- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX markets analysis – DXY, JPY, AUD, MXN, CNH, EUR

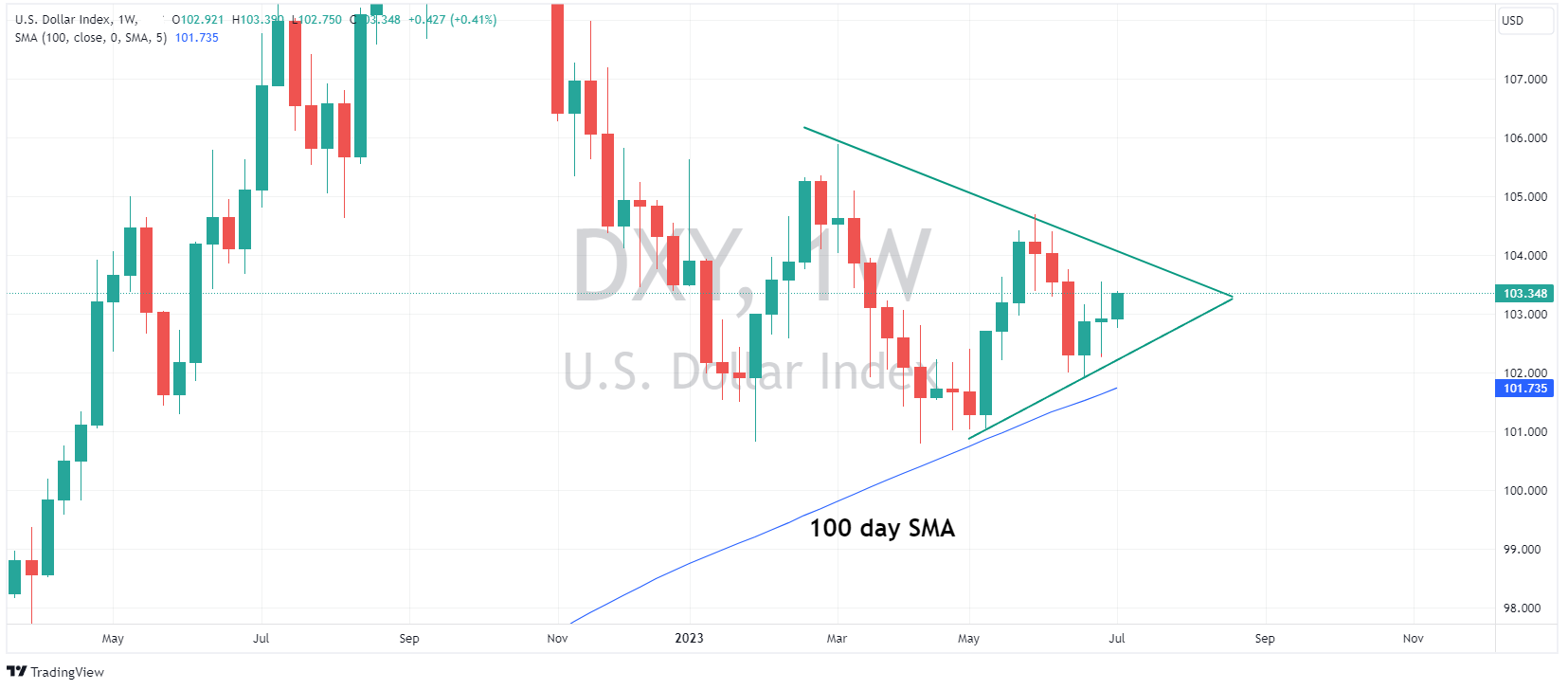

News & AnalysisUSD rose on Wednesday with participants returning from the long weekend pushing the Dollar Index above the key 103.00 level. FOMC minutes from the June meeting were released, with nothing new in Dot Plot projections but they did confirm that some policymakers were pushing for a 25bp hike rather than the hold we got, which lent support to the USD. A sharp move higher in US Treasury yields also giving the USD a tailwind. DXY continuing to hold above the 100 Day SMA and forming a rising wedge pattern, some big data later this week from the US will likely decide which direction it breaks out from here.

EUR saw some downside on the back of USD strength with EURUSD falling from peaks of 1.0907 to close at session lows of 1.0852. Not much in the way of EU news but there was comments from ECB’s Visco who said he doesn’t understand and doesn’t agree with those who prefer the risk of tightening too much rather than too little which stymied some of the losses in EUR.

