- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX analysis – USD decline continues post FOMC, JPY outperforms on probable BoJ intervention

- Home

- News & Analysis

- Forex

- FX analysis – USD decline continues post FOMC, JPY outperforms on probable BoJ intervention

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX analysis – USD decline continues post FOMC, JPY outperforms on probable BoJ intervention

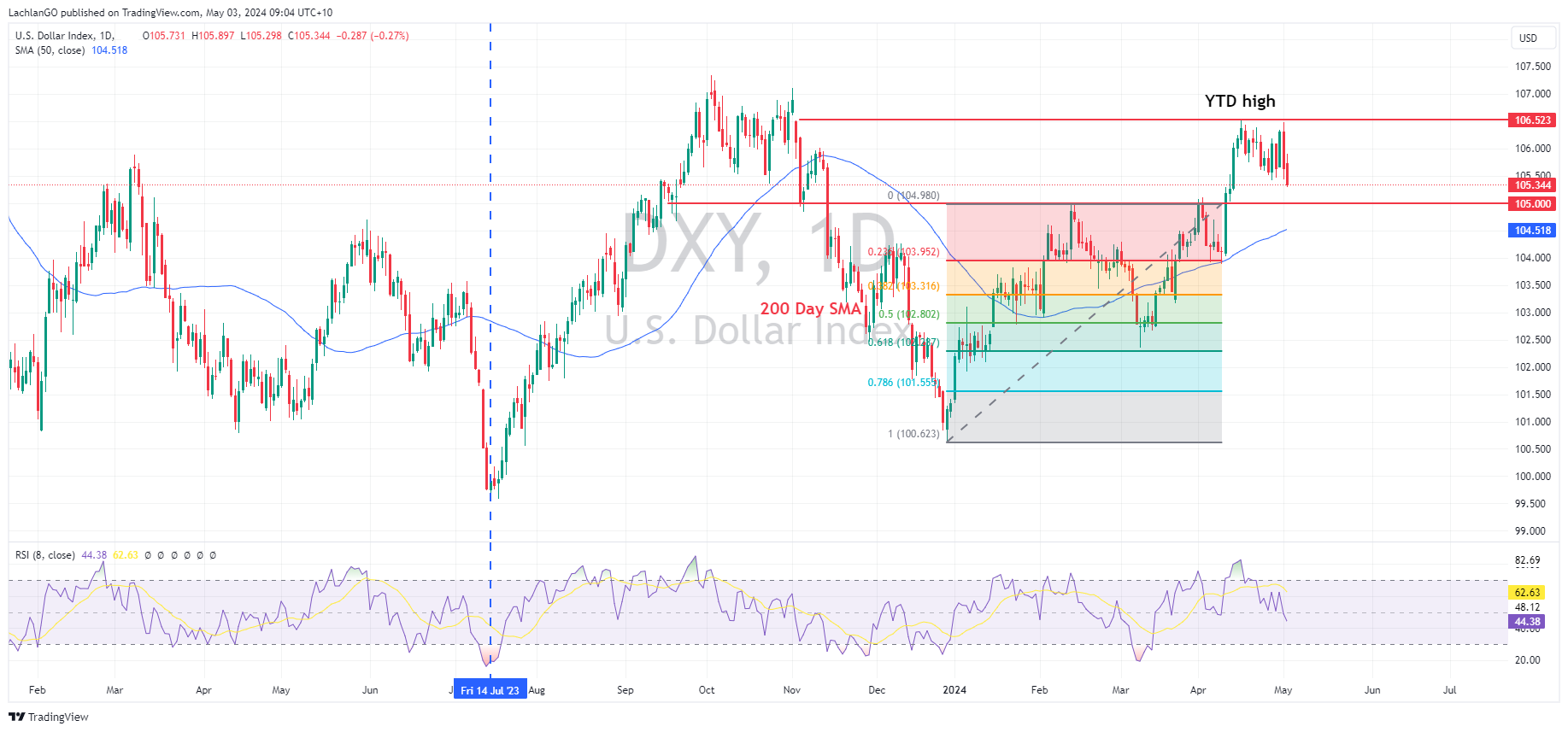

3 May 2024 By Lachlan MeakinUSD continued the move lower sparked by a somewhat dovish Powell in Wednesdays FOMC meeting. And ahead of today’s key NFP print. DXY did hit highs after hot labour costs data, though quickly reversed to hit 3-week lows of 105.29, closing at session lows and looking to test the major support at 105.

