- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Potential Reversal on the NZDUSD?

News & AnalysisThe current market consensus is that the Reserve Bank of New Zealand (RBNZ) would likely keep interest rates at 5.50% at the upcoming meeting on 12th July. This is supported by the RBNZ’s monetary statement indicating that “monetary policy is having a sufficiently moderating effect on demand and inflation, and that we are yet to see the full effects of past tightening on the economy. A pause would also allow more time to assess the impact of the significant tightening, and the timing of any further increase that might be needed.”

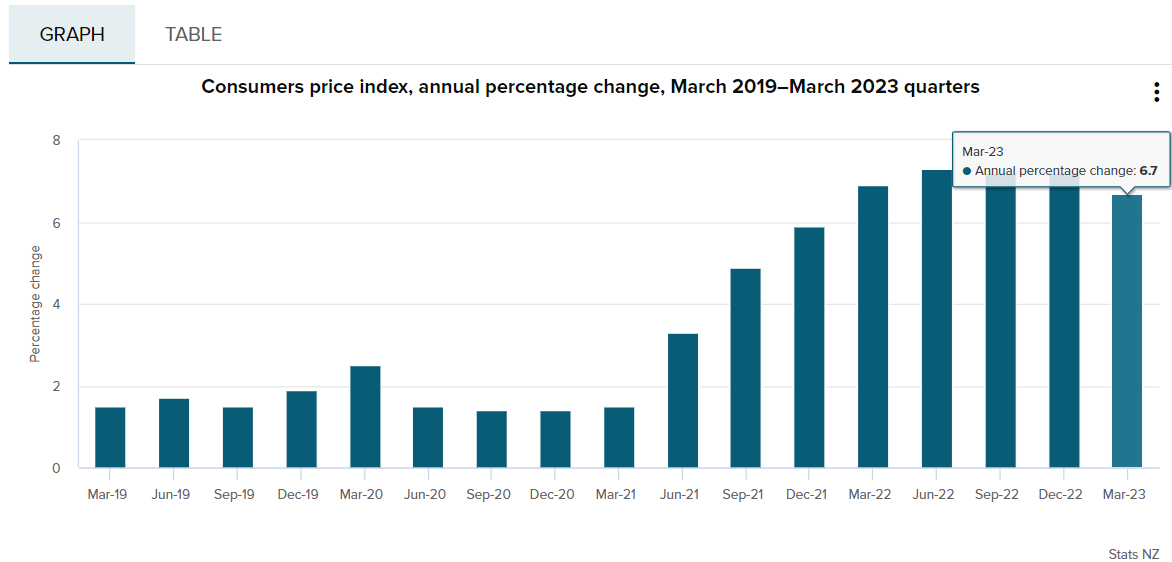

However, while the Consumer Price Index (CPI) has turned down from its peak of 7.3%, the most recent data was released at 6.7%, this is still significantly higher than the RBNZ’s target level of 1-3%. Therefore, another rate hike from the RBNZ cannot be ruled out.

In May, the RBNZ released its decision to hike rates to 5.50% but also indicated that the official cash rate has reached its peak at 5.50% but would need to remain at the restrictive level until at least the middle of 2024. This led to the NZDUSD falling steadily from 0.6250 to reach the round number support level of 0.60.

As the NZDUSD climbs toward the 0.6250 price area, formed by the previous swing high and the downward trendline, look for a potential reversal if the RBNZ holds interest rates at 5.50% as forecasted. A reversal to the downside could reach the price level of 0.61, supported by the upward trendline, and beyond that, the 0.60 round number key support level.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Market analysis – USD lower ahead of key CPI figure, GBP breaks out on strong jobs data

USD was marginally lower in Tuesdays session , trading in a tight range amid thin newsflow and market participants awaiting the key June CPI reading released later today. After breaking the psychological 102 level in Mondays session, DXY tested a re-entry into the range but found the previous support at 102 acting as stiff resistance, seeing DXY ...

July 12, 2023Read More >Previous Article

FX markets analysis – DXY, JPY, AUD, MXN, CNH, EUR

USD rose on Wednesday with participants returning from the long weekend pushing the Dollar Index above the key 103.00 level. FOMC minutes from the Jun...

July 6, 2023Read More >