- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Are we 5 weeks away from a US Government shutdown?

- Home

- News & Analysis

- Shares and Indices

- Are we 5 weeks away from a US Government shutdown?

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAre we 5 weeks away from a US Government shutdown? …and what does this mean for the markets?

President Donald Trump has had a few admittedly less-than-stellar weeks. Topping off his widely condemned remarks following the Charlottesville, Virginia events, he went on to attack his Republican colleagues in the House and Senate.

Recent polling has shown his numbers dropping below the 40% mark, with the largest drops coming from his own Republican voter base. Although Republicans control both houses of Congress and the Presidency, as we all witnessed last month with the health care debacle, they were unable to overcome different political factions and tribalism. Congress will have two very large issues this month: raising the debt ceiling, which is the limit of how much the US government can borrow, and passing a spending bill. The Treasury department has stated that Congress needs to raise the debt ceiling by Friday September 29. Failure to pass a spending bill could force a government shutdown.

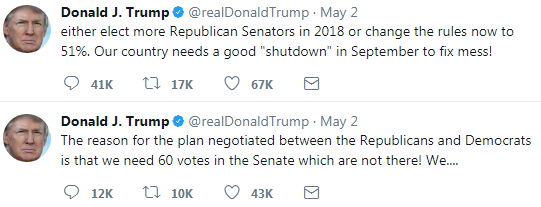

During a rally in Phoenix, he stated that he was willing to allow the government to experience its second shutdown in recent years if they didn’t include funding for his wall (that Mexico will supposedly pay for). This is not the first time that he’s threatened to close the government. Below were his tweets from three months ago:

Source: Twitter

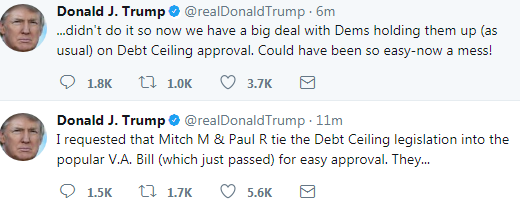

And his tweets from Thursday August 24th:

Source: Twitter

Even with President Trump’s tweets and statements, Republican leaders have stated that they want to avoid a shutdown. President Trump and his administration need a boost to the ever-declining poll numbers beyond the funding for the border wall. They’ll also be requesting more immigration officers and an increased military budget. Between uniform opposition among Democrats and infighting among the Republicans, you’ll expect to see more Republicans breaking rank if his poll numbers sink lower – something rather problematic for the President’s agenda. The House of Representatives requires a simple majority – something the Republicans already have; 240 versus 194. While the Senate in practice requires 60 to pass a bill, the Republicans only have 52 (the Democrats have 48). Thus, Democratic support for the spending bill will be required, which will force Republicans in Congress to make some very difficult concessions.

What does this mean for the markets?

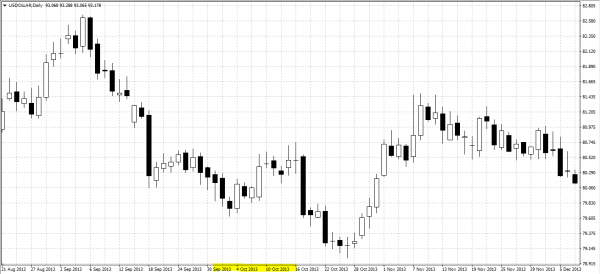

The last time the government had a shutdown was the 1st – 16th of October 2013. The Democrats were in control of the Presidency and Senate, while Republicans held the House. Below we’ve highlighted the shutdown on the GO Trader 4 US Dollar Index daily chart.

US DOLLAR INDEX

Source: GO Markets MT4

If you’re unfamiliar with the US Index, it’s the value of the US Dollar relative to a basket of foreign currencies. Thus, rather than analyzing a single currency pair, you’re able to monitor its movements and hedge your position against a rising or falling Dollar. It’s one of the Futures CFDs that GO Markets offers. As you can see in the lead-up to the shutdown the index slumped, and immediately following the end of the shutdown the index dropped to the lowest point of 2013.

Latest update on the Shutdown

President Trump made a deal with the Democrats reportedly to avoid what was going to be a wild September with a number of legislative deadlines and a probable government shutdown. Majority and minority leaders, together with the House Speaker, announced in a joint press conference that an extension deal for the debt ceiling to March next year and a spending bill was made until mid-December for Hurricane Harvey victims.

In the context of national calamities, Trump sided with the Democrats to reassure Americans and to avoid instability by shutting down the government. The US Dollar experienced a boost on the news. While House Speaker Paul Ryan finds the idea of playing politics with the debt ceiling ‘ridiculous’, Trump unexpectedly sided with the Democrats this time around. He mayalso be taking a position where he can aim to push tax and other reforms in his favour.

US DOLLAR INDEX

Source: GO Markets MT4

It will be interesting to see how Trump works together with Congress to reach a deal in December.

By: Samuel Hertz

GO MarketsReady to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Middle East Tensions

Report by Deepta Bolaky A buoyant open on Oil markets this week amidst clampdown on corruption. The sudden arrests of a dozen princes, business tycoons and top officials in Saudi Arabia has caused a rally in oil prices, hitting a 2-year high. UKOUSD and USOUSD Source: GO Markets MT4 It is reported that private airports were closed to prevent jets ...

November 7, 2017Read More >Previous Article

New sanctions imposed on North Korea

New sanctions imposed on North Korea by United Nations (UN) Security Council North Korea has been slapped with new sanctions after the detonation of a...

September 13, 2017Read More >