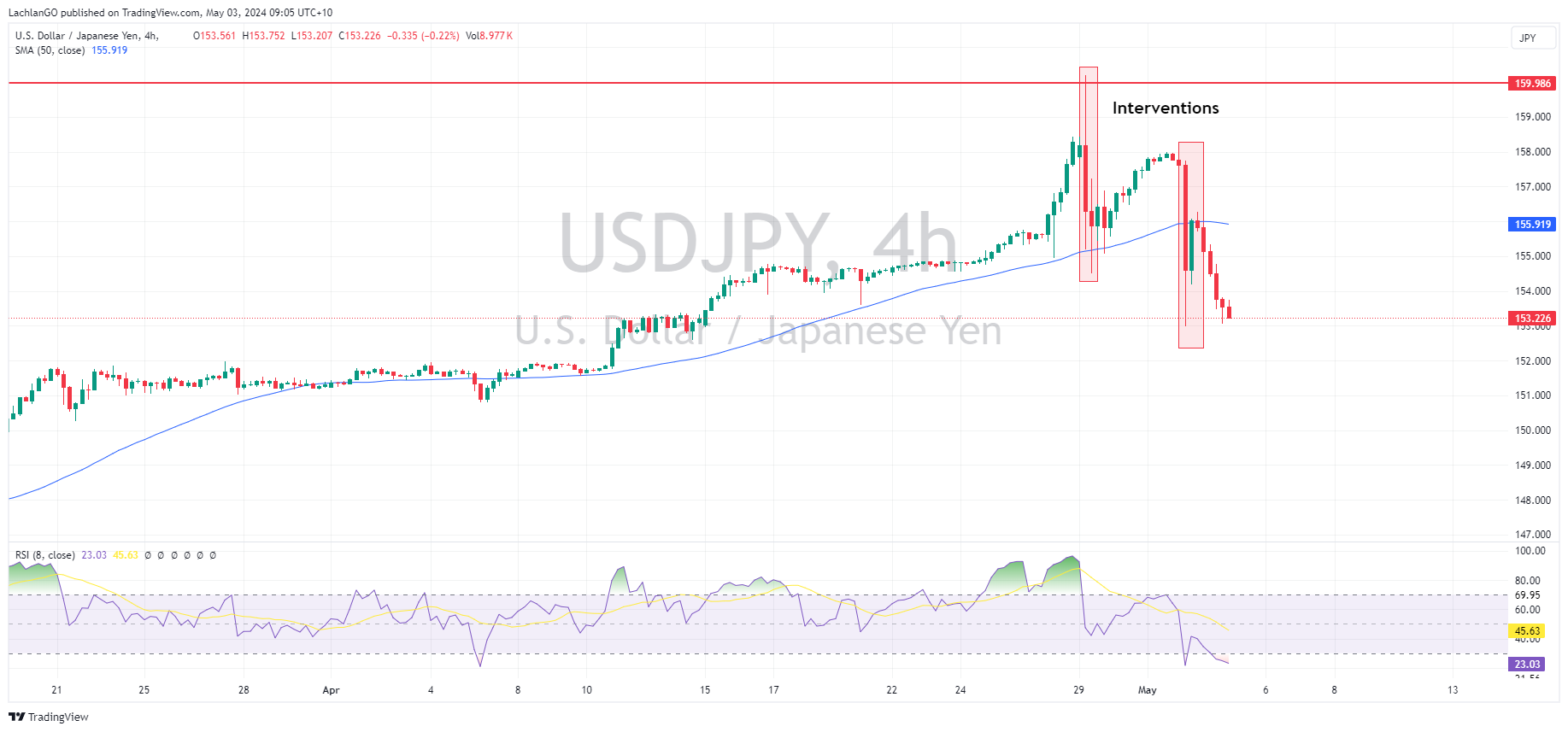

JPY was the clear outperformer of G10 currencies, helped by a Reuters report that BoJ data suggesting that the sharp spikes in Yen strength on Monday and Wednesday this week were indeed BoJ intervention. USDJPY dropping almost 4.5% from the spike high early in Monday’s session to be hovering just above the 153 mark coming in to today’s APAC session.

