- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Lithium darlings fall to 6 months lows.

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Lithium darlings fall to 6 months lows.

News & AnalysisNews & Analysis

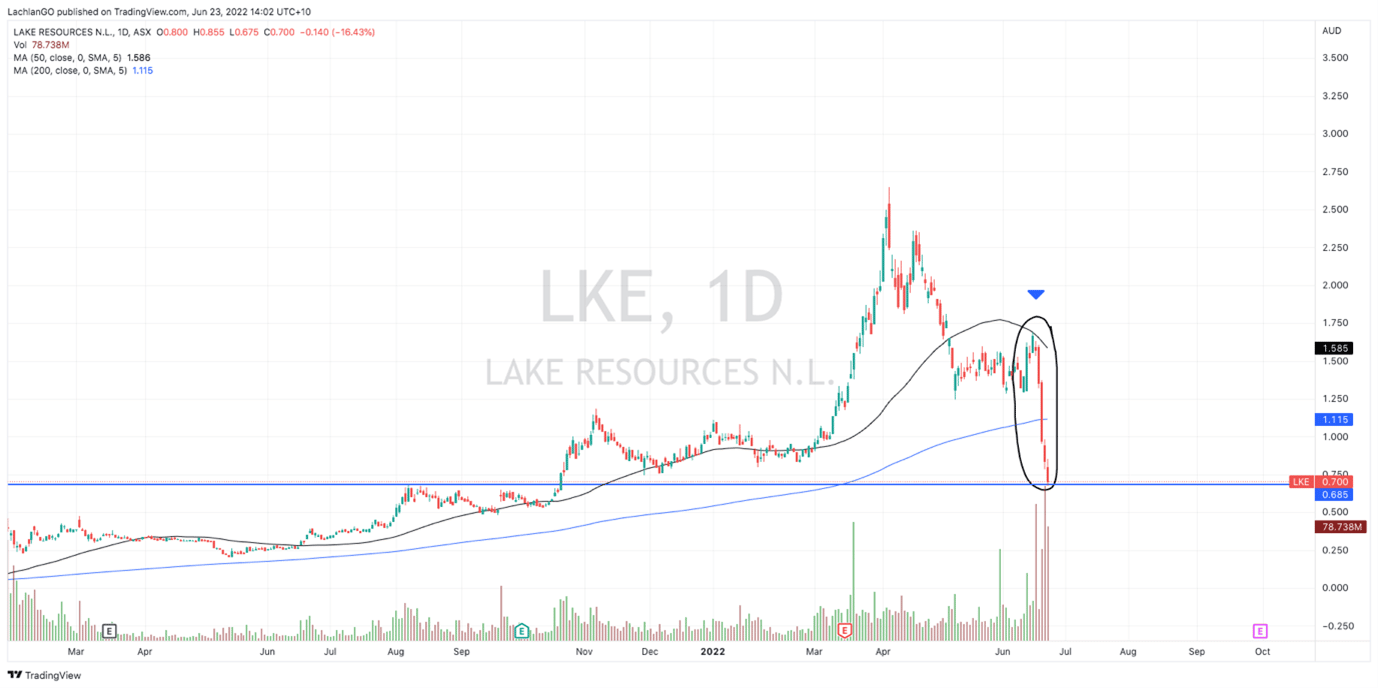

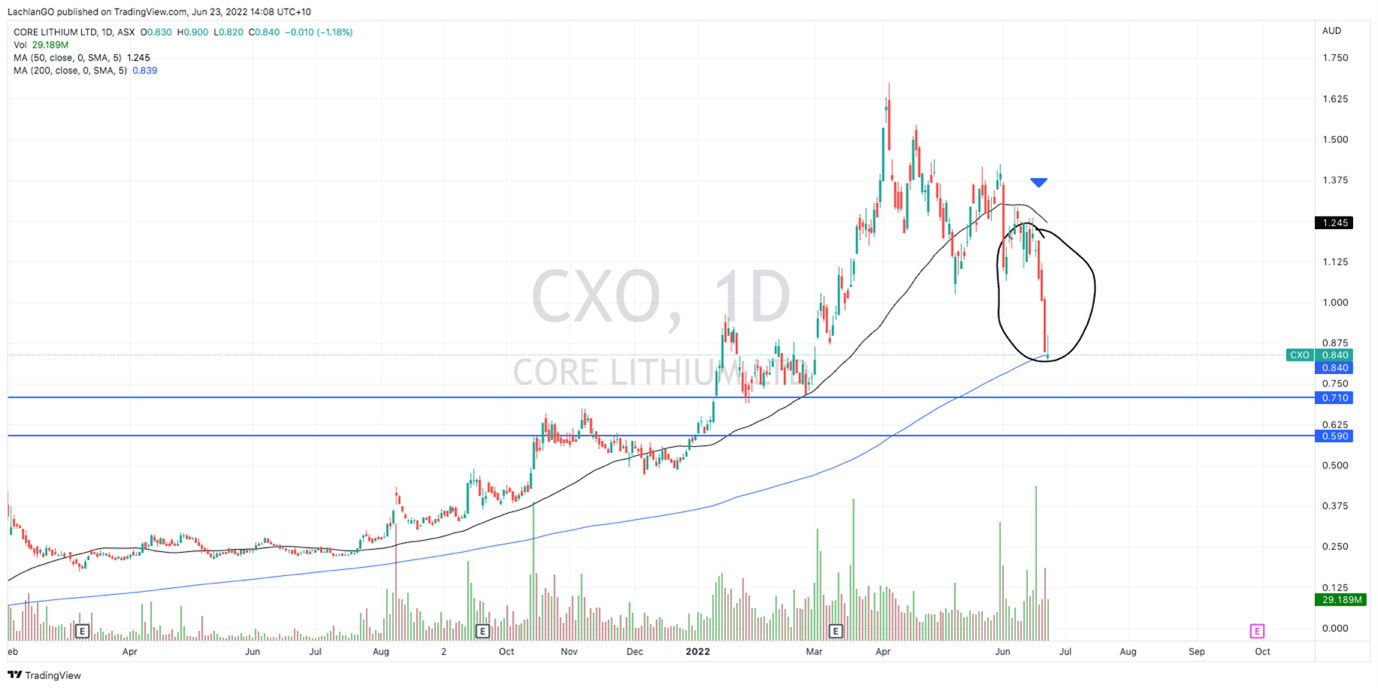

News & AnalysisNews & AnalysisTwo junior lithium companies, Core Lithium, (CXO) and Lake Resources, (LKE) have seen aggressive sell offs after motoric rises in the last few years.

The Backstory

Lithium stocks companies had seen a momentous rise in the past 3 years largely on the back of the push towards renewable energy and electric vehicles which require lithium for their batteries. Core Lithium (CXO) and Lake Resources, (LKE) have been two companies who have benefited a great deal from the rise in interest and price of lithium. Both companies became so large that on the 20th June 2022 they were both added to the ASX200 Index or XJO. This was a key milestone as it meant that large funds and ETF’s were required to buy shares of the companies. This created an almost artificial surge in demand as pools of money were flowing into these companies.

Leading up to the sell off

Prior to the addition into the XJO, many lithium stocks had suffered through a bloodbath type of sell off. The selloff was caused by rising inflation and interest rate levels disproportionately affecting growth companies which many lithium companies are and also an over extended bull market that was in need of a pullback. As the price of many of these companies began to see their share prices drop such as Tesla and Allkem, LKE and CXO remained relatively strong. Once again much of this strength was due to institutions and funds holding the price up due to the rebalancing.

The sell off

