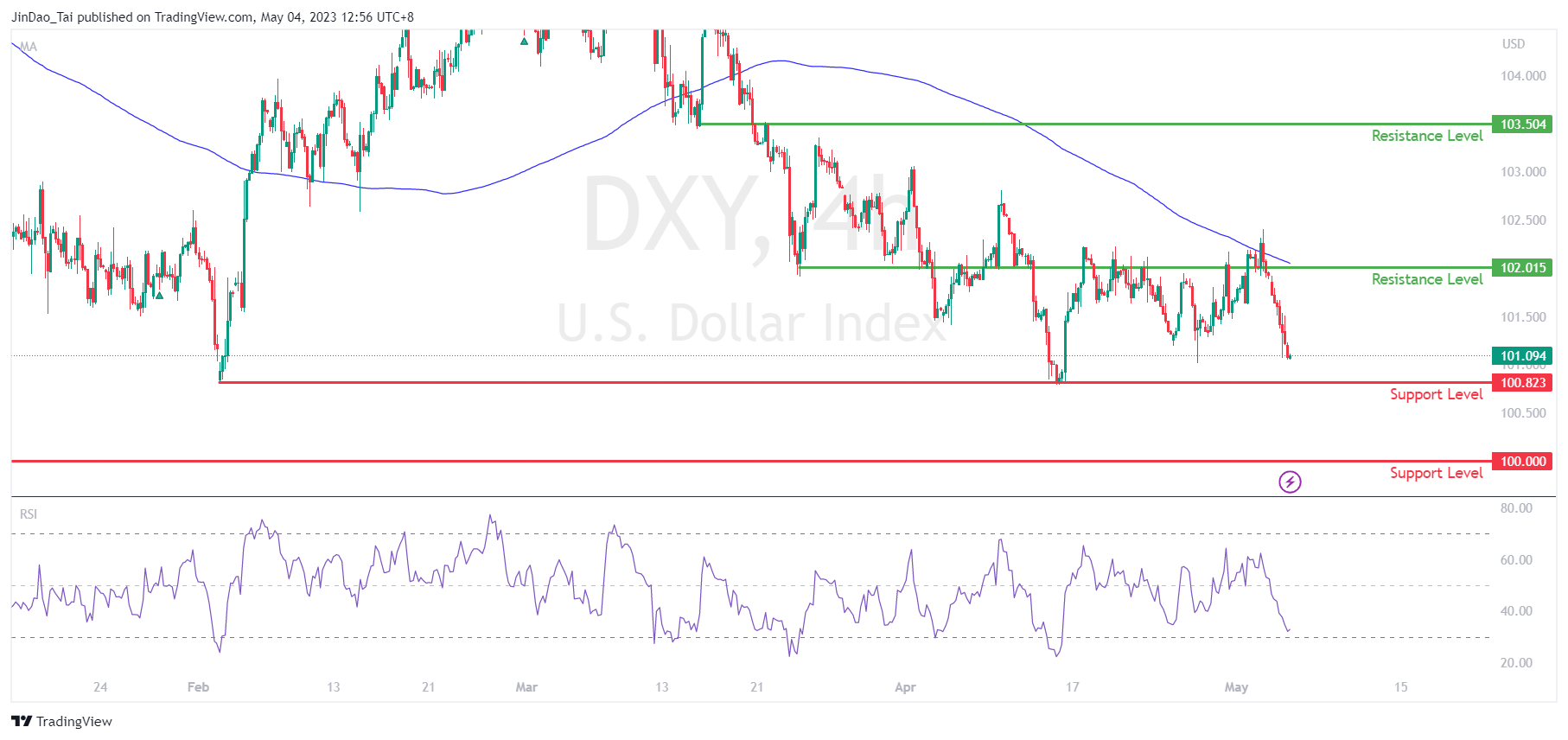

News & AnalysisIn the most recent meeting, the US Federal Reserve hiked rates by 25 basis points, as anticipated, to take interest rates in the US to 5.25%, slightly beyond the terminal rate of 5.1%. However, the US Dollar Index (DXY) fell to the key support level of 100.80 which was last reached in April and February 2023, following the release of the rate hike decision.

The DXY trading lower was driven primarily due to comments from Chair Powell where he indicated that the Federal Reserve was “closer to the end than the beginning” and that it “felt like they are close, or even there”. This signaled to the market that the Federal Reserve could pause on future rate hikes, leading to the weakness seen on the DXY.

In the lead-up to the Federal Reserve rate decision, the upside on the DXY was limited by the round number resistance area of 102 and the 200-period moving average (200 MA). With the DXY approaching the key support level of 100.80 and the relative strength index (RSI) heading down toward the oversold region, watch out for the development of price action along the support level. If the DXY continues to trade lower the next key support level is at 100 which was last tested in April 2022.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Apple posts strong results

World’s largest company Apple Inc. (NASDAQ: APPL) announced the latest financial results after the market closed in the US on Thursday. After disappointing results last quarter, the company bounced back in the fiscal 2023 second quarter ended April 1, 2023, topping revenue and earnings per share (EPS) estimates. Company overview • Founded:...

May 5, 2023Read More >Previous Article

Kraft Heinz Q1 results

US food giant The Kraft Heinz Company (NASDAQ: KHC) reported Q1 financial results before the market open on Wall Street on Wednesday. The company topp...

May 4, 2023Read More >