- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

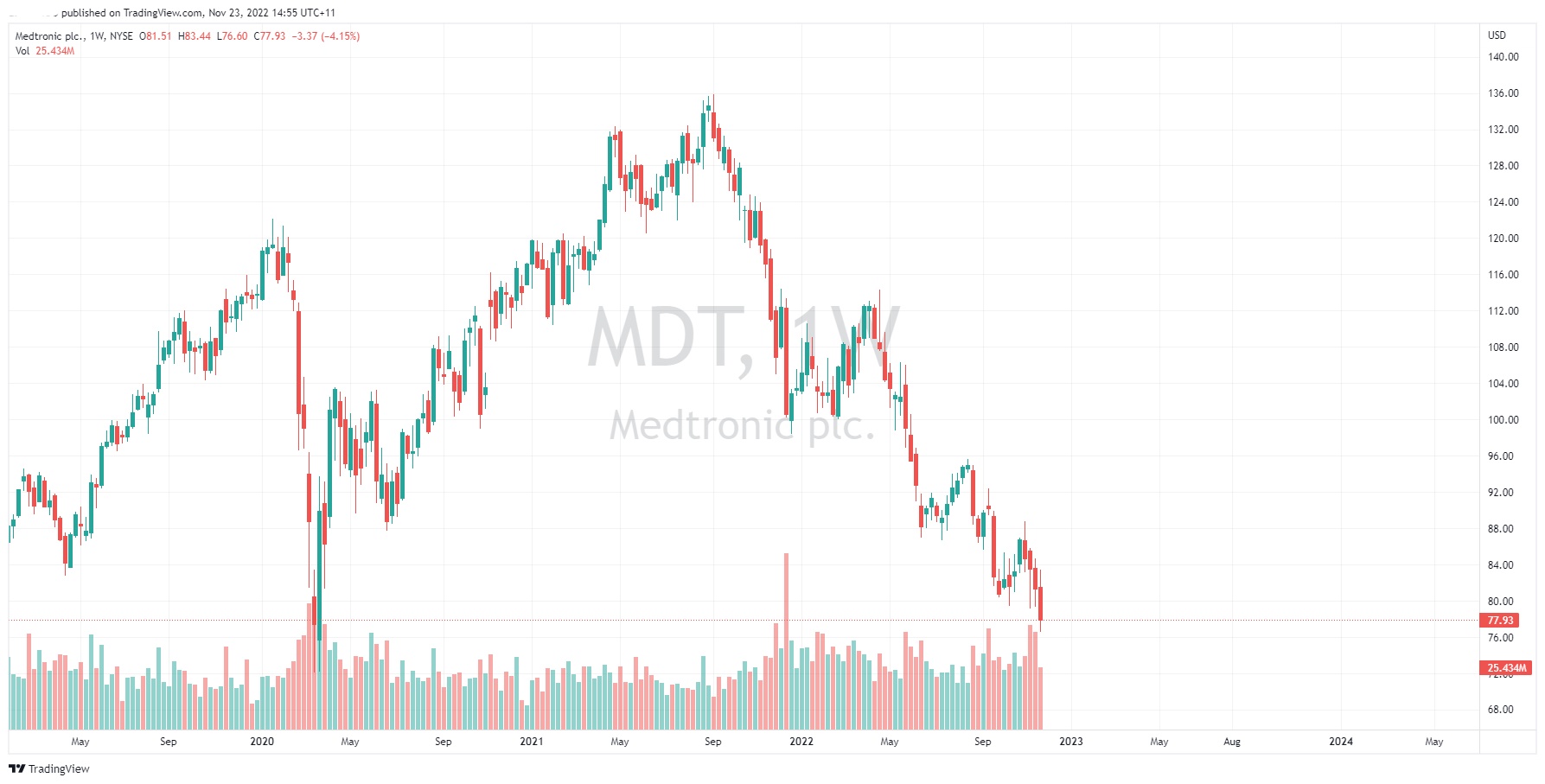

- Medtronic posts mixed results

- 1 month: -2.62%

- 3 month: -8.79%

- Year-to-date: -20.45%

- 1 year: -27.42%

- Barclays: $90

- Truist Securities: $89

- Mizuho: $100

- Jefferies: $87

- Morgan Stanley: $97

- RBC Capital: $110

- Wells Fargo: $96

- Stifel: $105

News & AnalysisMedtronic posts mixed results

Medtronic Plc (NYSE: MDT) reported latest financial results for its second quarter of fiscal year 2023, which ended October 28, 2022 on Tuesday.

The medical technology company posted mixed results for the quarter.

Revenue reported at $7.585 billion (down 3% year-over-year) vs. $7.698 billion expected.

Earnings per share reported at $1.30 per share (down by 2% year-over-year) vs. $1.277 per share estimate.

“Slower than predicted procedure and supply recovery drove revenue below our expectations this quarter. We continue to take decisive actions to improve the overall performance of the company, including streamlining our organizational structure, strengthening our supply chain, driving a performance culture, and strategically allocating capital to support our best growth opportunities with the investments they deserve,” Geoff Martha, CEO of the company said in press release.

“We’re seeing the benefit of these changes – along with new incentives and strong execution – in certain businesses, and we’re focused on ensuring these efforts translate into improved performance across the company. Looking ahead, we’re confident we have a clear path to delivering durable growth and increased shareholder value,” Martha concluded.

The stock was down by around 5% on Tuesday at $77.74 a share.

Stock performance

Medtronic price targets

Medtronic is the 114th largest company in the world with a market cap of $109.37 billion.

You can trade Medtronic Plc (NYSE: MDT) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: Medtronic Plc, TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

How to trade in low volatility conditions

The market in recent months has created exceptionally difficult conditions to trade. Low volatility and obscure price action has reduced the volatility available for traders to capitalise on. These conditions have affected FOREX, Equity, and Index trading. It has been specifically difficult for momentum and trend following traders as a certain leve...

November 23, 2022Read More >Previous Article

Why you need to know about Expected Value

Many traders early on in their trading journey may jump into trading without knowing if their system or edge can be profitable. The most important met...

November 22, 2022Read More >