- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- TSMC posts better-than-expected results – the stock rises

- Home

- News & Analysis

- Shares and Indices

- TSMC posts better-than-expected results – the stock rises

- Founded: 1987

- Headquarters: Hsinchu Science Park, Taiwan

- Number of employees: 73,090 (2022)

- Industry: Semiconductor

- Key people: Mark Liu (Chairman), C.C. Wei (CEO and vice-chairman), Wendell Huang (VP and CFO)

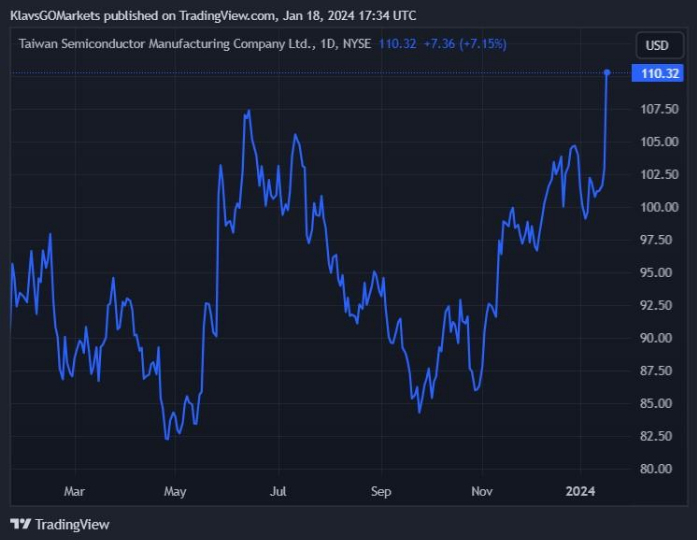

- 5 day: +9.03%

- 1 month: +7.62%

- 3 months: +18.78%

- Year-to-date: +6.12%

- 1 year: +24.84%

- TD Cowen: $95

- Barclays: $105

- Needham & Company LLC: $115

- Susquehanna: $130

- Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours

- Reduce your risk and hedge your existing positions ahead of a new trading day

- Extended trading hours on popular US stocks means extended opportunities

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisWorld’s second largest semiconductor company, Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE: TSM), reported the latest results for Q4 of 2023 before the opening bell in Wall Street on Thursday.

TSMC achieved revenue of $19.785 billion in Q4 2023 vs. $19.675 billion expected. Revenue rose by 14.4% from Q3.

Earnings per share was reported at $1.456 per share, which exceeded estimate of $1.385 per share.

Company overview

CEO commentary

“Our fourth quarter business was supported by the continued strong ramp of our industry-leading 3-nanometer technology. Moving into first quarter 2024, we expect our business to be impacted by smartphone seasonality, partially offset by continued HPC-related demand,” Wendell Huang, CFO of the company said in statement to investors.

Stock reaction

The stock rose by over 7% during Thursday’s session after the company posted the latest results, trading at $110.32 a share.

Stock performance

Taiwan Semiconductor Manufacturing stock price targets

Taiwan Semiconductor Manufacturing Co. Ltd. is the 11th largest company in the world with a market cap of $570.66 billion.

You can trade Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE: TSM) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to “Trading” then select “Share CFDs”.

GO Markets offers pre-market and after-market trading on popular US Share CFDs.

Why trade during extended hours?

Sources: Taiwan Semiconductor Manufacturing Co. Ltd., TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The Week Ahead – BoJ, ECB, BoC meetings headline – the charts to watch.

Markets enter the new week with risk-on firmly the narrative with all three major US indexes hitting all-time highs last week. In FX markets, the positive market sentiment has seen the march higher in the US Dollar hit resistance and cyclical currencies AUD, NZD and GBP bounce. Ahead this week, traders have a slew of risk events to navigate with...

January 22, 2024Read More >Previous Article

Charles Schwab announces Q4 and 2023 full-year results

The Charles Schwab Corporation (NYSE: SCHW) released Q4 and 2023 full-year earnings results before the opening bell in Wall Street on Wednesday. Th...

January 18, 2024Read More >