- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Possible high return Swing Trade on USDCHF

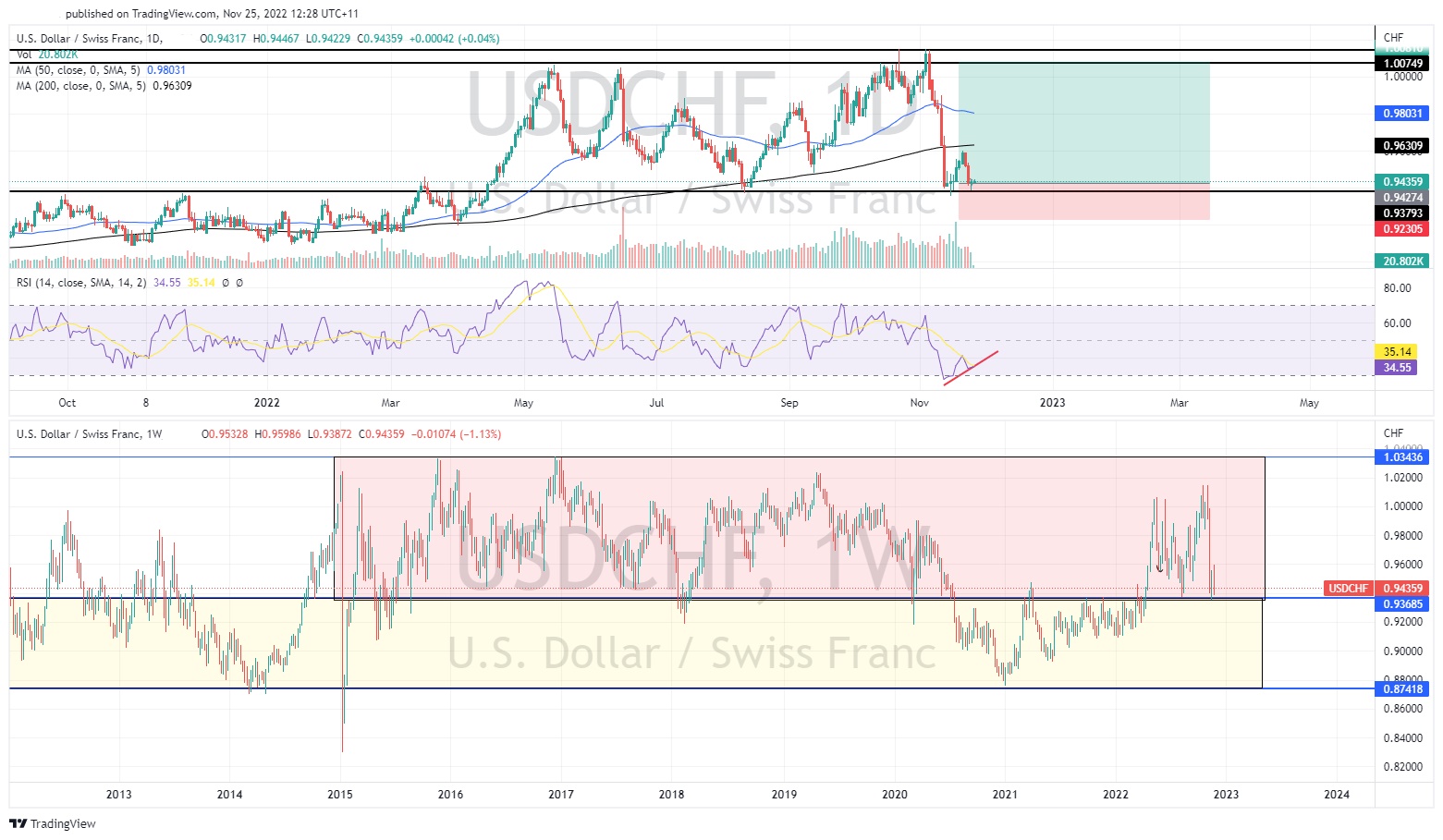

News & AnalysisThe USDCHF has just reached a significant support zone providing a potential entry for a low-risk high return trade. In recent weeks the USD has an aggressive pulled back on the back of weaker then expected inflation figures. This has benefited the CHF and most other non-USD currencies as expectations of a potential pivot grow and money moves away from the Greenback.

From a technical perspective the price of the USDCHF has fallen to its lowest price since August 2022. The price has also largely been in a ranging pattern since 2010 between 1.03436 0.8741. In addition, besides the Covid years, the price has been in a tighter range between 0.94 and 1.03.

The current price zone has been a really important area of support and in the most recent test of this area, in August the price bounced quite strongly. Interestingly, during times of higher market volatility the price extends its lower bound of the range from 0.94 to 0.87. For example, the prices extended its range during the GFC and the Covid pandemic. However, generally, the pair trades in the tighter range. Therefore, as it is arguable if the current market conditions represent volatility as sinister as the GFC or the Pandemic this current price action lends itself to a potential bounce over a further sell off.

The bounce is also supported by the RSI which is not just oversold but showing the potential for a divergence. With the price at an ideal entry point, it allows for a high potential risk reward trade. The trade’s target is 1.0075 as seen on the price chart.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Phillip Lowe apologises to the Australian Public over missed forecasts

Phillip Lowe, governor of the Reserve Bank of Australia, (RBA) has issued an apology to the Australian public in his most recent statement. Lowe specifically apologised for providing guidance in 2020 and 2021 that the official cash would only rise in 2024. Instead, rate rises began earlier this year and rises have occurred in 7 straight months. Dur...

November 28, 2022Read More >Previous Article

Shares of Deere rise as financial results exceed expectations

Shares of Deere rise as financial results exceed expectations Deere & Company (NYSE: DE) announced financial results on Wednesday for the fourt...

November 24, 2022Read More >