- Trading

- Platforms & tools

- Education

- Education

- Resources

- Help & support

- More

News & Analysis

FX Analysis – USD rallies as markets turn risk-off ahead of Jackson Hole

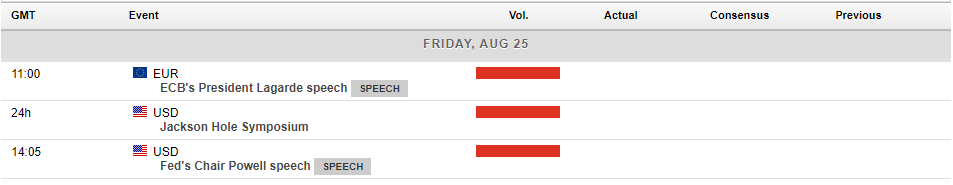

25 August 2023USD was higher on Thursday, with The Dollar Index bouncing back strongly from Wednesdays decline, breaking through the resistance level of 103.60 to touch on the weekly highs at the big 104 level and hitting overbought levels on the daily RSI. Market risk-off, rising yields and a lower than forecast jobless claims figure giving the USD a boost as good news is bad news for equities which in turn is good news for the USD (if that makes sense!) Looking ahead to Friday’s session, all attention will be on Fed Chair Powell speaking at Jackson Hole 14:05 GMT, we are sure to see some volatility in USD as traders look for hawkish or dovish clues from the Fed chair.

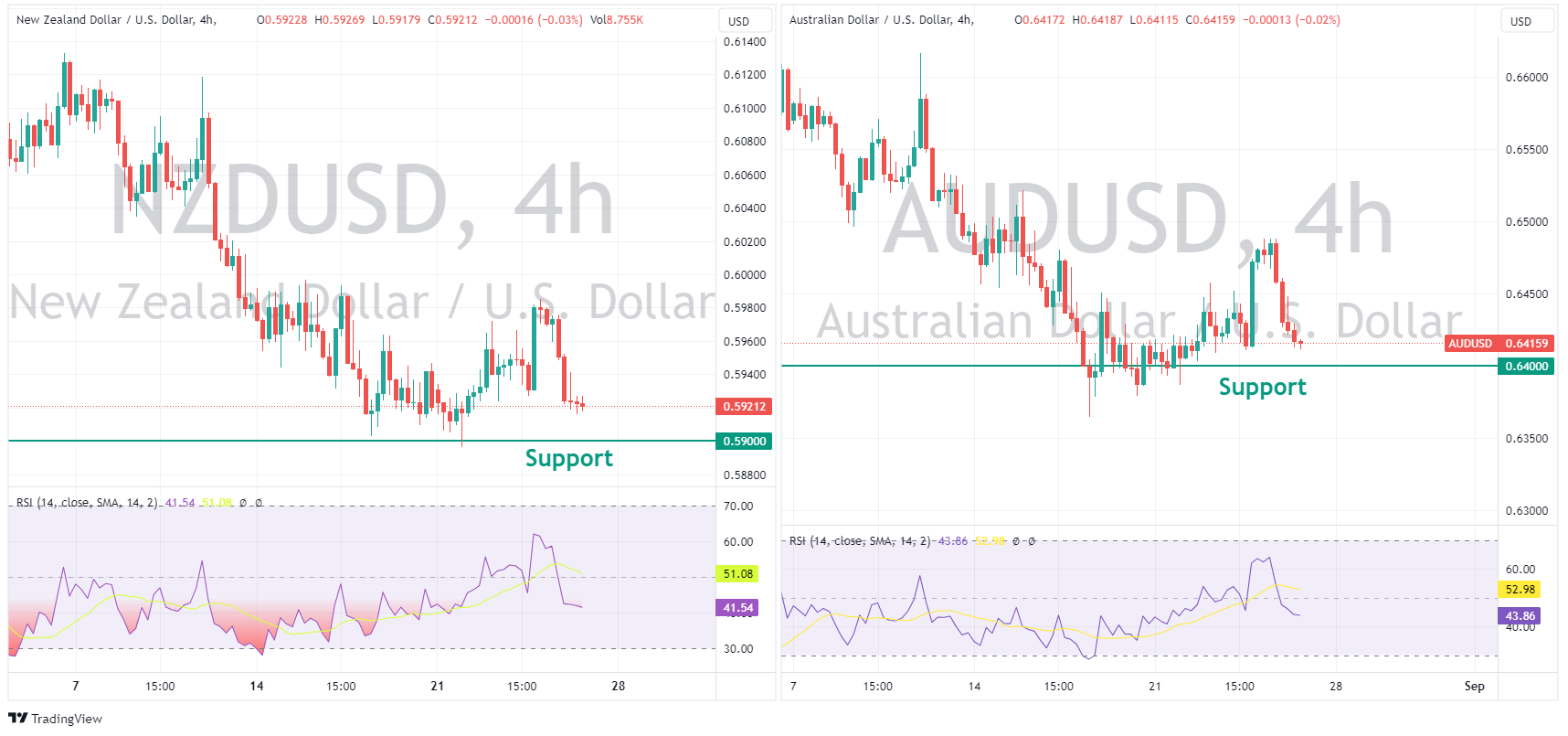

AUD, NZD, and CAD all saw losses to varying degrees against the USD on broad risk-off sentiment resulting in haven flows to the USD. CAD was the “least worst” with a rally in oil prices supporting CAD somewhat. Risk sensitive AUD and NZD were the underperformers with both AUDUSD and NZDUSD giving back all their Wednesday gains and then some. AUDUSD and NZDUSD both sliding to test their major support levels at 0.6400 and 0.5900 respectively. Again, these will be key levels to watch as we head into Jackson Hole.

