- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Geopolitical Events

- Gas and electricity crisis hits the East Coast of Australia

- Home

- News & Analysis

- Geopolitical Events

- Gas and electricity crisis hits the East Coast of Australia

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAustralians have been hit with a massive spike in gas and electricity bills as the country deals with a sudden shortage in power. Electricity prices were soaring so high and fast that the energy regulator had to step in and place a cap on the price of energy at $40 a gigajoule until 10 June 2022.

Causes of the Crisis

The supply shock has been caused by a perfect storm of factors. A cold freeze and a supply shortage of coal, among a volatile global market which has led to the increase in prices. Adding to this, one of the country’s largest energy suppliers Origin Energy, (ORG) announced earlier in the week that it would not be able to source enough black coal to run the country’s largest plant to full capacity and the problem is not set to ease any time soon.

Australia has a large supply of coal and gas; however, it is a net exporter meaning that it sells most of the commodity overseas. Therefore, as prices rise, the cost to produce electricity within the country increases as well. As coal stations age they fail more regularly, and Australia has an older generation of coal plants. In addition, the transition towards green energy has accelerated the closure of many of the plants.

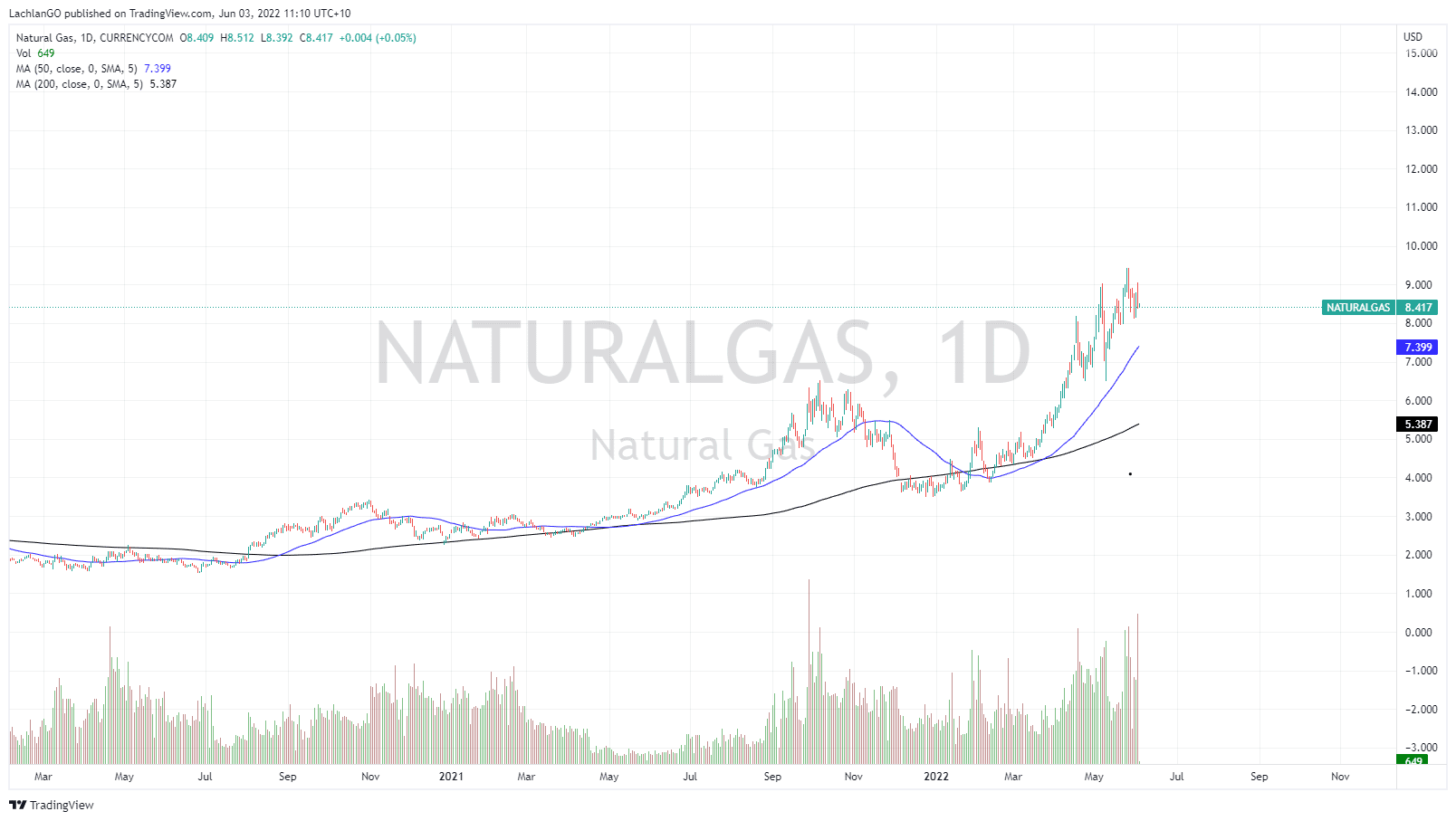

In response the coal crisis some of the energy producers have increased their production of energy by using gas. However, similar issues apply, in that the country exports a large amount of gas meaning to supply the market, gas must be bought on the international market at international prices. Consequently, the pressures affecting much of the international market now affect Australians too. This is mainly from supply chain issues relating to the Russia and Ukraine crisis.

