- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- US Dollar Index Update, EURUSD Technical Analysis

- Home

- News & Analysis

- Shares and Indices

- US Dollar Index Update, EURUSD Technical Analysis

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAn update on an article posted on the 1st of September regarding the US Dollar Index: https://www.gomarkets.com/au/featured/us-dollar-analysis-technical-perspective/

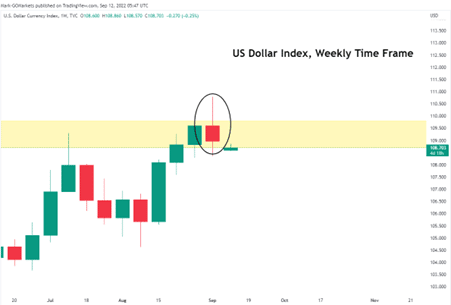

Last week the US Dollar Index struggled to break and close above a major resistance area between $108.7 to $109.8, with a weekly candlestick breaking above but closing below the highlighted range means that the previous analysis of the US Dollar Index,( Analysis done on September 1) still holds its ground with the bears in control.

Until there is a clear candlestick close above the highlighted range, only then will we look at further upside targets for the Dollar Index.

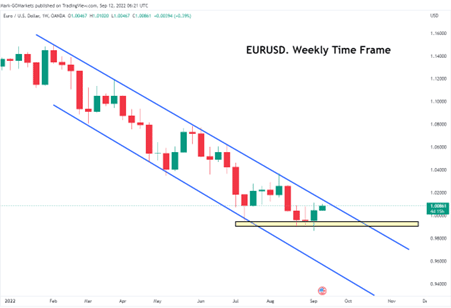

In addition, due to the high negative correlation between the US Dollar Index and EURUSD, there may be a potential reversal for EURUSD.

EURUSD has been bouncing between a downward channel since January 2022 and has recently began forming into a potential reversal, double bottom pattern. This indicates that sellers are slowing down, and buyers are starting to come in at this critical level between $0.991 to $0.995. The double bottom could push the price of EURUSD to break above the channel, confirming a change in trend.

If the breakout is confirmed, then a potential target of $1.036 exists at the nearest daily resistance.

This analysis aligns with the potential weakening of the dollar, however a strong jump in the US Dollar could mean that EURUSD may respect the trend line at the top of the channel and continue its downtrend.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Will the CHF/JPY reach 150?

The CHF has moved almost parabolically against the JPY and is almost touching 150, which would mark a 40 year first. With the Bank of Japan indicating its need to maintain current interest rate levels which are already among the lowest in the western world, the currency has been severely weakened. Statement that has come from some of its members...

September 13, 2022Read More >Previous Article

Kroger tops estimates for Q2 – the stock is up

The Kroger Company (KR) released its latest financial results for Q2 on Friday. The American grocery supermarket chain reported revenue of $34.638 ...

September 12, 2022Read More >