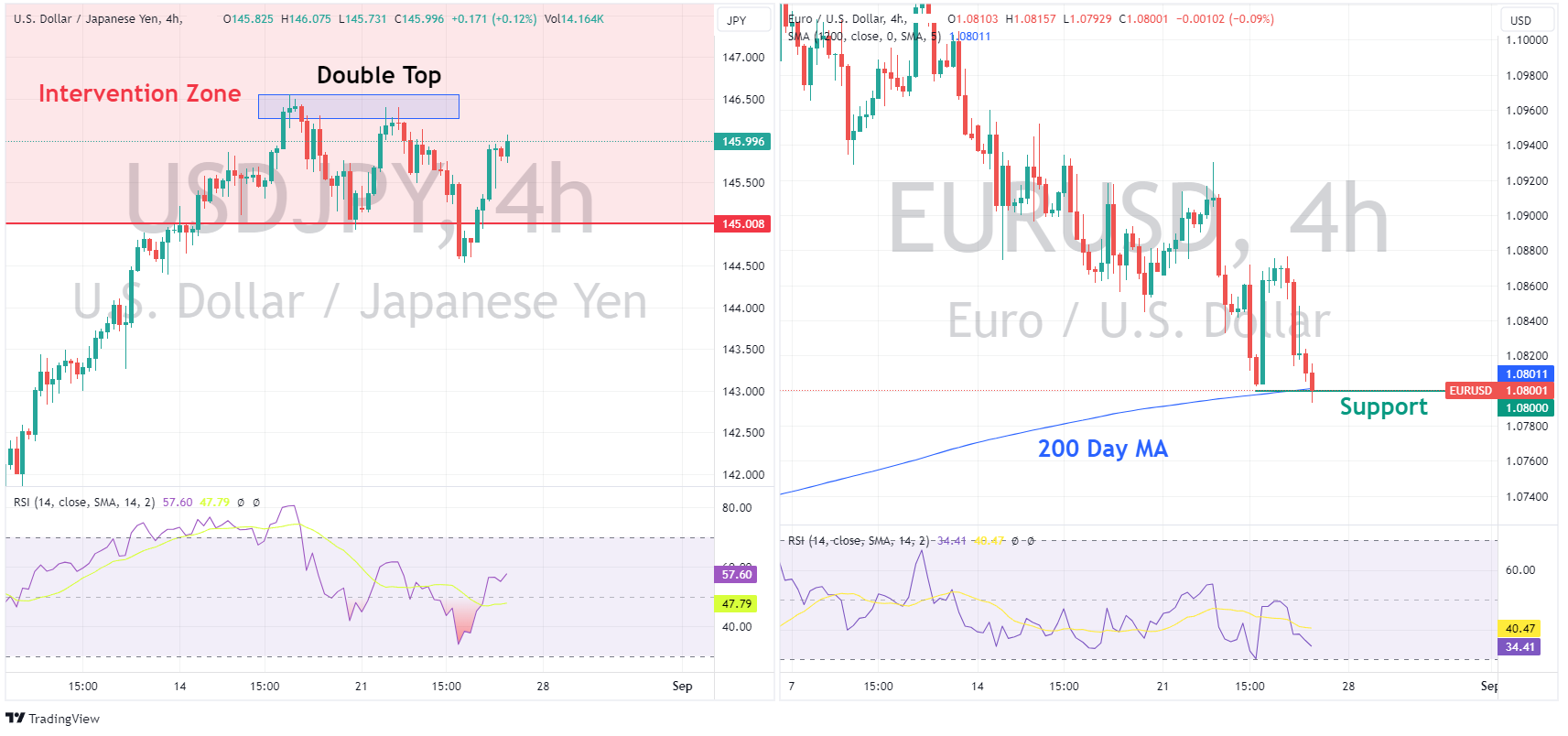

EUR and JPY both also saw losses against the USD, but not as deep as the more risk sensitive cyclical currencies above. EURUSD managing to defend the psychological 1.0800 level, which was the support level set in Wednesday’s session and also the 200 Day MA level. USDJPY held beneath 146.00, but still well above the key 145 level, rising US yields pushing this pair higher, but held back somewhat by the safe haven status of the Yen.

In risk events for today and the weekend, all eyes will be on the Jackson Hole Symposium, where the main event will be comments from Fed Chair Jerome Powell, also on the docket will be other Fed speakers and ECB President Lagarde.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

AUDUSD Reacts in Anticipation of Fed Chair Powell’s Talk

In yesterday’s session, the AUDUSD pair experienced a decline of nearly 1%, erasing the gains it had achieved over the past few days. This retracement arrives as the USD displays signs of renewed strength ahead of an upcoming speech by Fed Chair Jerome Powell. Market participants are eagerly awaiting Powell's remarks for to see if he drops any hi...

August 25, 2023

Read More >

Previous Article

FX analysis – USD drops, Gold pops on soft data, falling yields

A raging US equity market fuelled by soft data, a drop in treasury yields and blowout earnings from NVDA (which saw its stock price hit an all-time hi...

August 24, 2023

Read More >