- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Middle East conflict & US interest rates send Gold back towards all-time highs.

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Middle East conflict & US interest rates send Gold back towards all-time highs.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisMiddle East conflict & US interest rates send Gold back towards all-time highs.

16 January 2024 By Ryan BoydSince reaching a local bottom in October of last year, XAUUSD has experienced a strong uptrend of over 13%. Closing its third consecutive positive session, Gold is inching closer to its all-time high, now sitting just above $2,050 USD per ounce.

From a technical standpoint, Gold is following a well-defined rising channel that has been predominantly respected since November 2023. As the price approaches the midpoint of this channel, there is a possibility, especially on lower time frames, that this point may act as temporary resistance. This is a crucial level to monitor closely.

Image: GOLD Chart

The recent positive momentum in XAUUSD is closely tied to escalating tensions in the Middle East. The enduring conflict between Gaza and Israel, coupled with the initiation of a new US-led conflict in Yemen against the Houthis, has contributed to the precious metal’s strength.

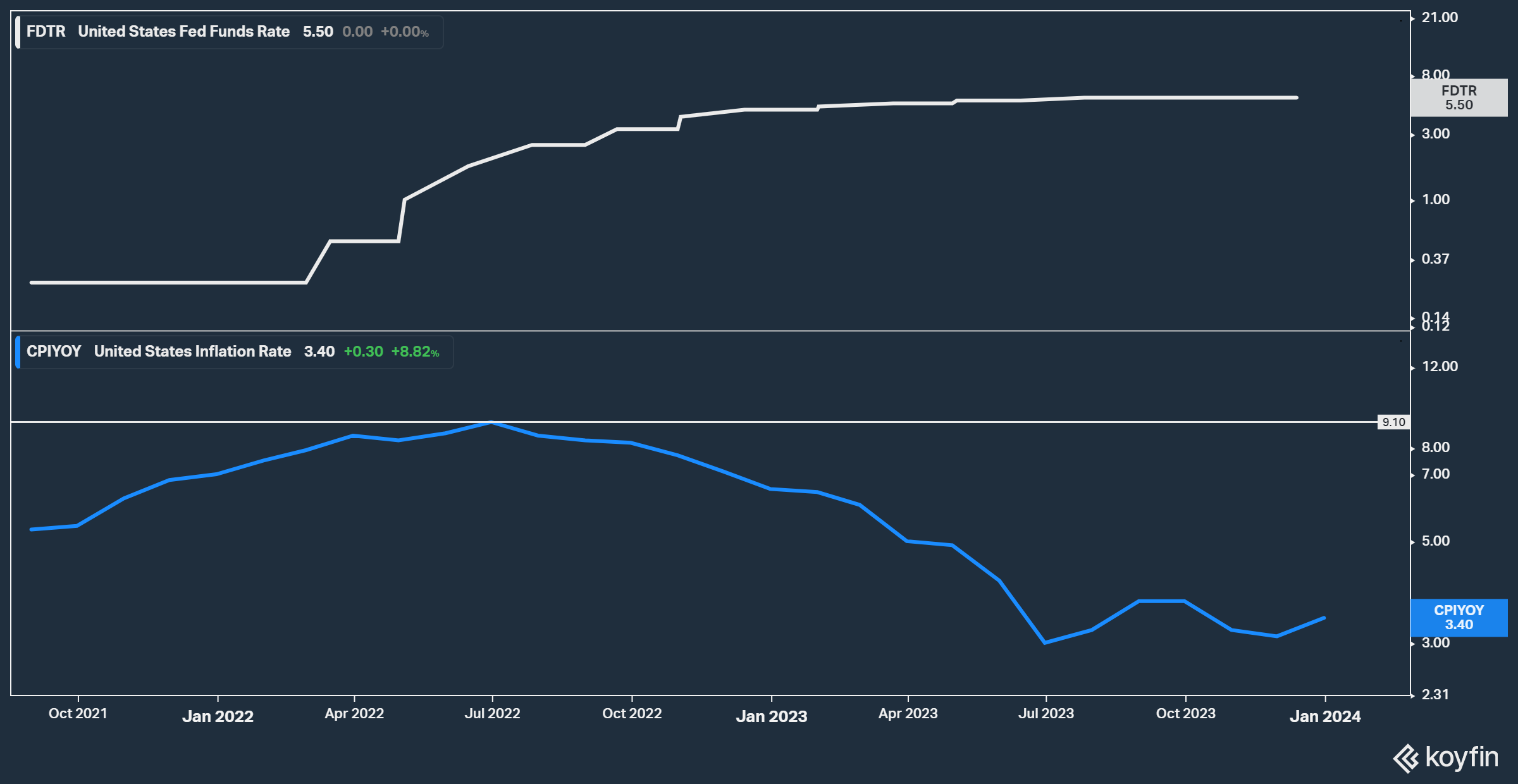

The current economic landscape in the United States, along with projections for rate cuts in 2024, also is playing a pivotal role in Gold’s recent performance. In response to US inflation climbing from nearly 0% to a peak of 9.10% in July 2022, the US Federal Reserve has raised interest rates 11 times. The rates have surged from 0.25% to the current 5.50%.