Once the rebalancing occurred on 20 June 2022 the buying pressure subsided and the selling took over in a fairly violent manner. LKE in particular saw a massive drop. Furthermore, the selloff was exacerbated by CEO, Stephen Promnitz, quitting on the same day for no apparent reason. The relative selling volumes of LKE shares were drastically higher than prior periods of trading. The price is now holding just above its support at $0.70 after falling almost 75% from its peak in April 2022. With the market capitalisation now under 1 billion dollars, what happens next for the company will be intriguing. After such a large capitulation can the share price have a strong bounce, or does it have further to go?

The CXO share price has seen a less aggressive dump. Whilst it was not struck with the same bad news as LKE was with regards to its lead, it still saw a massive sell off although with the volume of selling not at the same level as LKE. The price is just holding above its 200 day moving average and has pulled back just over 51.33% from its peak in April 2022. The next week or so of price action may provide a great deal of insight into where the share price will go next.

With inflationary pressure set to continue and growth companies baring the brunt of the sell off the short term future of both these companies is murky at best.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The Week Ahead – Stock Markets

After weeks of relentless selling the market provided a decent rally to end the week. The S&P 500 saw a nice jump rising 3.44% during Friday’s trading session. This may provide investors and traders some positive momentum for the beginning of the week. Whilst the market is still holding a down trend, it was able to bounce of the bottom of the...

June 27, 2022Read More >Previous Article

Accenture latest results announced

Accenture (ACN) reported its latest financial results before the market open in the US on Thursday. The Irish-American professional services compan...

June 24, 2022Read More >