- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- OPEC announces increase in oil production

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- OPEC announces increase in oil production

News & AnalysisNews & Analysis

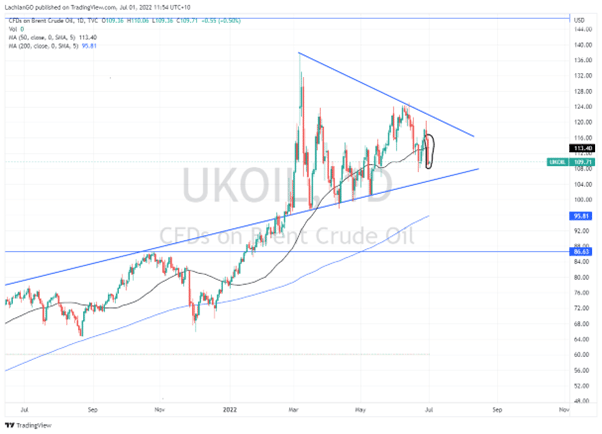

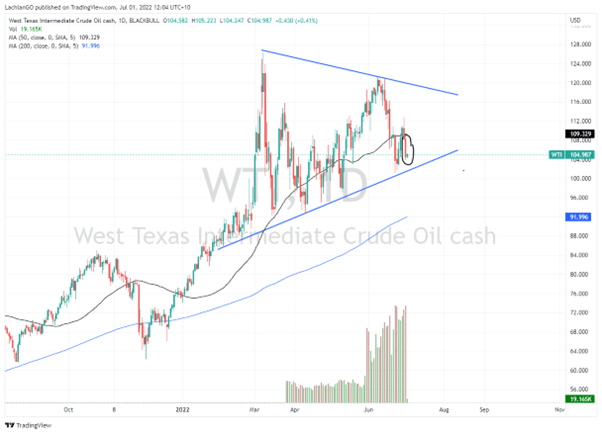

News & AnalysisNews & AnalysisThe OPEC group has announced plans to increase production of Crude oil to reduce the panic and ease the supply crunch. However, some analysts believe that the amount will be insufficient reduce the price. The organisation agreed to increase production to 648,000 barrels from 400,000 per day beginning in August. Brent crude and WTI dropped in price in response, although they did settle as the day progressed.

Background

The price of oil initially spiked in response to the Russian and Ukraine crisis as sanctions were placed on Russia and supply chains began to come under stress. This caused a supply shock, and prices began to rocket up. The added pressure of record high inflation has only accelerated the prices higher. Despite the increase in production, the emerging countries who produce oil are already struggling to keep up with their production targets. For instance, Nigeria, Venezuela, and Libya are struggling to produce their required amount for various reasons and have been set over ambitious targets. This leaves the USA and Saudi Arabia are left to pick up the slack.

Geopolitical Problems

Political forces are also at play whenever oil is mentioned. Russia has such a powerful role in the production. Restrictive economic sanctions placed on them since the crisis began has only added to uncertainty and volatility. Analysts believe that reducing the Russian influence on OPEC may reduce the volatility of oil prices, however this strategy will ultimately fail if Russia produces less oil and not more. Isolating Russia and placing more sanctions on them may prove counterproductive to dealing with oil supply.

Initial price action

The price of oil dropped on the news with both WTI and Brent Crude oil dropping significantly. WTI dropped by 3.44% whilst Brent dropped 2.93%. Both prices remain volatile and in pattern of medium-term consolidation. The price remains at the mercy of inflation rates and geopolitical influences.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Twiggy’s Beefy Winner

Andrew ‘Twiggy’ Forrest has bet on a winner in Australian Agricultural Company (AAC). The company is Australia’s largest integrated cattle and beef producer and is recognised as the oldest continuously operating company in Australia. In recent week’s key investment figure, Twiggy Forrest through his investment company Tattering, has doub...

July 6, 2022Read More >Previous Article

KFC operator share price shoots up after a strong year

The operator of KFC and Taco Bell restaurants across Australia, Europe and South East Asia Collins Foods Limited, (CKF) saw its share price shoot up b...

July 1, 2022Read More >