- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- GOLD and how it moves in times of crisis

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- GOLD and how it moves in times of crisis

- Safe haven investments offer protection from market downswings.

- Precious metals, currencies, and stocks from particular sectors have been identified as safe havens in the past.

- Safe havens in one period of market volatility may react differently in another, so there is no consistent safe haven other than portfolio diversity.

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

For years, gold has been considered a store of value. As a physical commodity, it cannot be printed like money, and its value is not impacted by interest rate decisions made by a government. Because gold has historically maintained its value over time, it serves as a form of insurance against adverse economic events. When an adverse event occurs that lingers for a while, investors tend to pile their funds into gold, which drives up its price due to increased demand.

There have been many instances in our history, where war has ignited investment into gold. One particular moment in the 21st century which signaled a strong movement into gold as a safe haven was the unfortunate event which occurred on 9/11. Another was the Global Financial Crisis in 2008. In both instances gold’s price sored and it returned higher profits than any other financial asset. It’s important to understand at this stage, even though gold has these unique characteristics, it is not a long-term solution for a portfolio hedge or as a safe heaven. Negative news tends to come after more negative news, which changes investor behaviors and tends to worry investors who in turn would sell their positions in gold, thus sending the price down to original levels or even lower.

Some Key Points

Latest Price Action

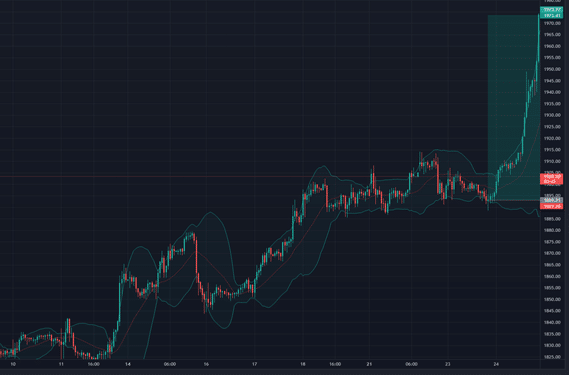

Prior to Russia’s intentions of an invasion into Ukraine and fears of war, which is creating upheaval in the political landscape in Europe and around the world, gold was steadily rising in a sideways movement. However this past week you would have noticed a sharp price action jump 3% from $1892.00 to $1973.00 USD (see below), a price that we haven’t seen since 1st of January 2021 and there is a strong feeling that it could push past this figure as Russia ramps up its invasion into eastern Ukraine. If this happens, we could start to see higher highs as a result, as investors are spooked by the potential turmoil and destabilization.

Gold or XAUUSD, can be accessible in different forms. You can purchase gold bullion in a number of ways: through an online dealer, or even a local dealer or collector. A pawn shop may also sell gold. You are advised to note gold’s spot price – the price per ounce right now in the market – as you’re buying, so that you can make a fair deal. You could also find access to gold in the following ways:

Gold Futures, ETFs that own gold, Mining Stocks, ETFs that own mining stocks, or you if you wish to trade it, you could use CFDs, where you can trade the value of the shiny metal when it goes up or down. Visit our website here to get started with a CFD trading account and start taking advantage of opportunities.

Sources: www.bankrate.com, Investopedia, Tradingview.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Below expectations – Beyond Meat falls short in Q4

Beyond Meat Inc. reported their latest financial results for Q4 2021 after the closing bell on Wall Street today. The US plant-based meat substitute producer company fell short of analyst expectations for the last quarter, sending the stock price lower in the after-market hours. The company reported revenue of $100.678 million in Q4 (decrease...

February 25, 2022Read More >Previous Article

How to identify key resistance levels

A resistance level is a key tool in technical analysis, indicating when an asset has reached a price level that market participants are unwilling to s...

February 8, 2022Read More >