- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Disney company tops Wall Street estimates

- 1 Month +20.97%

- 3 Month +86%

- Year-to-date -27.41%

- 1 Year -36.87%

- RBC Capital $150

- Truist Securities $125

- Goldman Sachs $130

- Wells Fargo $130

- Keybanc $131

- Barclays $120

- Citigroup $145

- Morgan Stanley $125

- Deutsche Bank $130

News & AnalysisThe Walt Disney Company (DIS) reported the latest financial results for its third fiscal quarter after the closing bell on Wednesday.

World’s largest entertainment company reported revenue of $21.504 billion for the quarter (up 26% year-over-year), topping Wall Street forecast of $20.994 billion.

Earnings per share reported at $1.09 per share (up 35% year-over-year) vs. $0.97 per share estimate.

”We had an excellent quarter, with our world-class creative and business teams powering outstanding performance at our domestic theme parks, big increases in live-sports viewership, and significant subscriber growth at our streaming services. With 14.4 million Disney+ subscribers added in the fiscal third quarter, we now have 221 million total subscriptions across our streaming offerings,” said Bob Chapek, CEO of Walt Disney in a press release.

”We continue to transform entertainment as we near our second century, with compelling new storytelling across our many platforms and unique immersive physical experiences that exceed guest expectations, all of which are reflected in our strong operating results this quarter,” Chapek concluded.

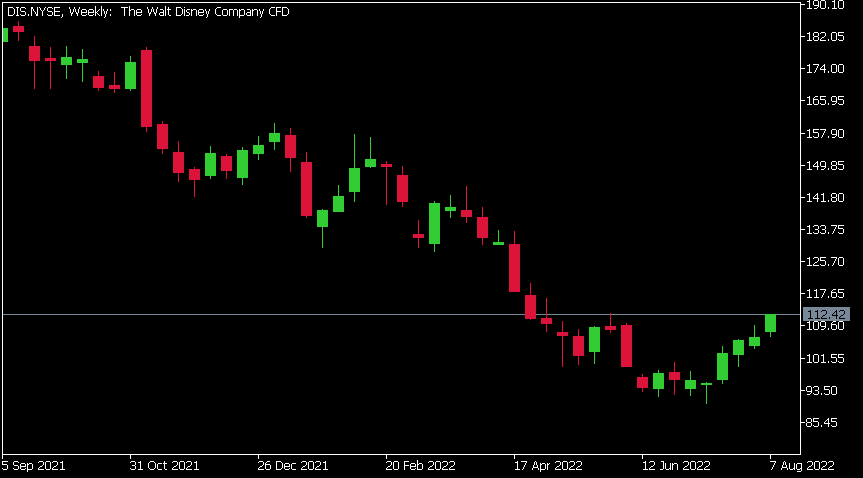

The Walt Disney Company (DIS) chart

Shares of Disney were up by 3.98% at the close on Wednesday at $112.42 a share. The stock price rose by around 6% in the after-hours trading following the latest results announcement.

Here is how the stock has performed in the past year:

Walt Disney price targets

The Walt Disney Company is the 47th largest company in the world with a market cap of $204.78 billion.

You can trade The Walt Disney Company (DIS) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: The Walt Disney Company, TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Rivian Q2 results have arrived

Rivian Automotive Inc. (RIVN) announced its Q2 financial results after the closing bell in the US on Thursday. The American automaker reported revenue of $364 million vs. estimate of $335.378 million. The company reported a loss per share of -$1.62 per share vs. -$1.63 per share expected. ”The second quarter of 2022 represented important...

August 12, 2022Read More >Previous Article

Coinbase reports disappointing results for Q2 – the stock is falling

Coinbase Global Inc. (COIN) released its financial results for Q2 after the market close in the US on Tuesday. The company reported revenue that fe...

August 10, 2022Read More >