- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- The Week Ahead – Volatility set to return with FOMC, BoE and NFP ahead

- Home

- News & Analysis

- Forex

- The Week Ahead – Volatility set to return with FOMC, BoE and NFP ahead

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Week Ahead – Volatility set to return with FOMC, BoE and NFP ahead

29 January 2024 By Lachlan MeakinFX traders have a bumper week of major economic announcements to navigate, with markets in a holding pattern awaiting the pivotal January Federal Reserve meeting, adding to that a Bank of England policy meeting, CPI readings out of Australia and Europe topped off by the US non-farm employment report.

The Charts to Watch:

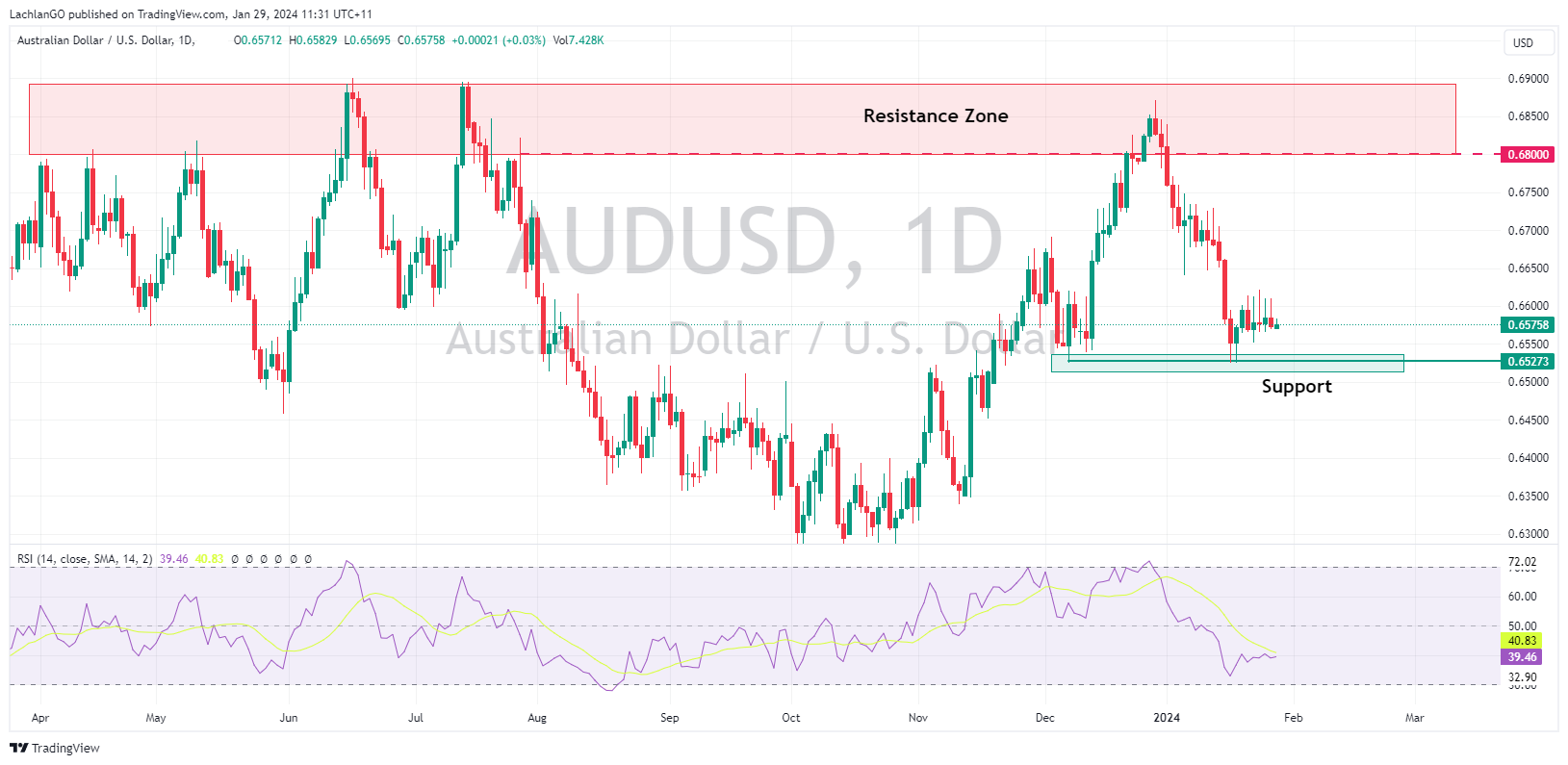

AUDUSD – Aussie CPI and Chinese manufacturing PMI

Since hitting a cycle low of 0.6525 and finding support at the December lows on January 17 AUDUSD has traded in a tight range between that support and 0.66 where multiple attempts to push higher have been rebuffed.

This week’s data looks set to test that range, starting with Aussie CPI and to a lesser extent a Chinese manufacturing PMI on Wednesday. 0.66 will be the level to watch if we get a hot CPI reading, the support at 0.6525 to the downside if there is a cooler than expected reading.

