- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- GBPCAD – G10’s Best Performing Currencies Lock Horns

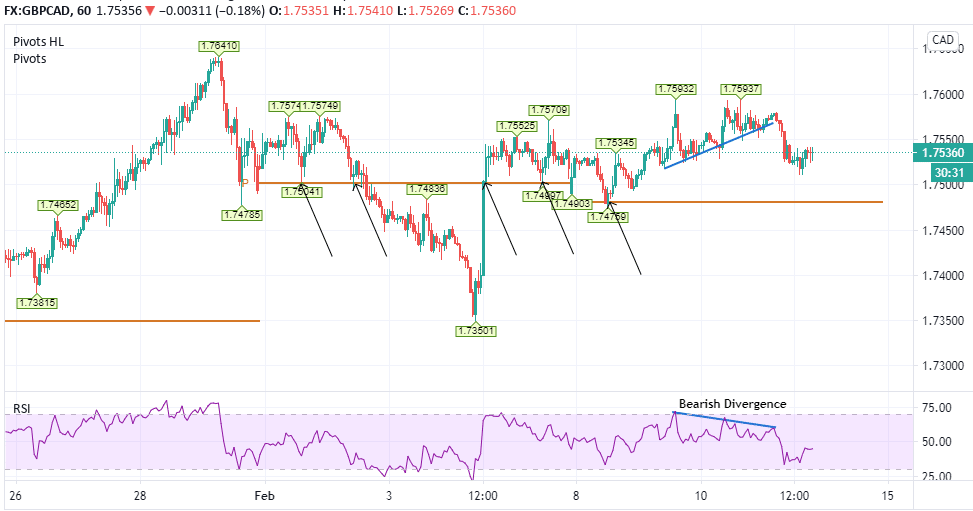

News & AnalysisGBPCAD – Hourly

Individually, both the British Pound and the Canadian Dollar have surged in recent trading sessions, appearing relatively strong against their peers in the short-term. With the latest fundamental data suggesting both currencies have benefited from similar economic drivers, it could be tough to navigate a directional bias for GBPCAD, as we’ll discuss in today’s Chart of The Day.

Firstly, as the markets come to grip the idea that the Bank of England will seek to avoid cutting interest rates into negative territory, the Pound should continue to gather momentum along with positive reports of vaccine rollouts around the country. Similarly, the Bank of Canada has also dismissed talks of negative rates and reaps the rewards of recent steadiness in global oil prices. At around $58 per barrel, we’re seeing the highest oil prices in just over a year. And with further potential production cuts earmarked for Saudi Arabia, the commodity-sensitive CAD could see additional gains.

Technically speaking, Sterling does appear to have the slight upper hand from a longer-term trend perspective. However, in the short-term, the hourly chart shown looks bearish. We might be witnessing more corrective moves or some profit-taking activity following last week’s sharp advance to higher levels instead of specific CAD demand. This idea neatly ties in with the recent bearish divergence pattern highlighted on the RSI indicator above.

A further sell-off on the hourly could target the current weekly pivot point (gold line), located at 1.7475. Looking at the price action during the past few weeks, it has a habit of utilising weekly pivots as critical support areas. For example, not only did GBPCAD test last week’s pivot of 1.7500 multiple times, but it even touched January’s final pivot with pinpoint accuracy, reaching exactly 1.7350 before rebounding upwards. To the upside, the pair continues to find resistance around the early 1.76 regions, but as mentioned before, these trends display a more bullish bias when viewed longer-term.

So despite all the factors contributing to a favourable condition for the Canadian Dollar, the Pound edges ahead in dominance as 2021’s top-performing G10 currency thus far. Given its momentum, any weakness is probably likely to be viewed as temporary, with traders eyeing the dips in price as possible opportunities to go long.

Sources: Go Markets, Meta Trader 5, TradingView, Bloomberg

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Week Ahead: All time highs for US markets, China drives oil rally and Bitcoin boost.

World equity markets finished modestly positive for a week sparse of economic news. US markets again hit all time highs on the back of strong corporate earnings, continued optimism in fiscal stimulus and COVID progress as the US infection rate eased to its lowest level since October. Equity Markets US The NASDAQ outperformed with T...

February 15, 2021Read More >Previous Article

AUDNZD – Kiwi Returning To The Status Quo

AUDNZD – Daily Despite the Australian Dollar having a strong rally towards the end of last year, it appears the New Zealand Dollar is once again ...

February 3, 2021Read More >