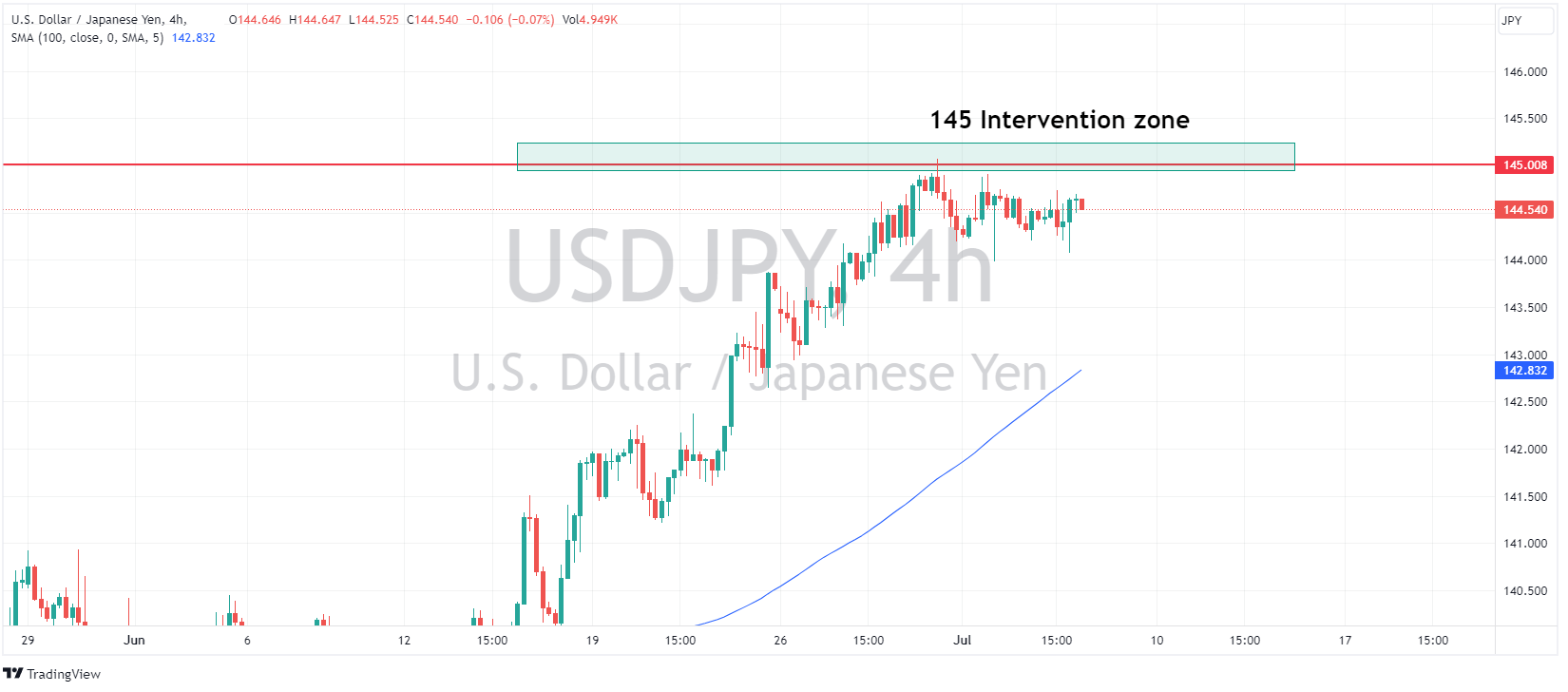

JPY was marginally weaker vs the USD , Asian session strength in the Yen saw USDJPY fall to test 144 to the downside coming in within 9pips of the round level before paring back above 144.50 with a push higher in UST yields driving the reversal, traders seem very aware of previous BoJ intervention around the 145 level which has seen the uptrend come to a halt for now.

The Chinese Yuan saw weakness vs the USD, despite a firmer than expected Yuan fixing, after a miss in the Caixin PMI data and tensions regarding export controls rare metals. USDCNH rallying strongly to close in on the June and 2023 highs of 7.2855

AUD was the G10 underperformer with Aussie traders still digesting the latest RBA meeting where rates were left unchanged and ahead of today’s May trade balance data. The weaker CNH also weighing on the Aussie, keeping AUDUSD beneath the 200 Day SMA which acted as resistance.

In EM FX the MXN was the outperformer, with USDMXN falling beneath 17 for the first time in over seven years. USDMXN continuing to trend downwards with as an attractive carry trade opportunity and a hawkish tone from the Mexican Central bank.

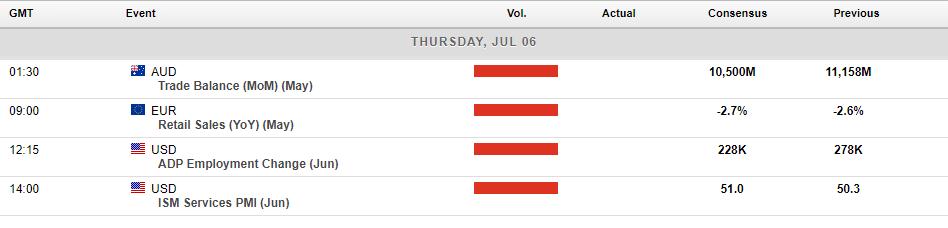

Today’s Economic Calendar below:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Potential Reversal on the NZDUSD?

The current market consensus is that the Reserve Bank of New Zealand (RBNZ) would likely keep interest rates at 5.50% at the upcoming meeting on 12th July. This is supported by the RBNZ’s monetary statement indicating that “monetary policy is having a sufficiently moderating effect on demand and inflation, and that we are yet to see the full ef...

July 11, 2023Read More >Previous Article

Could the RBA Surprise with another rate hike?

In June, the Reserve Bank of Australia (RBA) surprised markets with a decision to hike rates by 25bps, taking the Australian cash rate to 4.10%. This ...

July 3, 2023Read More >