- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Will gold hold its support or will the USD push it below $1660

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Will gold hold its support or will the USD push it below $1660

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisWill gold hold its support or will the USD push it below $1660

1 September 2022 By Adam KahlbergWill gold hold its support or will the USD push it below $1660

Gold has dumped again after recession fears and a strong US dollar continue to grip the

market. With Gold priced in US dollars it means that when the USD is strong the price of

gold and other commodities is reduced. In recent days, following on from Jackson Hole the

price has slumped further with the question remaining? Will it drop further or hold the

support level.The Federal Reserve came out very hawkish at Jackson hole and this spurred the USD to

keep rising. Whilst the correlation between the USD and gold is not exact, it can move

inversely of each other. In the most recent rise of the dollar, Gold has slipped substantially

and is now sitting on its long term support at $1700.However, how much higher can the USD go? Will the future actions form the Fed be enough

to keep pushing the value up or will it become overextended and drop back down.

The argument for a further rise is that the Federal reserve has made it clear it will continue

hiking interest rates until inflation moves back towards a sustainable level. In addition, with

much of the rest of the world suffering through extreme inflation and impending recessions,

money has continued to flow into the greenback. With no obvious reason for this pressure

to ease any time soon, the price may just continue to go up.On the other hand, with the dollar so overextended and much of the worst of interest rate

hikes already priced into the market, there may be a thought that there is only so much

more room for the USD to go up. The price is nearing 20 year highs and therefore need to

push past the conditions of the early 2000’s in order to keep rising. However, the market in

the 200’s time did not have to deal with a pandemic and barely any interest rates. These

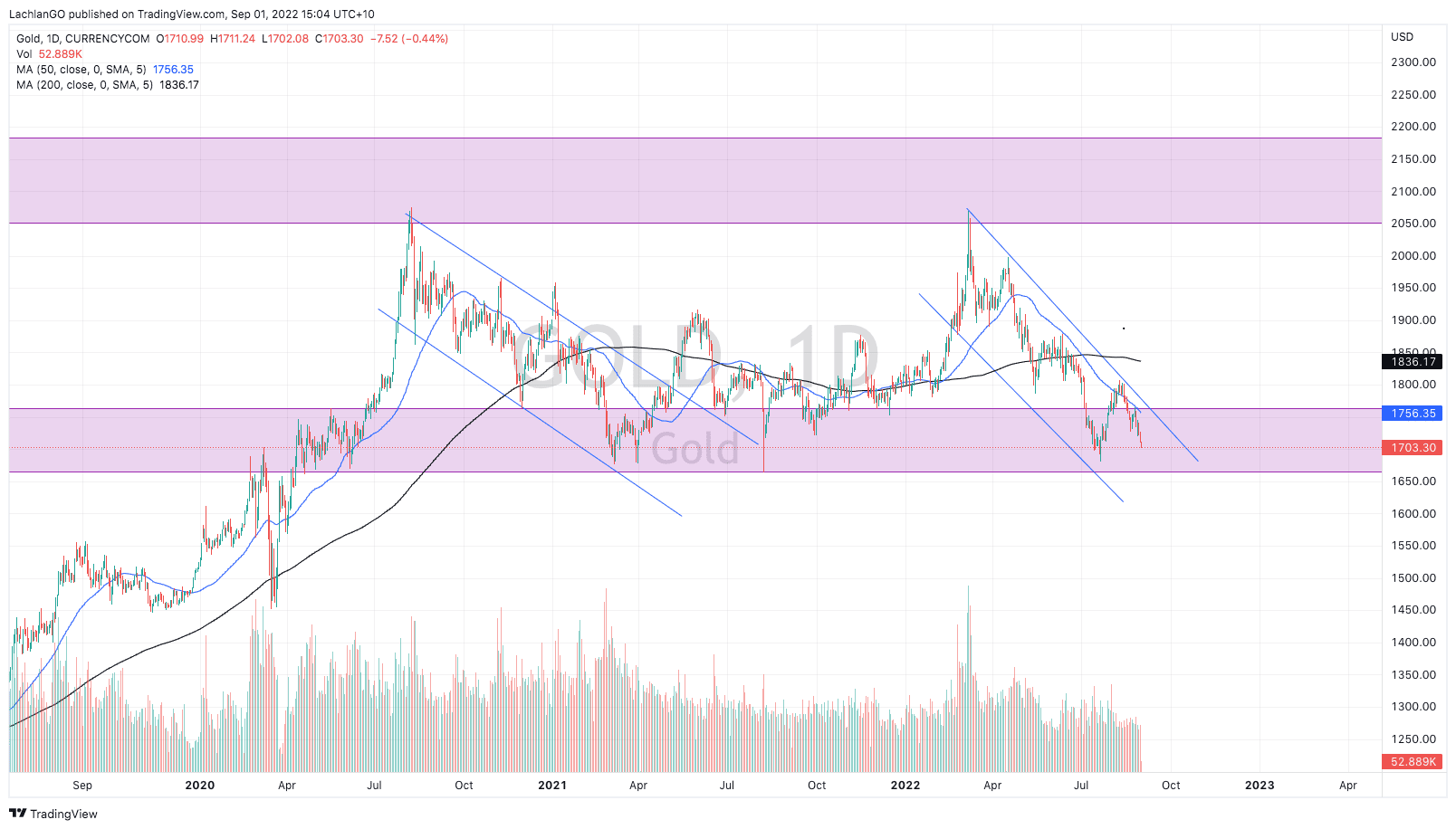

unusual conditions may allow for more momentum for the USD.Gold Chart

The Gold chart shows how the price was unable to break out of the downward channel and

how it bounced off the 50 day moving average. The $1665 level looms as a key level of

support and has so far been unable to break down through this level on four separate

occasions. If it does fall through, it may bring about an influx of selling.

