- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Natural Gas showing getting ready to test important level

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Natural Gas showing getting ready to test important level

News & AnalysisNews & Analysis

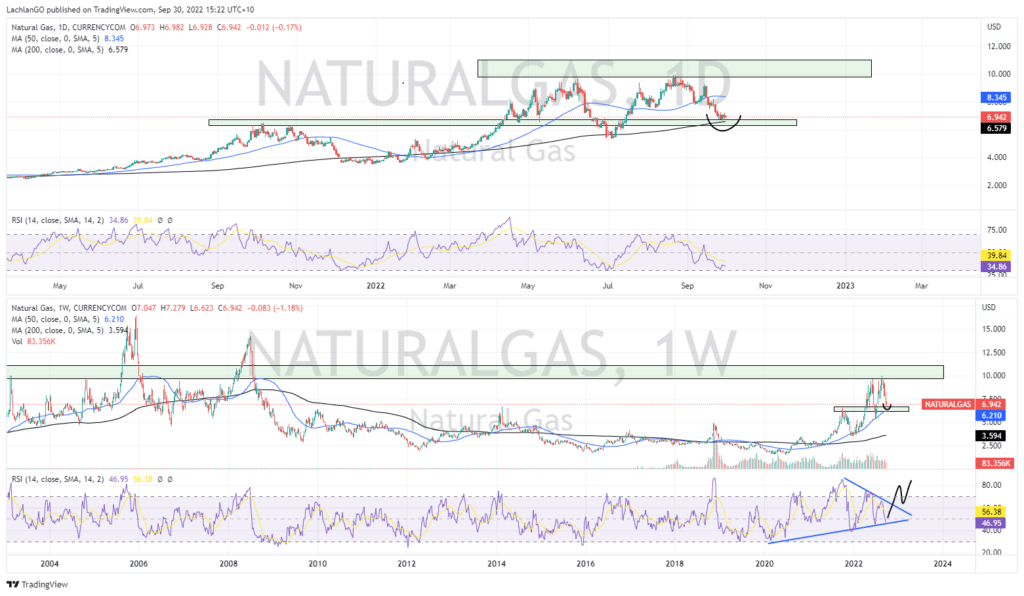

News & AnalysisNews & AnalysisNatural Gas prices have had a volatile year to say the least. After finding multi decade highs on the back of geo-political volatility and record high inflation levels the price has seen an aggressive retracement. With the overall commodities market suffering a big drop as recessionary pressures have taken over and a resilient USD, Natural gas has seen a 30 per cent drop from its peak. News about leaks in the Nord Stream 1 Pipeline and Russia’s control over much of the rest of Europe’s supply has seen an increase of volatility and with Europe entering winter soon and the surety of supply still on a knifes edge, the market remains volatile.

Looking at the recent price action of Natural Gas, the long-term chart shows that the current price is sitting on a strong area of support at 6 USD. Not only is the price sitting on a strong area of support, the area also doubles as the 200-day average. The weekly candle is a Doji showing indecision as buyers and sellers look to find the equilibrium price.

By comparing both the RSI from the weekly and daily charts its can be observed that there is interesting divergence of patterns. On the weekly timeframe, the RSI is consolidating into a symmetrical triangle whilst the daily RSI shows a bounce off the oversold zone. This may provide a clue as to which direction the price may go next. If the price continues to bounce off the oversold level, it may indicate a longer-term break on the weekly chart. This bounce would provide an obvious target for a reversal to the long side to the top of the range at 10 USD.

With general market volatility still quite high and commodities seeing aggressive moves, the next 6-12 months may provide some interesting trading opportunities for natural gas in both directions.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Optimising trading strategies by using multiple timeframe analysis

Many trading strategies utilise technical analysis to predict price patterns and for entries and exits. These strategies revolve often begin with the idea of the price having identifiable support, resistance and trendline market structures which indicate where various buying and selling points can be placed for a trade. These support and resistance...

October 3, 2022Read More >Previous Article

What are Bonds and how do you trade them?

Maturity, Yields, Par Values and Coupon payments. These are words that everyone has heard of but not many have a good understanding of what they mean....

September 28, 2022Read More >