- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Crude Oil analysis – WTI drops 3% to fills the gap on inventory build and dwindling supply disruption fears

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Crude Oil analysis – WTI drops 3% to fills the gap on inventory build and dwindling supply disruption fears

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisCrude Oil analysis – WTI drops 3% to fills the gap on inventory build and dwindling supply disruption fears

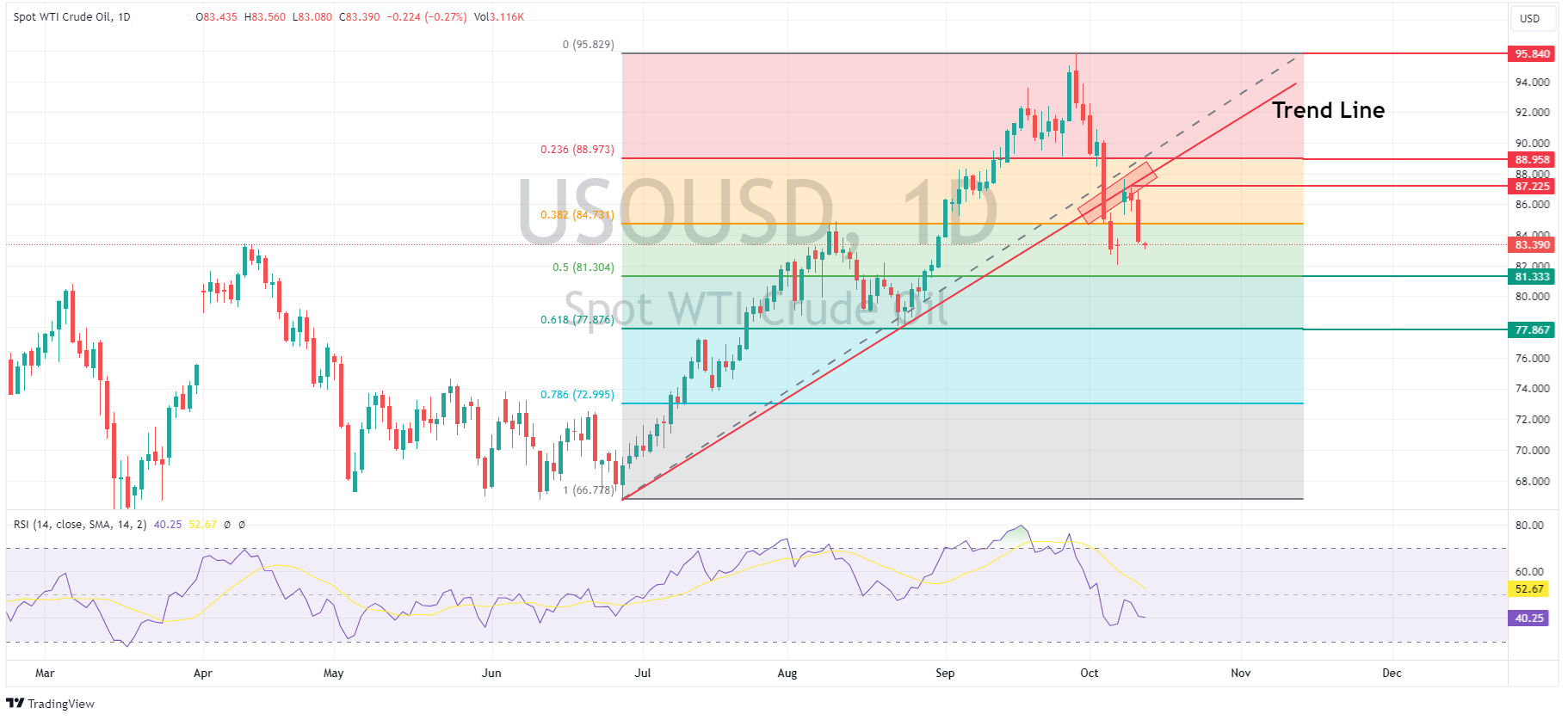

12 October 2023 By Lachlan MeakinWTI Crude oil got off to a flyer on Monday open as news broke of conflict in the Middle East saw a hefty risk premium being priced in fueled by fears of supply disruptions. It seems some of those fears have abated and along with a massive crude inventory build of almost 13mm barrels reported by API on Wednesday, a classic gap fill chart pattern has formed on USOUSD after a steep drop, with USOUSD currently trading at 83.37, down markedly from the conflict spike high of 87.65 in Monday’s session.

Geopolitical risk will be very much at the forefront of Oil traders’ minds with an escalation and/or expansion of the current conflict very much having the ability to cause high volatility in oil, we do also have some important technical levels and scheduled economic announcements to watch for the remainder of the week’s trading.

Chart Technicals:

Monday’s gap open found resistance at the upward trend line, which up until early October has been a significant support level, to the upside this will be the next technical level to watch, around the 87.225 zone, a retake of this trendline support could then see USOUSD next testing the 23.6 fib level at 88.958 which had also offered support during September.

To the downside Fridays low and the nearby 50% fib level at 81.333 will be the first major technical level, a break of this support zone will indicate a possible leg down to the 61.8 fib level around 76.867, which was also a swing low support level back in August.

Along with further updates from the Middle East, tonight’s US CPI figure will also be important to watch, a low reading will cheer market participants that are banking on a less aggressive Federal Reserve, this will likely see risk assets rally, and Oil along with them as a less aggressive Fed will take the shackles off the US economy and have oil repricing for a more robust demand.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Analysis – USD and yields surge on hot CPI, Gold down, AUD and NZD pummelled

USD surged higher on Thursday, with DXY having its second biggest daily gain since March, reclaiming the big figure at 106 and holding above its trendline support. Hotter than expected CPI readings with the M/M rising 0.4% (exp. 0.3%) and Y/Y coming in at 3.7% , above the 3.6% consensus got the Dollar rally going, but a dismal US 30yr auction later...

October 13, 2023Read More >Previous Article

FX Analysis – Yields and Dollar drop ahead of NFP , AUD and NZD outperform, JPY traders watching the 150 level

The USD sell off continued Thursday moving in lockstep with yields again ahead of today’s key non-farm payroll figure. Unemployment claims came in...

October 6, 2023Read More >