- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – Hot PMIs support EUR and GBP, BoC disappoints CAD bulls

- Home

- News & Analysis

- Forex

- FX Analysis – Hot PMIs support EUR and GBP, BoC disappoints CAD bulls

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – Hot PMIs support EUR and GBP, BoC disappoints CAD bulls

25 January 2024 By Lachlan MeakinUSD was ultimately lower on Wednesday after a rollercoaster of a session. Broad risk-on sentiment early on saw the Dollar Index (DXY) plummet to hit a low of 102.77 until strong S&P Global Flash PMIs coupled with souring risk sentiment after a dismal US 5yr auction saw a sharp turn-around. DXY retaking the 103 handle at session end, with the 50% Fib resistance the level to watch on the upside.

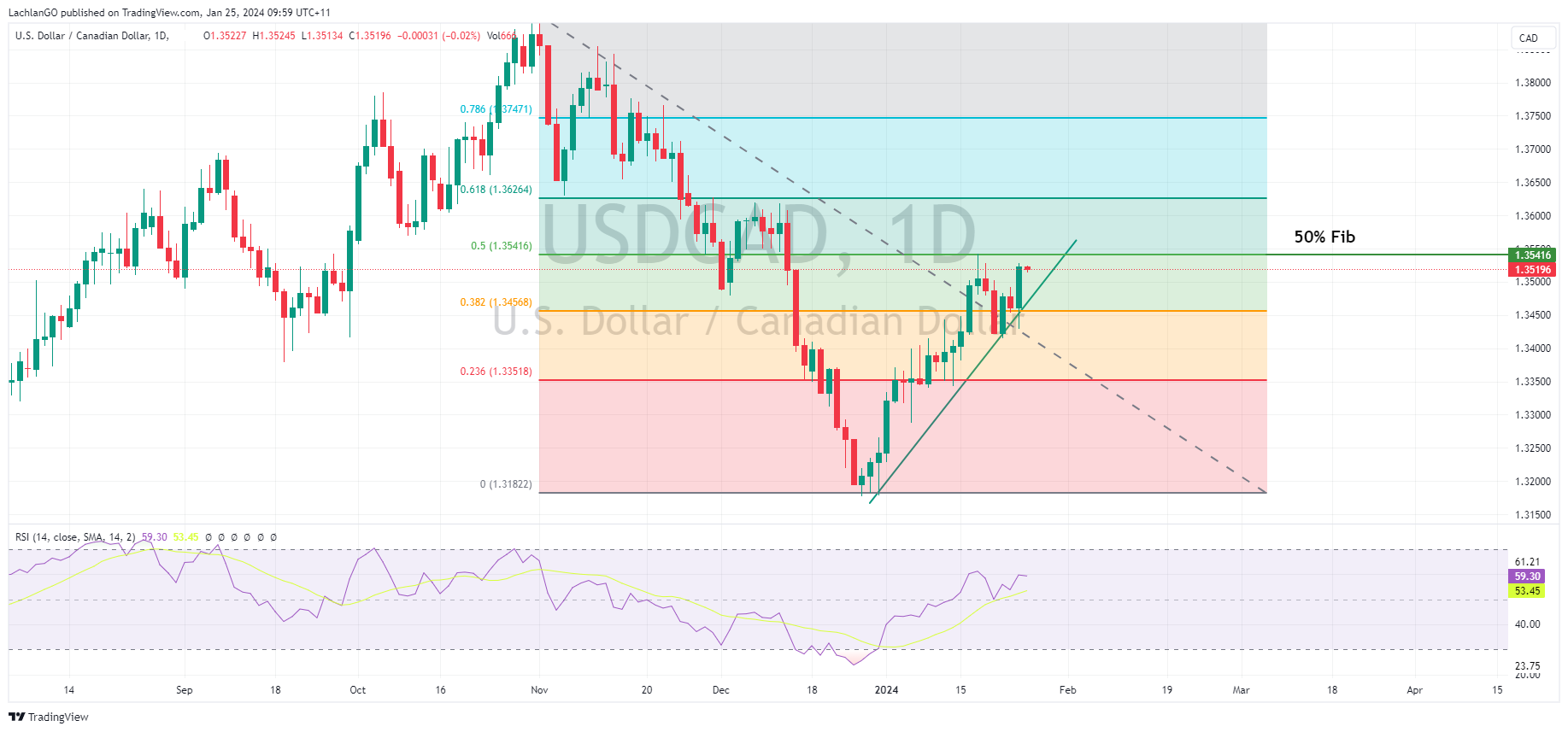

CAD was under pressure with steep losses against all majors in the aftermath of the BoC rate decision. The Bank of Canada held rates at 5.0% as expected but the Bank’s decision to omit language that it is prepared to raise rates further if needed was seen as a dovish and hammered the CAD lower, USDCAD moving higher to 1.3525 and looking set to re-test the resistance level at 1.3541.

EUR saw decent gains against the USD. Europe saw beats in Flash PMIs headline figures for EU, German and French Manufacturing which supported the single currency. Though EURUSD was unable to hold the key resistance and psychological level of 1.09 as USD strength returned later in the session. EUR traders also have the ECB rate decision to look forward to later in the session, the ECB is expected to hold, but as always it will be the messaging traders will be watching.

GBP also saw strength in the aftermath of strong UK PMIs, as manufacturing, Services, and Composite all topped expectations. GBPUSD rallied to test the trend line resistance before pulling back on USD strength, with 1.2772 being a key level to watch in today’s session.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

IBM Q4 results exceed expectations – the stock is rising in the after-hours

International Business Machines Corporation (NYSE: IBM) announced Q4 2023 financial results after the closing bell in the US on Wednesday. The American IT and consulting company reported revenue of $17.381 billion for the last quarter of 2023 (up by 4% year-over-year), narrowly beating Wall Street estimate of $17.289 billion. Earnings per sha...

January 25, 2024Read More >Previous Article

FX analysis – JPY , AUD, NZD, CAD, USD

USD tracked higher with yields in Tuesday’s session with the Dollar Index (DXY) hitting a high of 103.820, setting a new YTD high and breaking throu...

January 24, 2024Read More >