- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- ASX200 resting on a knifes edge

News & AnalysisInflation and recessionary pressures have caused the aggressive sell offs of some of the largest global indices, however so far, the ASX200 or XJO has fared relatively well. However, there are worrying signs that a resilient XJO may be coming to an end. Whilst the inflation rate in Australia is still at levels that are low compared to much of the rest world giving the Reserve Bank of Australia flexibility in how it attacks the inflation problem.

The Australian dollar has seen a sell off as commodity prices have come falling. In addition, as risk sentiment has shifted money has moved away from the AUD as it is seen as a drop which has not been helpful to the overall Australian market. At the same time the USD has been on an absolute tear as market players look to move their money into safer asset classes.

The broader macroeconomic factors and connectiveness of global markets is beginning to take its toll on the XJO. With the outlook in America looking very bearish and the UK and Europe looking likely to enter a recession has already caused some aggressive selling in Australia especially across its growth companies.

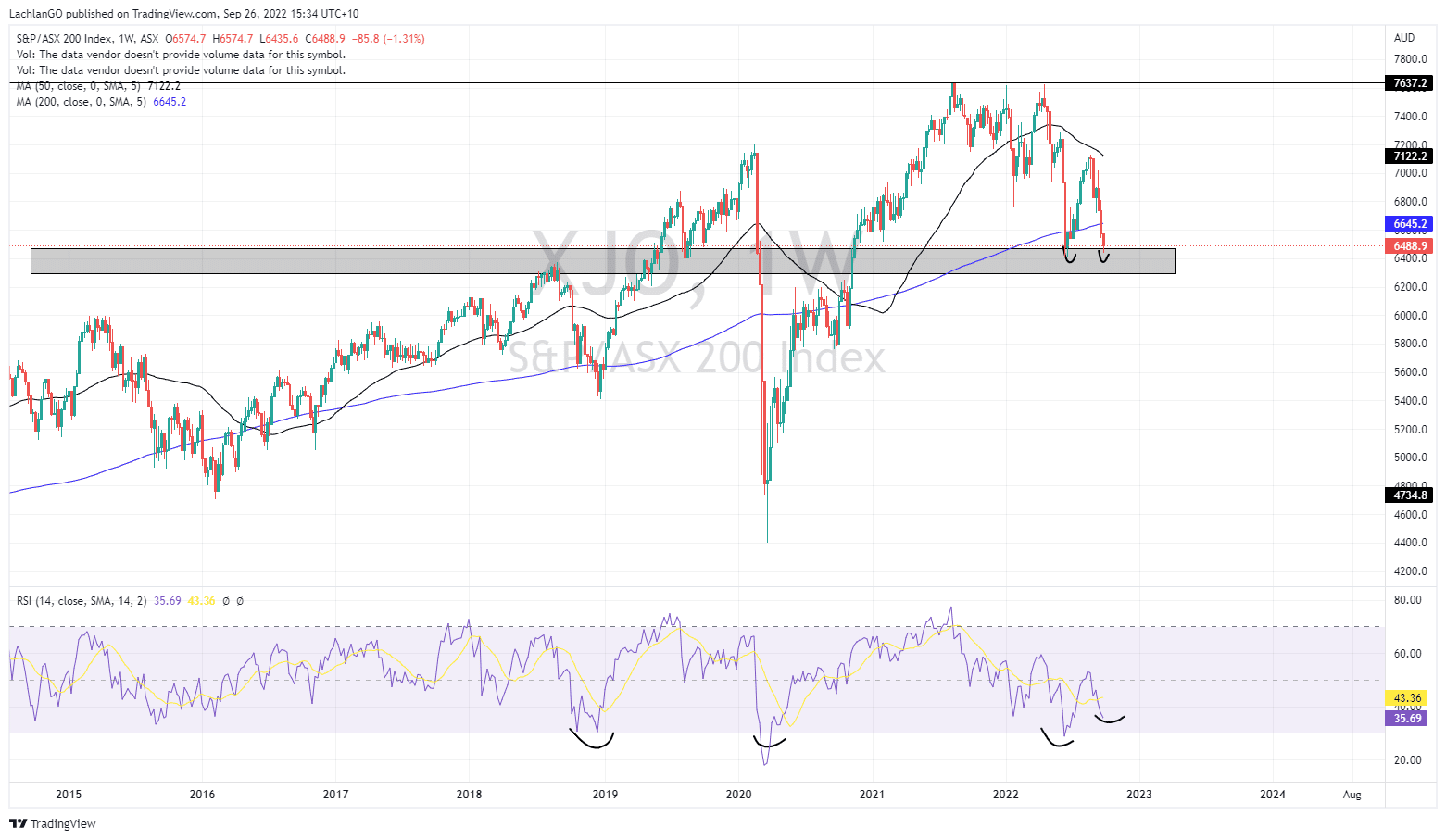

This XJO has dropped to its lowest level in more than 6 months. The weekly price chart shows that the recent sell off is ready to test the long-term support zone between 6300-6500 points. In addition, the price has broken through the 200-week moving average which is a cause for concern as it may indicate that the bearish trend will continue. Another concern is that the RSI which has been a reasonable predictor of the bottom of pullbacks is yet to reach the same oversold level as it was on the previous bounces, which may indicate that there is more selling to come.