Image: CPI and Federal Funds Rate (FFR) Chart

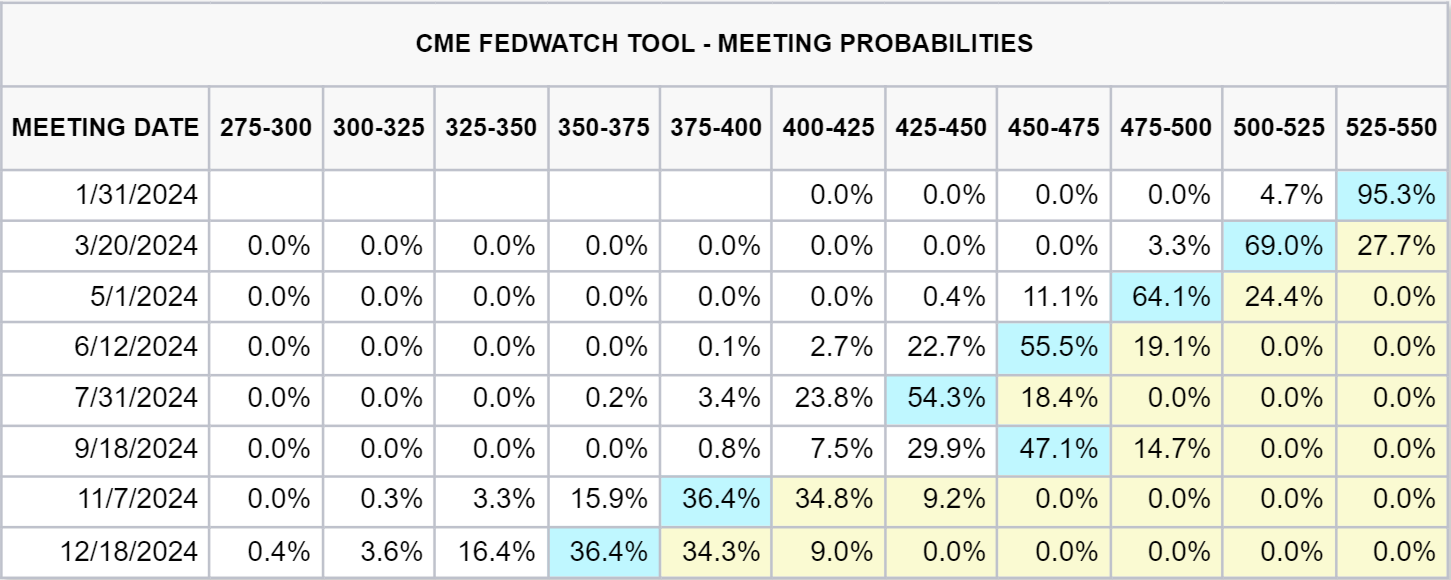

Data suggests the possibility of multiple rate cuts in 2024, with some anticipating cuts as early as the March Federal Open Market Committee (FOMC) meeting. According to CME data, market expectations indicate a projection of six rate cuts for 2024, culminating in an effective rate of approximately 3.50-3.75% by year-end.

Image: CME FedWatch

Historically, the appeal of non-interest-bearing assets like Gold tends to rise when interest rates decrease, contributing to the recent upward trajectory of Gold prices.

Gold traders will be closely monitoring the evolving tensions in the Middle East and upcoming US Consumer Price Index (CPI) data. This scrutiny aims to draw insights into the potential timing of Federal Reserve rate cuts and their subsequent impact on Gold’s market dynamics.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Analysis – USD and GBP up on hot data, JPY and AUD under pressure

A hotter than expected CPI reading out of the UK along with a beat in US retail sales saw global markets turn risk off as rates markets hawkishly re-priced chances of cuts coming from Central Banks. The unwinding of priced in Fed cuts saw a spike in treasury yields and the USD bid, with DXY hitting a high of 103.69 after the December US retail s...

January 18, 2024Read More >Previous Article

The Week Ahead – Jobs, CPI and Retail Sales – the Charts to watch

FX traders come into the new week with an uptick in tier one economic releases to look forward to after a very slow start to the year volatility-wise....

January 15, 2024Read More >