- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Dicker Data’s year of acquisitions

News & Analysis

Dicker Data is an Australian-owned and operated, ASX-listed technology hardware, software and cloud distributor. They were founded in 1978. As a distributor, they sell exclusively to a valued partner base of over 5,500 resellers. Dicker Data distributes a wide portfolio of products from the world’s leading technology vendors.

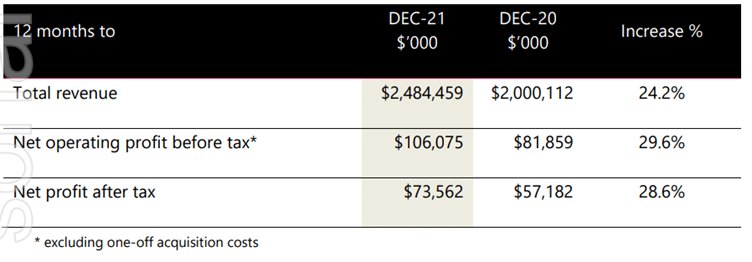

Dicker Data have successfully navigated the end of governmental business stimulus and the impact of a global semiconductor chip shortage to post a net profit of $73.6 million, which is an increase of 29%.

Sales figures increased 24% to $2.48 billion for the 2021 calendar year. Dicker Data declared a final dividend of 15 cents (USD), 100% flanked, on total earnings of 42.6 cents per share.

The company believes that shortages are a part of the computer business and have always planned around it. They identify the software sector to be its highest growth opportunity as dynamic workplaces, which allow employees to work from home, are currently in high demand.

They also identify that there will be a strong demand for audio-visual equipment, such as large format displays for meeting rooms, as workplaces welcome back employees to the offices.

The company’s debt over the period has almost doubled to $230.2 million after they have announced debt funded deals to acquire its rival IT distributor, Exceed, for $68 million. They have also recently acquired Hills Ltd’s Security and Information Technology business for $20 million last month.

The company also has their sights on another acquisition in the future, they have been in talks with a few bankers to help finance a potential acquisition of a rival US-based IT distributor, Ingram Micro.

Ingram Micro was sold to US private equity group Platinum Equity for $7.2 billion (USD) in July 2021. Prior to this, HNA Group acquired the business for around $6 billion (USD) in 2016. Co-founder David Dicker stated that his company would have acquired Ingram Micro for $7 billion (USD) if they had been able to raise the capital.

Dicker Data share value is slowly trending up since February’s acquisition. However, due to the Russia and Ukraine conflict, the ASX 200 index is currently dropping in value and this can trickle down to companies such as Dicker Data.

Overall, Dicker Data is currently in a growth state and is looking to acquire companies that would help increase the company’s value and offerings to its many clients. They aim to use debt to fund the acquisitions and then issue shares to pay down the debt once the acquisition is successful. The acquisitions have helped the company achieve a profitable year as evident in the earnings report. With the acquisition target of Ingram Micro, this can be an exciting opportunity to track the progress from start to finish.

If you would like to take this opportunity to invest in Dicker Data and don’t already have a trading account, you can register for a Shares account at GO Markets.

Sources: ASX, TradingView, AFR.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Advantages and disadvantages of using an Expert Advisor (EAs)

What is an Expert Advisor (EA)? Expert Advisors (EAs) are trading software that automatically run and trade based on their preprogrammed rules for initiating, managing, and exiting trades in the market. These automated trading systems are very popular among traders and are widely used on the Metatrader 4 and 5 platforms. For most traders, EA...

March 3, 2022Read More >Previous Article

NIO’s February delivery numbers are in

NIO Inc. (NIO) reported its latest delivery numbers for February on Tuesday. The Chinese electric vehicle company delivered 6,131 cars last month �...

March 2, 2022Read More >