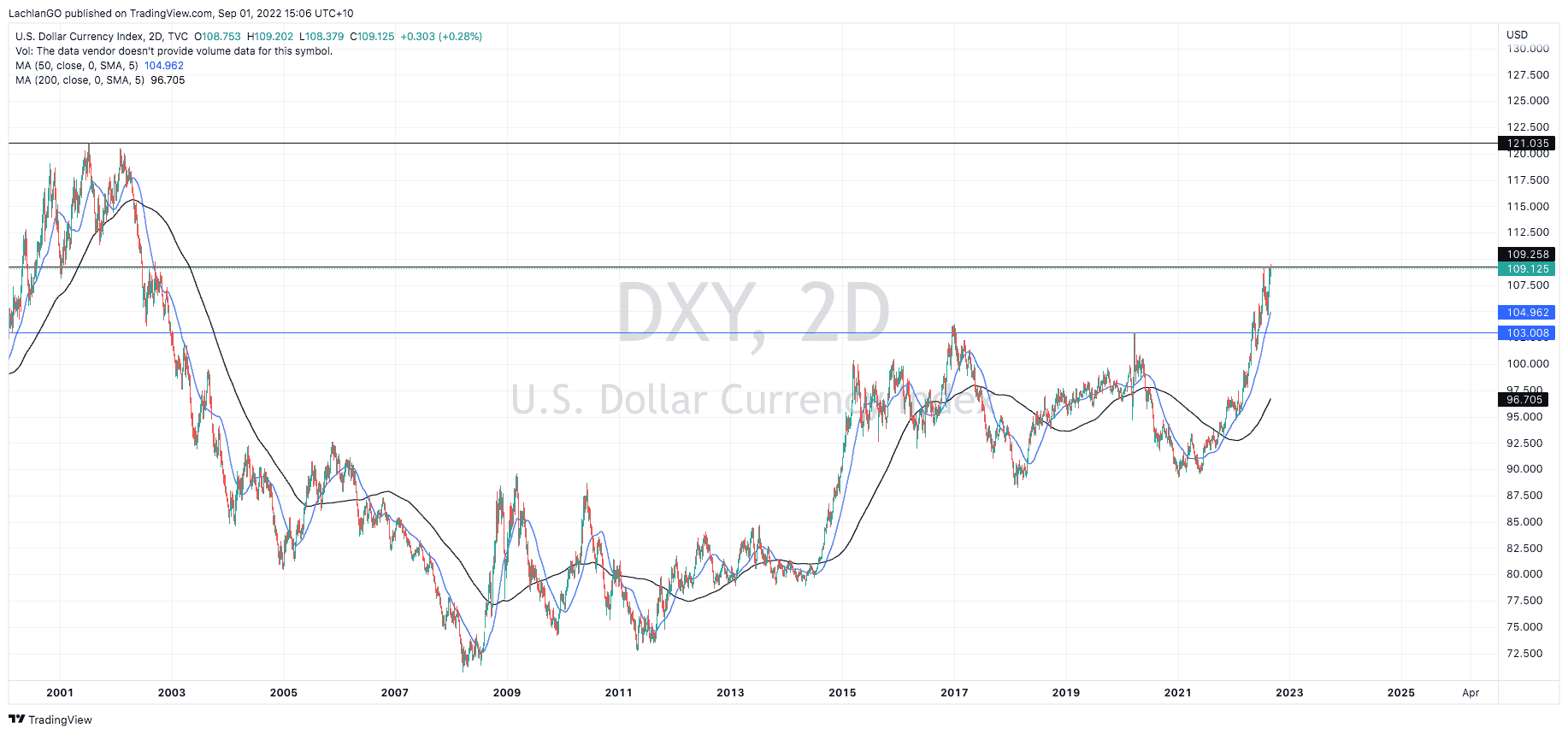

Conversely, the USD, which is shown on a two day moving average is testing its highest

levels since 2001. With the price seemingly ready to ready to breakout and target the next

resistance point at 121.

With the market so volatile at the moment, the USD and Gold are very much in play as both

indicators of wider market sentiment and trading them by themselves.Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Brent testing critical level again

Brent Crude oil much like many other commodities has seen its value drop on the back of a strong US dollar and weaker demand forecasts. With the tail wind of the Russia and Ukraine crisis fading, Brent has struggled to maintain its highs of $125 a barrel in the last few months. In addition, the price has dropped to the point where it is r...

September 2, 2022Read More >Previous Article

Opportunities await trading the JPY

With central banks aggressively hiking interest rates to combat inflation, one specific country stands alone in maintaining a dovish stance. The count...

August 31, 2022Read More >