- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Shares and Indices

- What to watch in 2025: Equities trends and insights

- Home

- News & Analysis

- Articles

- Shares and Indices

- What to watch in 2025: Equities trends and insights

- Monetary Policy Shifts

Central banks worldwide, particularly the Federal Reserve, will play a pivotal role in equity market performance. Further aggressive rate cuts in late 2025 could provide a tailwind for equities, particularly growth-oriented sectors such as technology. We are still above the target inflation of 2-2.5%, which appears to perhaps be paused at this stage which means a cautious approach in the early part of year is likely. - Inflation and Consumer Spending

Moderating inflation, and so interest rates could enhance consumer purchasing power, boosting retail, travel, and leisure stocks. However, persistent wage pressures may challenge profit margins in certain industries. Probably, the most unknown, and potentially most feared is that of the impact of potential import tariffs from the new Trump administration. These are seen as both inflationary, due to the impact on the cost of imported goods into the US, and may be likely to slow growth as a result of this and the indirect impact on potential rate cuts and subsequent cost of living impact on the US consumer. - Corporate Earnings

Earnings growth expectations for 2025 remain positively modest, but supportive of continued quarter on quarter growth through the year. Current growth on last earnings forward guidance is suggested to be 5.7% for the 12 months ahead, with analysts projecting a 6-9% increase for S&P 500 companies for the year. The changing political environment in the US will obviously be influential, not only in terms of direct impact of policy e.g. the increase in oil production, but also the impact of persistent inflation on corporate lending, and consumer spending are all important. - Geopolitical and Regulatory Factors

Trade tensions, particularly between the U.S. and China, could impact sectors such as industrials and semiconductors. We have already seen evidence of the latter in the last week. Additionally, environmental, social, and governance (ESG) regulations will influence investment flows in Europe as well in the US. The Middle-East conflict and the Russia-Ukraine situation, if persisting or even some escalation are all threats. - U.S. Presidential Transition

With a potential change in the U.S. administration, pre-election suggestions of policy shifts in areas such as taxation, import tariffs, infrastructure spending, and a reduction in green energy initiatives could significantly impact sector performance. Dependent of course on whether we see follow through on that which was promised, and the timing of such will obviously be a key factor. - Technology

The technology sector is poised for continued growth, driven by advancements in artificial intelligence, cloud computing, and semiconductor demand. Companies like NVIDIA, Microsoft, and Tesla are leading innovation in generative AI and automation. Semiconductor stocks such as AMD and Taiwan Semiconductor Manufacturing Company (TSMC) are expected to benefit from rising chip demand. - Healthcare

Aging populations in developed markets and innovation in biotech and pharmaceuticals present strong growth opportunities. Companies such as Johnson & Johnson, Moderna, and Illumina are well-positioned to capitalize on advancements in telemedicine and personalized medicine. - Energy Transition

Clean energy stocks are likely to benefit from government incentives and increasing global emphasis on reducing carbon emissions. SolarEdge Technologies, First Solar, and Tesla stand out as potential winners. However, the Trump administration’s rejection of evidence of global warming and a desire to support the more traditional carbon based energy sources may decrease potential growth in US based renewable energy stocks. - Consumer Discretionary

As inflation moderates, discretionary spending could rise, benefiting sectors such as travel, luxury goods, and e-commerce. Companies like Amazon, Nike, and hotel and travel stocks e.g. Marriott International, are positioned to capitalize on these trends. Strong brand equity and innovation in customer experience will differentiate winners in this space. - Industrials and Defence

With ongoing geopolitical tensions, defence spending is expected to remain elevated, benefiting aerospace and defence contractors such as Lockheed Martin, Raytheon Technologies, and Boeing. Infrastructure investments, if there is policy support for such, will also drive growth in construction and engineering firms, e.g. Caterpillar, who continue to produce excellent company reports. - Materials stocks

Many resource stocks are global irrespective of the exchange (or often multi-exchange) they trade on e,g, BHP. There is no doubt that any slowdown in China is likely to impact demand for resources and influence manufacturing. Despite evidence of recent stimulus in the Chinese economy, many remain sceptical about the impact without further increases in such. There is also little doubt that the “Trump Tariffs”, will impact, dependent of course as to the actual roll out of these, Although the cost of such will be worn by the US importer and not by the overseas company in simple terms, the indirect impact of potential need to drop prices to sell or looking elsewhere if local sources are not found may influence not only Chinese exports but also those companies who supply the raw materials to help make this happen. The impact on global materials stocks could be significant -