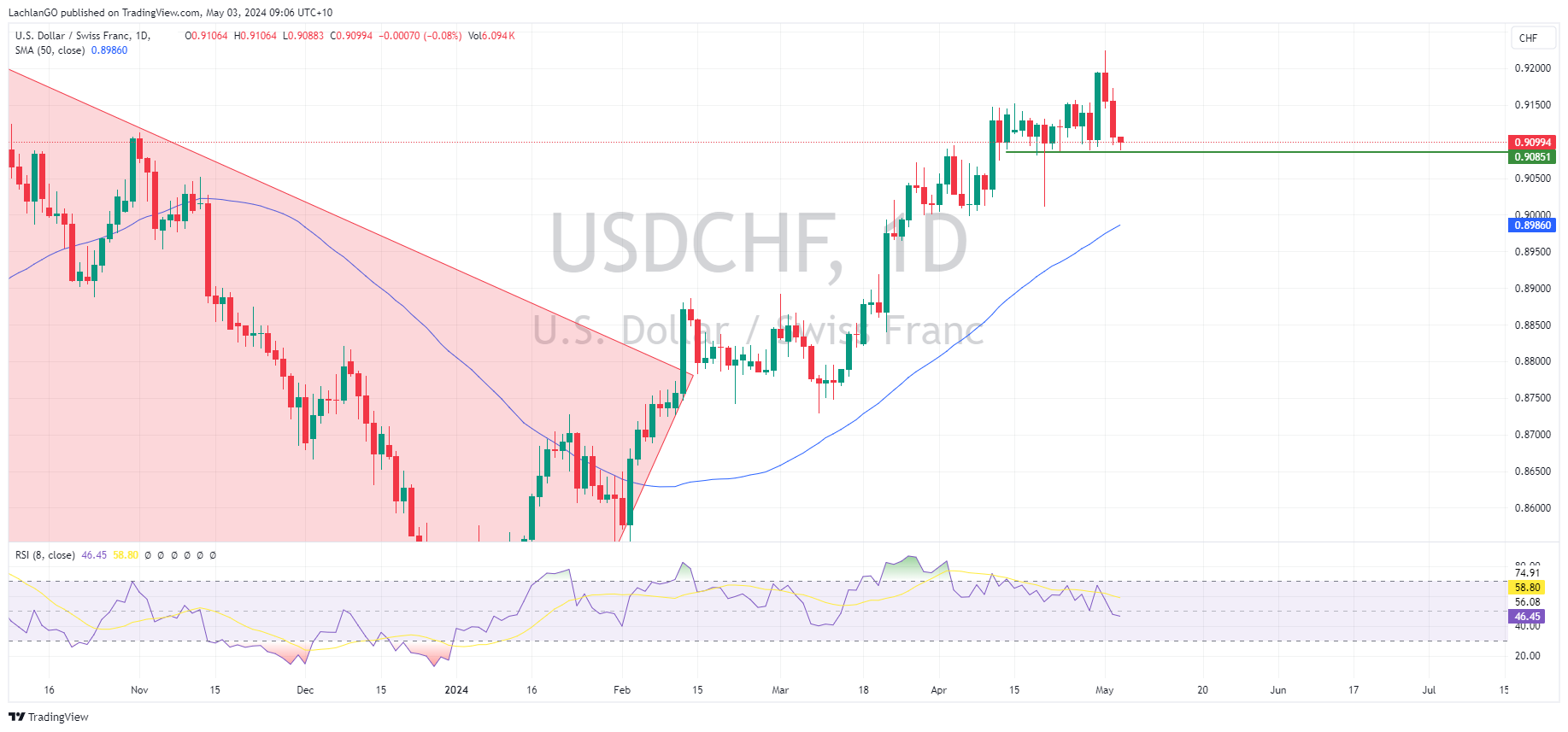

CHF was also an outperformer in Thursday’s session, led higher by a hot April Swiss CPI print where the headline figure of 1.4% Y/Y was well above the expected 1.1%. USDCHF dropped to a low of 0.9094 before finding some buyers at the April support level of 0.9085, this will be a key level to watch in this pair ahead oh US NFP later today.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Future metals: are we seeing the 2000s again?

Plenty has been made of the drive towards nickel and lithium as “future metals” as the world's “electrification” takes hold. This “electrification” has been nicknamed the “volt revolution” and when you get these kinds of technological leaps - what's appearing to be the “winner” now doesn't necessarily mean it will be the overall...

May 7, 2024Read More >Previous Article

Inside the Fed

Let us open with this: “It’s unlikely that the next policy rate move will be a hike. I’d say it’s unlikely,” – US Chair Jay Powell Th...

May 2, 2024Read More >