Government Response

The Australian government can apply the Domestic Gas Security Mechanism to reserve more of the export supply for domestic use. The mechanism was introduced in 2017 under Malcom Turnbull for situations exactly like this. The new Minister for climate change and Energy, Chris Bowen, left all options on the table stating that “action is necessary, and action is being taken.”

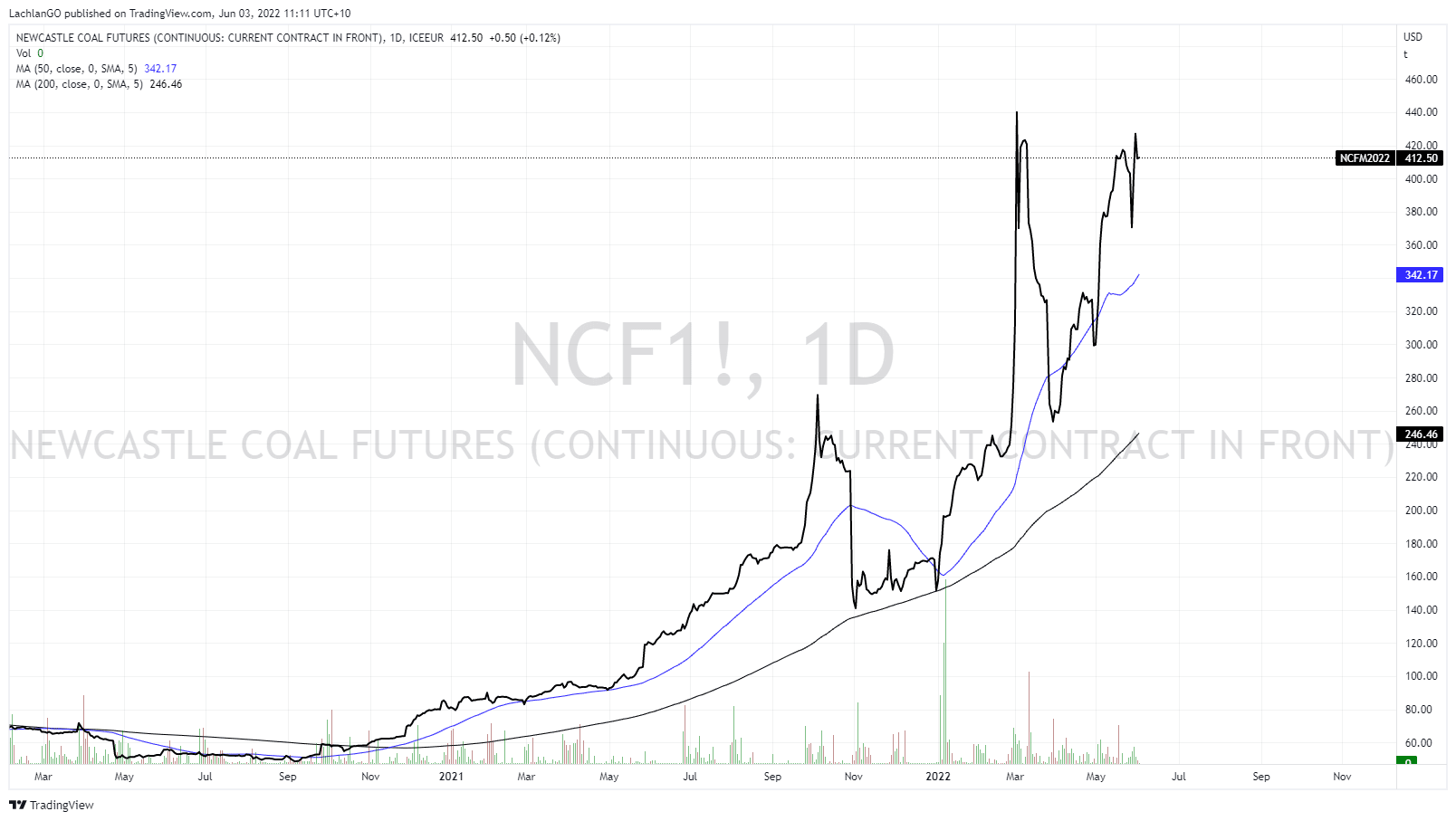

The price of natural gas is currently sitting at decade highs. The price globally has largely been influenced by the Russian and Ukraine crisis as countries have scrambled to secure gas supplies.

Concern for Manufacturers

The concern for businesses and manufacturers is paramount. The concern for businesses is that manufacturers may be hit hard with the increase in these costs. Furthermore, it is difficult for large manufacturers to adjust their contracts to include the additional costs. The economic cost may be felt as reduction in staff may be needed.

The short-term future for the energy market in Australia looks to remain volatile, especially as the country heads into winter. As the government finds ways to deal with the crisis, relief may be on its way.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Baby formula Shortage presents an opportunity for Aussie companies

The USA has seen a peculiar instance of widespread baby formula shortages. In many states around the country, more than half of the formula has been sold out in stores. Across the entire country, 40% of the formula is out of stock. Causes Firstly, and quite tragically, there were recently two infants who died from a rare infection associated ...

June 6, 2022Read More >Previous Article

What’s a VPS and why use one?

In my previous article we discussed, what is an EA and their benefits. To read up on their disadvantages please follow the link to an article written ...

June 3, 2022Read More >