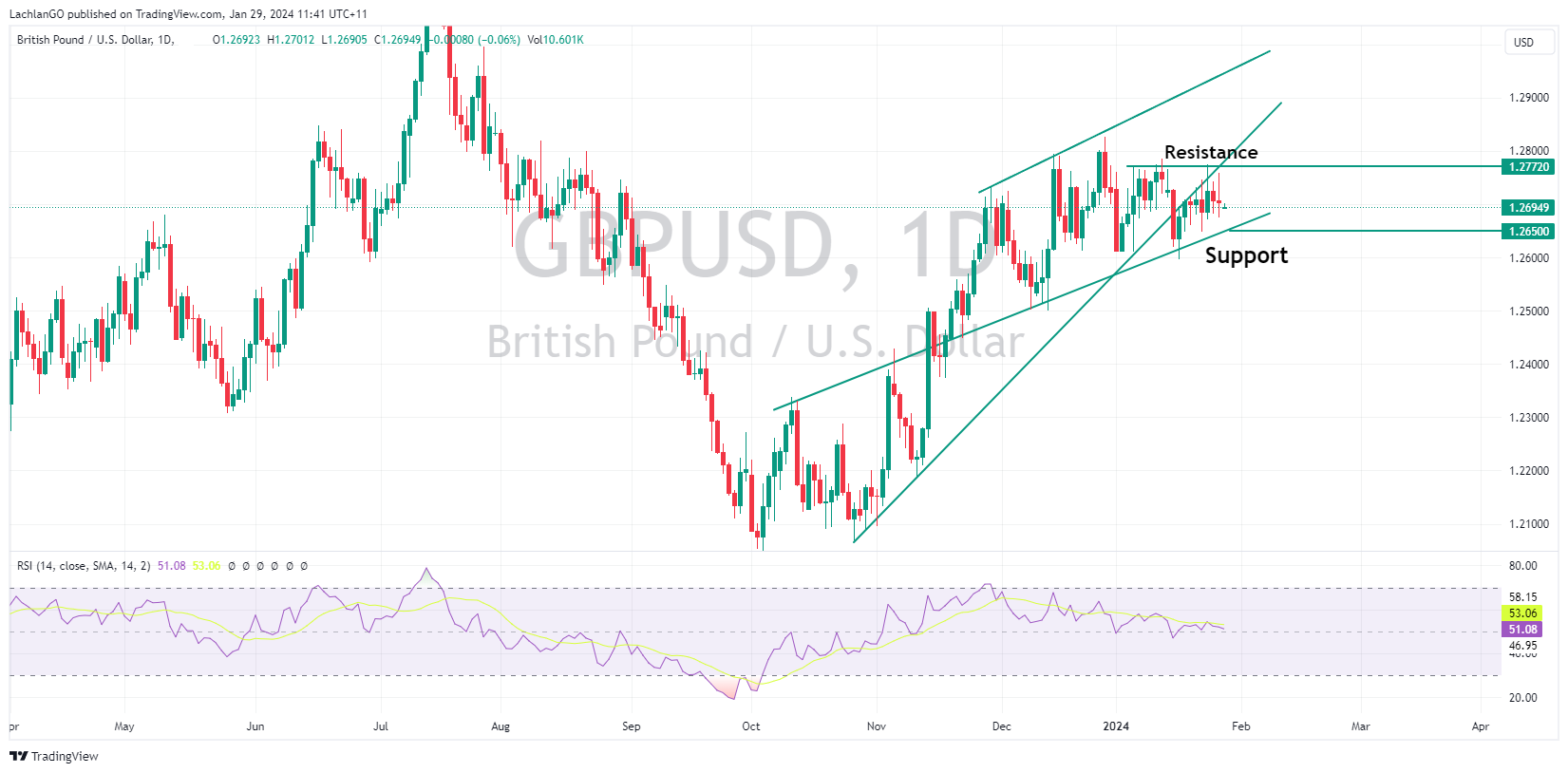

GBPUSD – Bank of England policy meeting

Cable has also spent the last week chopping around in a tight range, GBPUSD price action has been contained in a myriad of technical levels with resistance to the upside at 1.27720 and support at the lower 2024 trendline around 1.2650.

At this weeks Bank of England meeting, the central bank is expected to gold rates steady but is will be the accompanying statement and presser where traders will look for clues as to when the bank may start cutting rates that will see FX markets re-price.

US Dollar Index (DXY) – FOMC and NFP ahead

DXY comes off a choppy week with a pivotal FOMC meeting on Thursday and the always market moving NFP on Friday to get things moving.

The 2024 advance in DXY has been capped by resistance at the 200-day moving average along with the July lows-October highs 50% fib level at 103.55. The Fed is widely expected to hold rates steady at this meeting, with futures only pricing in a 2% chance of a cut, but it will be the messaging regarding the March meeting (where there is a 50-50 chance of a cut) that should see some volatility in the USD as markets re-price those odds. 103.55 will be the level to watch for the next move in DXY with a break above or below possibly signaling the next trend in DXY.

The weeks full calendar at the link below:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Nucor Q4 2023 results exceed expectations

The largest steel producer company in the United States, Nucor Corporation (NYSE: NUE), announced the latest financial results after the market closed in Wall Street on Monday. The company achieved revenue of $7.705 billion in the fourth quarter of last year, above analyst estimate of $7.635 billion. Earnings per share was reported at $3.16, ...

January 30, 2024Read More >Previous Article

American Express sets a new full year revenue record, raises outlook – the stock is up

American Express Company (NYSE: AXP) announced fourth quarter of 2023 and full year financial results before the market opened in the US on Friday, en...

January 29, 2024Read More >