- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Geopolitical Events

- The Dalian Port – “China’s Coal Ban”

- The port would cap the overall coal imports for 2019.

- Other major ports elsewhere in China have delayed clearing times.

- The delayed cargoes would not be included in the 12 million tonnes under the 2019 quota.

- Dalian, Bayuquan, Panjin, Dandong and Beiliang are the five harbours overseen by Dalian customs which will not allow Australian coal to clear through customs.

- Imports from Russia and Indonesia will not be affected.

- The goals are to better safeguard the legal rights and interests of Chinese importers and to protect the environment.

- Customs were inspecting and testing coal imports for safety and quality

- Beijing has been trying to restrict imports of coal more generally to support domestic prices.

News & Analysis

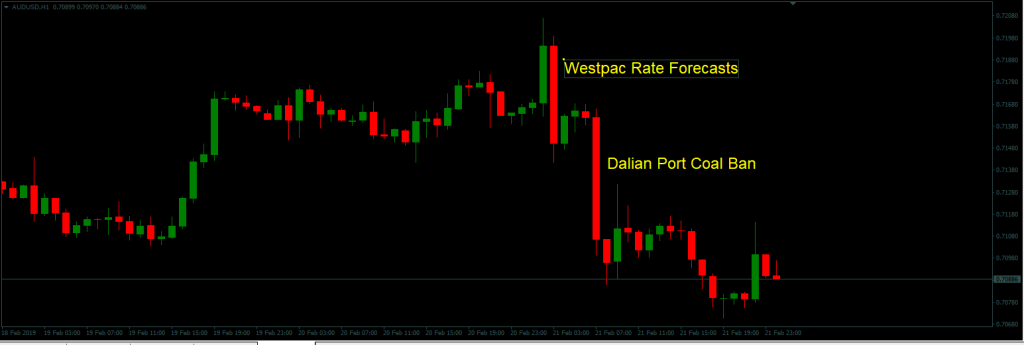

Wednesday was the bearer of bad news for Australia. Despite the buoyant employment report which briefly lifted its local currency, the Australian dollar plummeted on Westpac’s rate cut forecasts and the news of China’s Coal Ban.

Simmering diplomatic tensions could be the trigger behind the ban. The news that the Dalian port in China has blocked imports from Australia emerged on Wednesday. It was also reported:

Beijing and Canberra’s clash back in 2017 over cybersecurity and China’s influence in Pacific Island nations were already showing signs of Australia’s deteriorating ties with China. However, tensions increased again last month when Australia withdrew the visa of a prominent Chinese businessman, just months after barring Huawei from supplying equipment to its 5G broadband network.

At the moment, the comments from China are:

The coal ban put additional pressure on the Australian dollar which plummeted against major currencies. The AUDUSD pair lost its recent bullish momentum and dropped to 0.70 level.

AUDUSD (Hourly Chart)

Source: GO MT4This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Trade Deadline Delayed – “Substantial Progress”

Monday started on a buoyant note as the weekend negotiations between the US and the Chinese officials on structural issues, including intellectual property protection, technology transfer, agriculture among others were productive which encouraged President Trump to extend the 1st March deadline. Asian stocks and trade-sensitive currencies l...

February 25, 2019Read More >Previous Article

Margin Call Podcast – S1 E6: Karen Wong | Chapter Secretary of the Australian Technical Analysts Association

Karen Wong (Linkedin) is a private FX & Equities Trader, Sydney Chapter Secretary of the Australian Technical Analysts Association and technic...

February 20, 2019Read More >