- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Market Analysis – Gold tests key level, AUD dips ahead of CPI, Oil bounces

- Home

- News & Analysis

- Forex

- Market Analysis – Gold tests key level, AUD dips ahead of CPI, Oil bounces

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisMarket Analysis – Gold tests key level, AUD dips ahead of CPI, Oil bounces

10 January 2024 By Lachlan MeakinGlobal markets chopped about in Tuesday’s session with no key data released with traders seemingly waiting on the sidelines for US CPI and a slew of bank earnings later in the week.

Gold – XAUUSD

XAUUSD rallied in Tuesdays APAC session testing the 2040 USD an ounce resistance level before a sharp drop as Europe opened saw drop to a low of 2026. This will be a key level to watch for the gold bulls with 2040 now establishing itself as a cap to further price increase.

AUDUSD

The Aussie dollar took a hit on mixed risk sentiment, reversing modest gains made in the APAC session on a surprise beat in building approvals and above-forecast retail sales. AUDUSD losing the 0.67 handle and holding around 2024 lows. Ahead today AUDUSD traders will a CPI reading to navigate, with Year on year inflation expected to drop to 4.4% from last months reading of 4.9%.

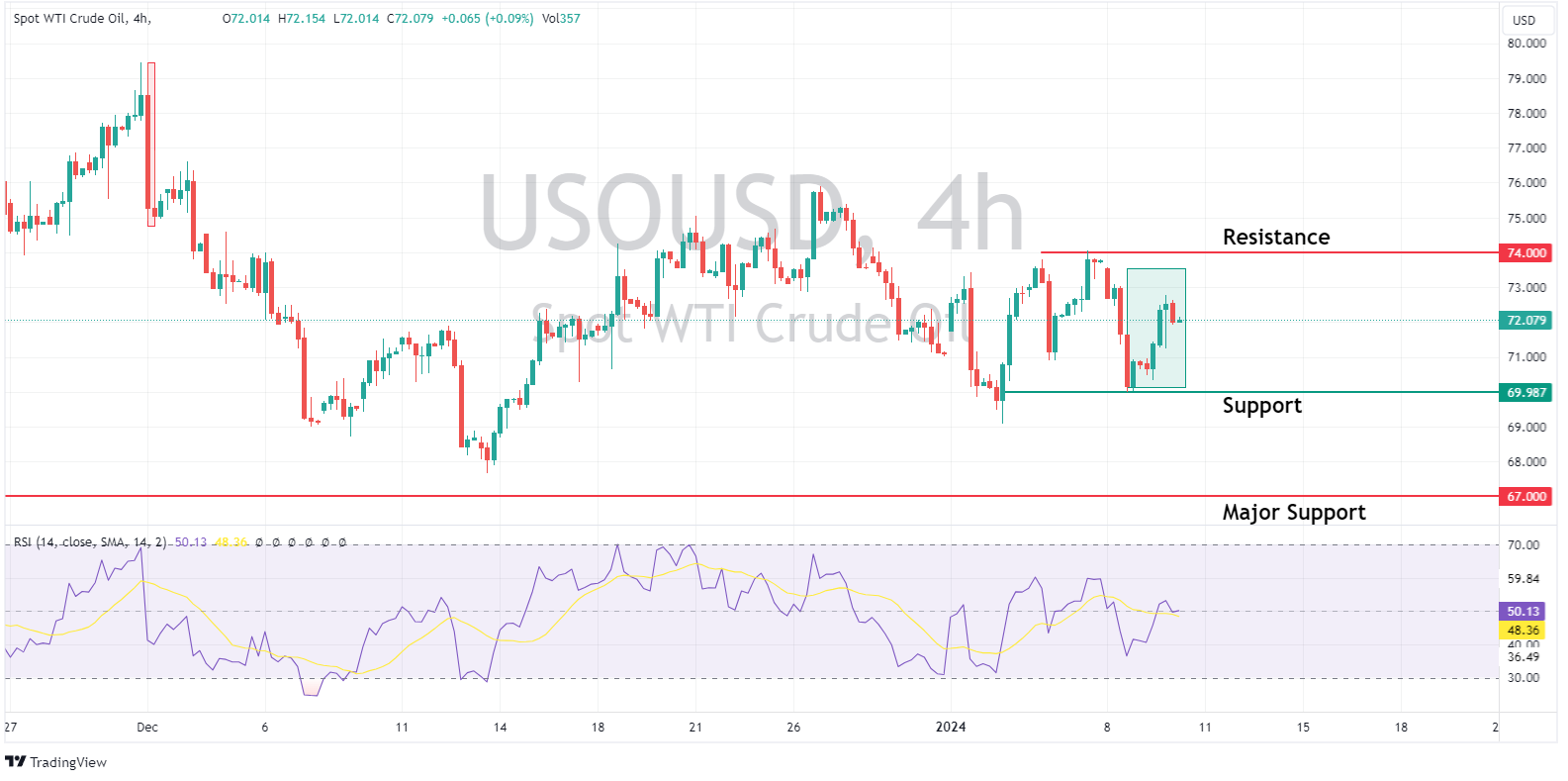

Crude Oil – USOUSD

Crude oil pared some of Mondays’ steep losses with Mid-East tensions continuing stoking supply concerns. USOUSD continuing to trade in its 2024 range of 70 support to the downside and 74 resistance to the upside. Geopolitical events currently being the main driver of crudes price action.

Ahead today with have Aussie CPI in the APAC session and BOE Governor Bailey speaking in the UK session.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Analysis – GBP, EUR JPY, USD

USD saw weakness in Wednesday’s session with a risk on equity market and only a marginal move higher in yields weighing on the Greenback ahead of today’s key US CPI report. There was little in the way of major US data releases but some hawkish leaning comments late in the session from the Fed’s Williams stemmed losses. The US Dollar Index (DX...

January 11, 2024Read More >Previous Article

AUD CPI Data Looms

Since the start of 2024, the AUDUSD has reversed from the resistance area of 0.6870, a high formed in June and July 2023. The main factor leading to t...

January 9, 2024Read More >