- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- PepsiCo tops Q2 estimates

- 1 Month +9.71%

- 3 Month -1.17%

- Year-to-date -1.40%

- 1 Year +11.98%

- Deutsche Bank $178

- Barclays $183

- JP Morgan $185

- UBS $182

- Wells Fargo $172

- Credit Suisse $168

- Morgan Stanley $198

News & AnalysisPepsiCo Inc. (PEP) reported its Q2 earnings results before the opening bell on Wall Street on Tuesday.

The US beverage and food company reported revenue of $20.225 billion for the quarter vs. analyst forecast of $19.513 billion.

Earnings per share also reported above analyst expectations at $1.86 per share vs. $1.74 per share estimate.

”We are pleased with our results for the second quarter as our business momentum continued despite ongoing macroeconomic and geopolitical volatility and higher levels of inflation across our markets,” Chairman and CEO Ramon Laguarta commented on the latest results following the announcement.

”Our results are indicative of our highly dedicated employees, the strength and resilience of our categories, agile supply chain and go-to-market systems and strong marketplace execution. Our performance also gives us confidence that our investments to become an even Faster, even Stronger, and even Better organization by winning with pep+ are working. Given our year-to-date performance, we now expect our full-year organic revenue to increase 10 percent (previously 8 percent) and we continue to expect core constant currency earnings per share to increase 8 percent,” Laguarta concluded.

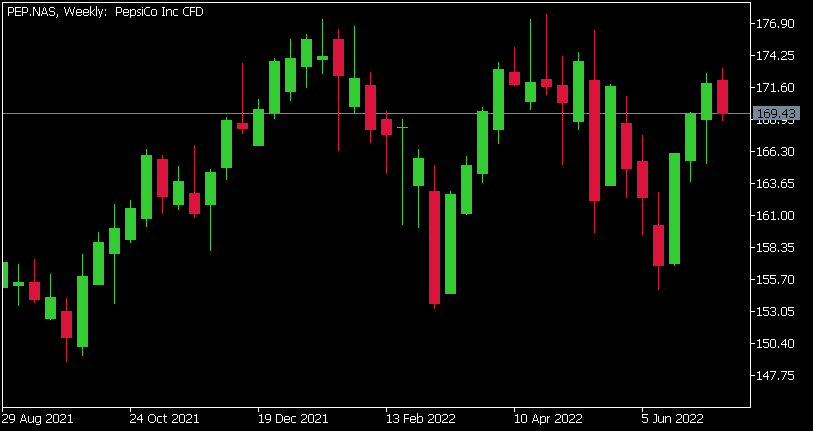

PepsiCo (PEP) chart

The latest results did not have a huge impact on the shares price, the stock was down by 0.57% at $169.34 per share on Tuesday.

Here is how the stock has performed in the past year:

PepsiCo price targets

PepsiCo Inc. is the 36th largest company in the world with a market cap of $236.89 billion.

You can trade PepsiCo Inc. (PEP) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: PepsiCo Inc., TradingView, MarketWatch, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Oil dips to the bottom of its range as recession fears hit the market.

Oil has seen its first real slip up in price since March. The commodity had been running on the back of high inflation and supply issues stemming from the Russian and Ukraine crisis. During the run Oil peaked at $137 a barrel before entering a period of consolidation. The recent catalyst for the drop was OPEC announcing that 2023 would likely re...

July 13, 2022Read More >Previous Article

How to ‘Trade the News’

‘Trading the news’, is a phrase that is often said, but to new traders it can be a confusing statement without much context. What does it mean to ...

July 6, 2022Read More >