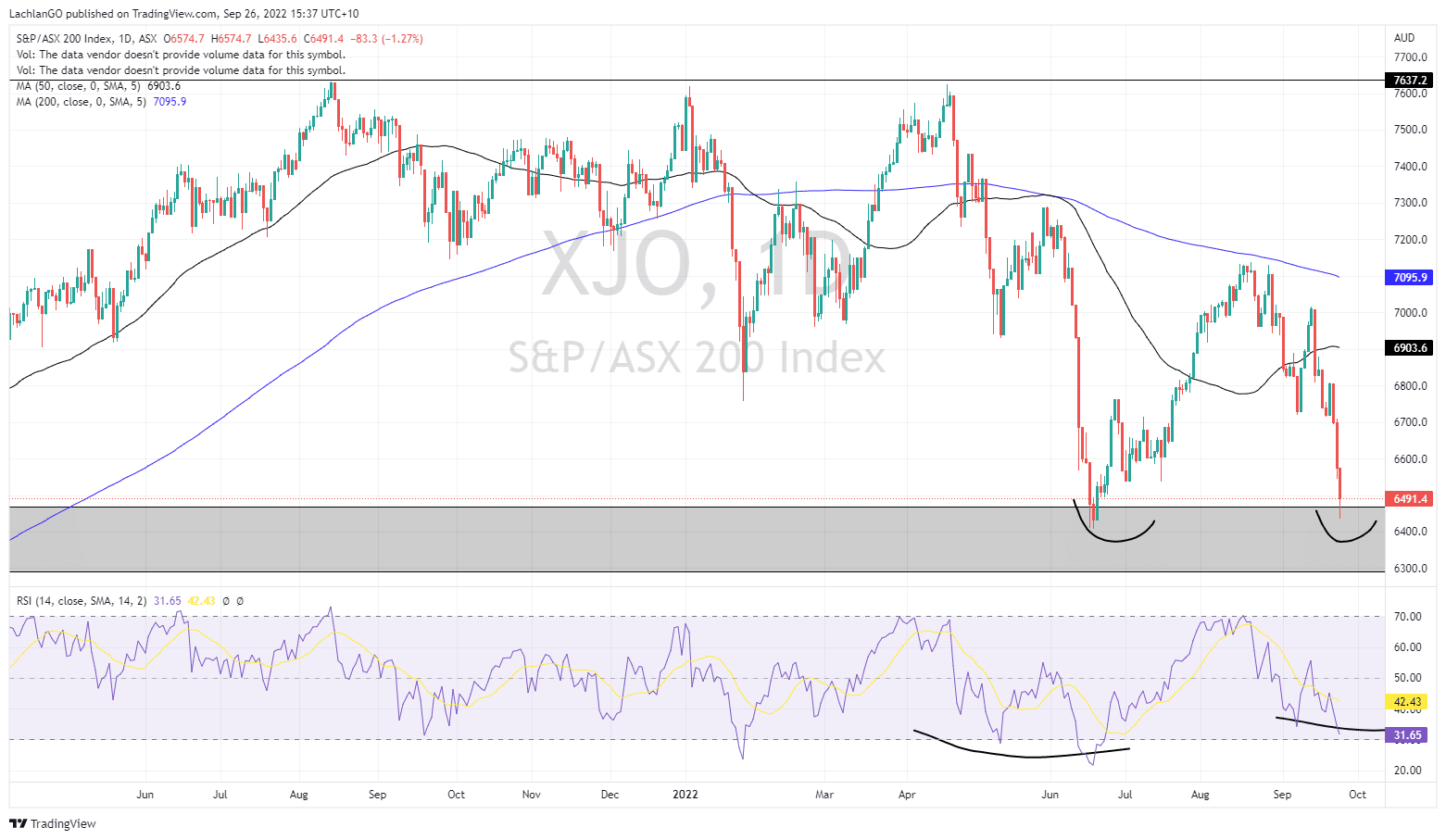

The daily chart is slightly more encouraging. Although it still shows the price of the XJO testing the support zone, it does show that the price has already bounced off the support. However, as the week progresses, there may still be cause for the index to drop further, especially if the conditions in the US and Europe continue to worsen. With the recessionary fears dictating much of the direction of the market, a break through the support zone is still a realistic possibility in the short term.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

More downside for major cryptos?

Following the previous Bitcoin analysis (https://www.gomarkets.com/au/articles/economic-updates/bitcoin-usd-technical-analysis/), bitcoin continues to break below pattern after pattern, recently breaking out and re-testing a descending flag pattern on a 4h time frame as seen below: With the next major support sitting around $17,619, it won�...

September 27, 2022Read More >Previous Article

USDJPY showing signs of another breakout

The USDJPY has been one of the strongest performing currency pairs since the beginning of the year. With geopolitical volatility and record high infla...

September 20, 2022Read More >