- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- AutoZone latest results have arrived

- 1 month: -6.28%

- 3 months: +8.69%

- Year-to-date: +3.30%

- 1 year: +36.62%

- UBS: $2260

- Wells Fargo: $2450

- Raymond James: $2350

- Goldman Sachs: $2296

- Morgan Stanley: $2420

- Citigroup: $2250

- JP Morgan: $2200

News & AnalysisAutoZone Inc. (AZO) reported its fourth quarter financial results for the period ending August 27, 2022 on Monday.

The largest US retailer of aftermarket automotive parts reported revenue of $5.348 billion (up by 8.9% from the same period last year) vs. $5.164 billion expected.

The company reported earnings per share of $40.51 for the quarter vs. $38.51 earnings per share expected.

”Our results are a testament to our AutoZoners’ ongoing commitment to delivering exceptional customer service every day. Our retail business performed well this quarter ending with positive same store sales on top of last year’s strong performance. And, our commercial business growth continued to be exceptionally strong at 22%. The investments we have made in both inventory availability and technology are enhancing our competitive positioning. We are optimistic about our growth prospects heading into our new fiscal year,” Bill Rhodes, Chairman, President and CEO of AutoZone commented on the results.

During the quarter, AutoZone opened 118 new stores and closed one in the United States.

As of August 27, 2022, the company had 6,943 stores within the United States (6,168), Mexico (703) and Brazil (72).

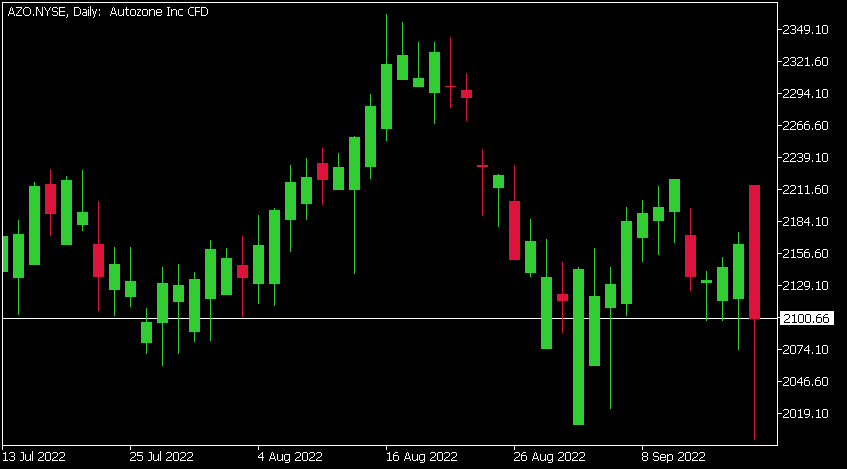

AutoZone Inc. (AZO) chart

Shares of AutoZone were down by around 2% on Monday, trading at $2100.66 a share.

Stock performance

AutoZone price targets

AutoZone is the 364th largest company in the world with a market cap of $42.20 billion.

You can trade AutoZone Inc. (AZO) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: AutoZone Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

USDJPY showing signs of another breakout

The USDJPY has been one of the strongest performing currency pairs since the beginning of the year. With geopolitical volatility and record high inflation rates impacting the global economy, the strength of the USD has just continued to be on show. On the contrary, the JPY has been pillaged from pillar to post as the Bank of Japan has refused to ch...

September 20, 2022Read More >Previous Article

Gold Testing Major Support Level

For the last 2 years, Gold has been bouncing in a range between $1700 and $2070 and is currently testing the major support level around $1700 as seen ...

September 16, 2022Read More >