- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Netflix’s Second-Quarter Results Analysed

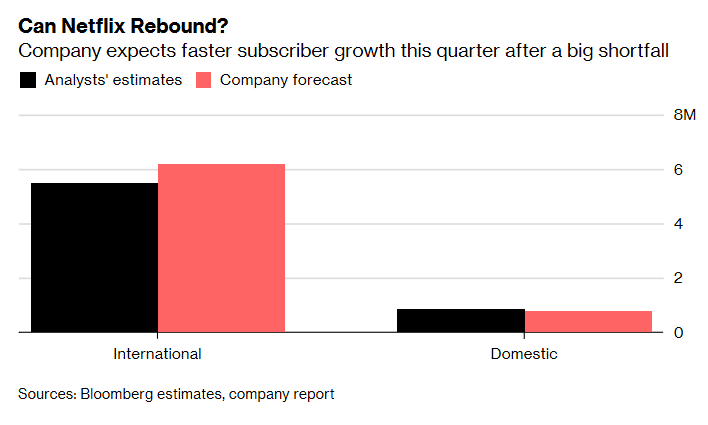

- New paid memberships grew only by 2.7 million compared to 5 million forecasted. In comparison to the Q2 2018, paid membership was less by 2.8 million.

- Profit in the second quarter of 2019 fell to $271m.

- The missed forecasts were across all regions, but it has been more prominent in the region with the price hikes. However, the company didn’t think that the price increase was the issue.

- The Company blamed the miss in new subscribers on a lack of original content rather than competition.

News & AnalysisNetflix’s Second-Quarter Results

Netflix, Inc. (NASDAQ: NFLX) has released its second-quarter 2019 earnings report on Wednesday after the US close. The company tumbled by more than 10% in after-hours trading as the streaming giant missed new memberships forecasts.

Below are the main highlights of the financial results:

“We don’t believe the competition was a factor since there wasn’t a material change in the competitive landscape during Q2, and competitive intensity and our penetration is varied across regions (while our over-forecast was in every region). Rather, we think Q2’s content slate drove less growth in paid net adds than we anticipated”

Netflix moved away from licensed shows and is relying more on its original films, anime shows and programs. The lack of strong content could have been the reason that the streaming company failed to bring in more subscribers.

In the face of serious competition with other companies like Disney, Apple, Hotstar, YouTube, among others offering streaming entertainment, Netflix will have to upstage its original content and stay relevant.

The company see subscribers picking up in Q3 due to the release of new seasons of popular shows. Also, popular shows like The Office and Friends will be wound down over the coming years, which will help to free up budget to allow Netflix to create more original content.

The rise of competition and the type of content are the major factors that Netflix will have to tackle to achieve the large projected ticks in subscribers in the third quarter.

Click here for more information on trading Share CFDs, also, see our Index Trading page for information in trading Indicies.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Why THIS US earnings season may be of interest to Forex traders

The traditional relationship between equity markets and forex is complex and often not particularly well correlated. As a result company earnings are often of little interest to Forex traders. However, this earnings season may be different. Theoretically, if a country’s equity markets perform well, as the US market has done year to d...

July 23, 2019Read More >Previous Article

Fundamental Analysis: Macro Factors

Fundamental Analysis: Macro Factors The rapidly growing global interconnectedness means that the health of one country's economy can impact the worl...

July 18, 2019Read More >