- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Gold Is Being Liquidated

News & AnalysisLiquidity Crisis

High levels of liquidity happen when there is both supply and demand for an asset, meaning transactions can take place easily. A market is considered to be liquid if it can absorb liquidity trades with significant changes in price.

A liquidity crisis is, therefore, an acute shortage or drying up of liquidity. In simple terms, it occurs when there is a simultaneous increase in demand and a decrease in the supply of liquidity across many financial institutions or businesses.

As the impact of the coronavirus has rattles markets, global central bankers and governments are ramping up efforts to address liquidity issues across markets.

Gold – A Highly Liquid Asset

In times of uncertainties, investors generally seek safety with traditional haven assets like Gold.

Why is Gold also selling off?

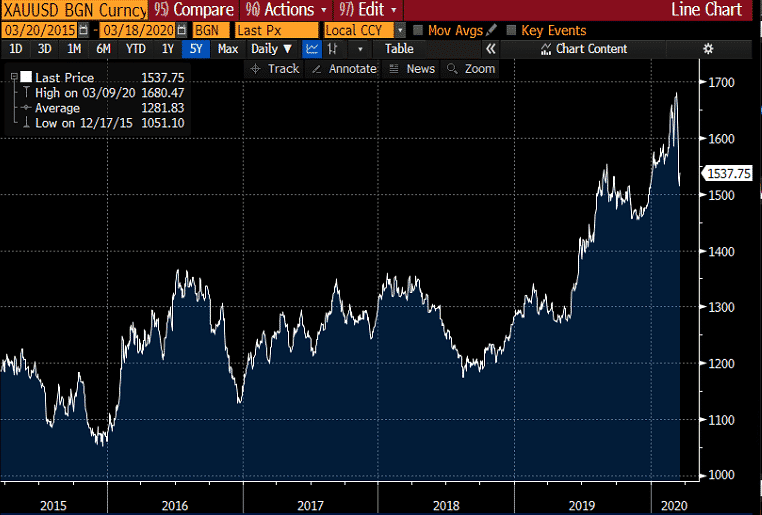

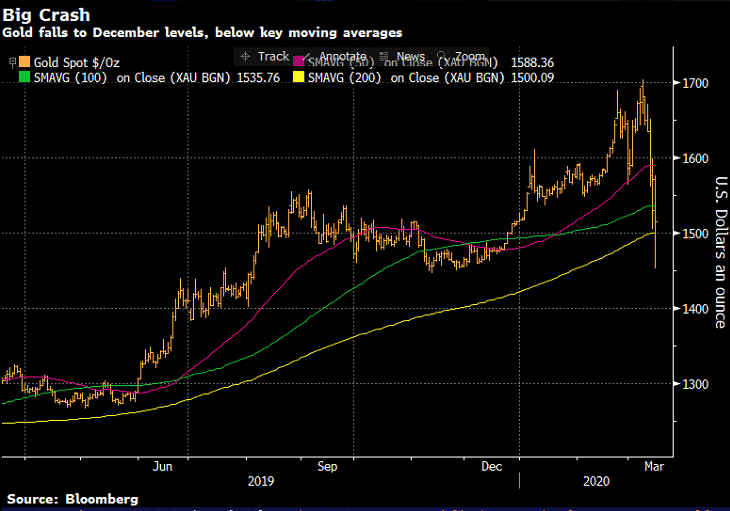

Gold is set apart as it has a feature of a liquid asset just like cash. Investors are on the hunt for liquidity which is prompting the gold market sell-off. An environment of thin liquidity and high volatility is forcing investors to unlock capital in gold to fulfil liquidity requirements. Gold was seen outperforming this year which makes it a profitable asset- prompting investors to take profit.

As the turmoil in global stocks intensifies, investors are looking for ways to cash in to meet margin calls.

At the same time, the safe-haven status of the gold is being hammered by a stronger US dollar. Despite the Fed’s bold emergency rate cuts, the greenback made an impressive comeback against its peers. Another wave of global easing hits markets, making the US dollar the preferred choice compared to other major currencies. The unusual tandem between the US dollar and Gold seen since the beginning of the year seems to have also faltered at the start of March.

Gold has recently lost some of its haven appeal as investors search for liquidity, but it has remained around elevated levels seen in the past 12 months. On Tuesday, reports of a big stimulus package of more by $1 trillion have helped the gold to rebound slightly

Source: Bloomberg TerminalGold Stocks

Gold is a victim of the sell-off because of its outperformance and liquidity features which are beneficial to investors during times of financial crisis.

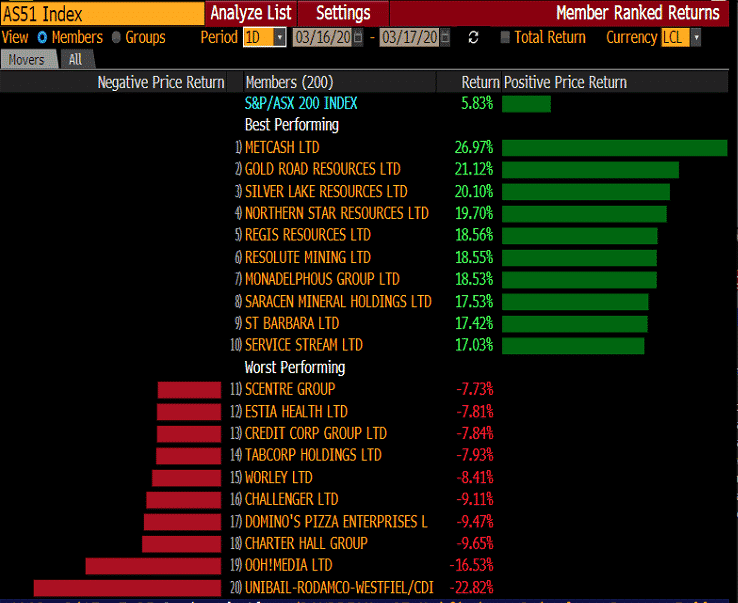

However, gold miners’ stocks have the potential to rally in anticipation that the price of precious metals will go up once the markets stabilise. In the Australian share market, the rebound on Tuesday was mostly driven by the gold mining stocks, which surged by more than 15% despite a fall in gold price.

Source: Bloomberg TerminalIt is therefore not uncommon for gold to act as a source of liquidity at the start of a liquidity crisis. As investors are convinced that central banks’ intervention measures like rate cuts and quantitative easing will inject enough liquidity in the financial market, Gold will likely find buyers.

About GO Markets

GO Markets was established in Australia in 2006 as a provider of online CFD trading services. For over a decade, we have positioned ourselves as a firmly trusted and leading global regulated CFD provider. Traders can access hundreds of CFD instruments including Forex, Shares, Indices and Commodities.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Year to Date: ASX Best Performer

It may be difficult to remain optimistic in such plunging markets. Global equities are in bear market territory and investors are moving away from riskier assets. Amid the mayhem, there might still be some buying opportunities if investors are selective about certain stocks. We are facing a global pandemic that is slowly forcing major countri...

March 20, 2020Read More >Previous Article

Should Current Market Volatility Merit a Review of how you are Trading?

Volatility Revisited Volatility is a measure of the range of price movement over a defined period on a specific timeframe on which any calcul...

March 11, 2020Read More >