- Europe

Europe’s equity markets face headwinds from slow growth and energy dependency. However, opportunities exist in green energy and industrials, supported by the EU’s more aggressive green transition agenda than is the case in the US. Companies such as Siemens and Vestas Wind Systems are well-positioned. - Emerging Markets

Emerging markets, particularly in Asia, hold long-term promise but face short-term risks from higher interest rates and currency depreciation. China’s reopening and policy stimulus could provide a boost, especially in consumer and technology sectors. Alibaba and Tencent are expected to benefit from a domestic demand recovery. - Australia

Though corporate earnings have remained strong and the index hit record highs this month, there is a continued reluctance of the RBA to cut rates is now likely to extend well into 2025, with February at the earliest, and some even suggesting that Q2 is more likely, predicted amongst analysts, This does threaten growth in consumer discretionary stocks. The other potential headwind, as previously discussed, is the indirect impact of US tariffs imposed on China, not only in terms of demand for exported goods and so manufacturing, but on global commodity prices e.g., copper. Hence the large materials sector may struggle at times dependent on the extent of these. - Japan

Japan’s markets have shown strength, driven by structural reforms and increased shareholder focus. Export-oriented industries, particularly automotive and robotics, are well-positioned for growth. Companies like Toyota and Fanuc are strong contenders. The potential additional rise in Japanese interest rates which the market is expecting this month or January 2025 may impact not only on local stocks but could impact globally due to the carry trade implications,

- Europe

- NVIDIA (NVDA): Leading advancements in AI and GPUs, NVIDIA remains at the forefront of technology innovation, poised to benefit from continued investment in generative AI.

- Microsoft (MSFT): Strong growth in cloud computing and AI-driven services ensures Microsoft’s leadership in technology.

- Tesla (TSLA): Beyond EVs, Tesla’s energy storage and clean energy initiatives position it for growth in multiple sectors. The relationship between CEO Elon Musk and incoming President Donald Trump is not likely to do any harm to policy support of Tesla.

- Carnival Corp (CCL): With price back to levels not seen since the pandemic, an improving earnings and debt reduction story and the potential for consumer discretionary stocks to outperform should there be continued rate cuts later in 2025, this cruise stock could benefit.

- Caterpillar (CAT): Infrastructure investments, evidence of continued strong corporate performance and general industrial growth suggest Caterpillar could be a strong performer in the industrials sector.

- Block Inc (SQ2.asx.): US company trading on the ASX who bought “Afterpay” to add to its global portfolio.

- Life 36) Inc. (360.asx): Another US based company who also trades on the local market, This family app has shown strong growth and recent earnings support all-time highs on the stock, which continues to look positive into 2025.

- Deep Yellow (DYL): Uranium stocks have looked strong in the latter half of 2024 and despite the recent pullback followed by a price move higher, price seems to be “at value”, particularly with the increase in Japanese nuclear energy commitment and a global (ex-US) desire to move to decarbonisation. DYL is well positioned to benefit from this during 2025.

- Webjet Travel Group (WEB): Webjet is a different entity to that which started 2024 with a split into two separate companies. Webjet travel group will benefit from increased consumer spending through 2025, which although may not happen significantly into at least Q2 2025, the company balance sheet is good and this stock looks as though it is well positioned at this current price to have a positive 2025 even if investors have to be patient initially.

- Yancoal Australia Ltd (YAL): Operating five coal mines and managing five others across New South Wales, Queensland and Western Australia, YAL is potentially well placed in this sector to benefit in 2025. After reaching an all-time high this year, global coal demand is expected to remain as is, and so longer than expected, before a decline in 2026, according to the latest edition of the International Energy Agency’s (IEA) annual coal market report. This would support a move higher during the coming months. Particularly if we see a breach of July highs of $7.40.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThis article provides an in-depth analysis of potential market drivers, sector-specific performance expectations, global trends shaping the investment horizon for the year ahead, and amongst other factors, the potential impacts of a U.S. presidential transition.

Within this analysis we will suggest what our provisional projection is and stocks that we think may benefit through 2025 and are perhaps worth some consideration providing of course they are a fit for your specific trading plan, personal objectives and financial situation,

The Current State of Equity Markets

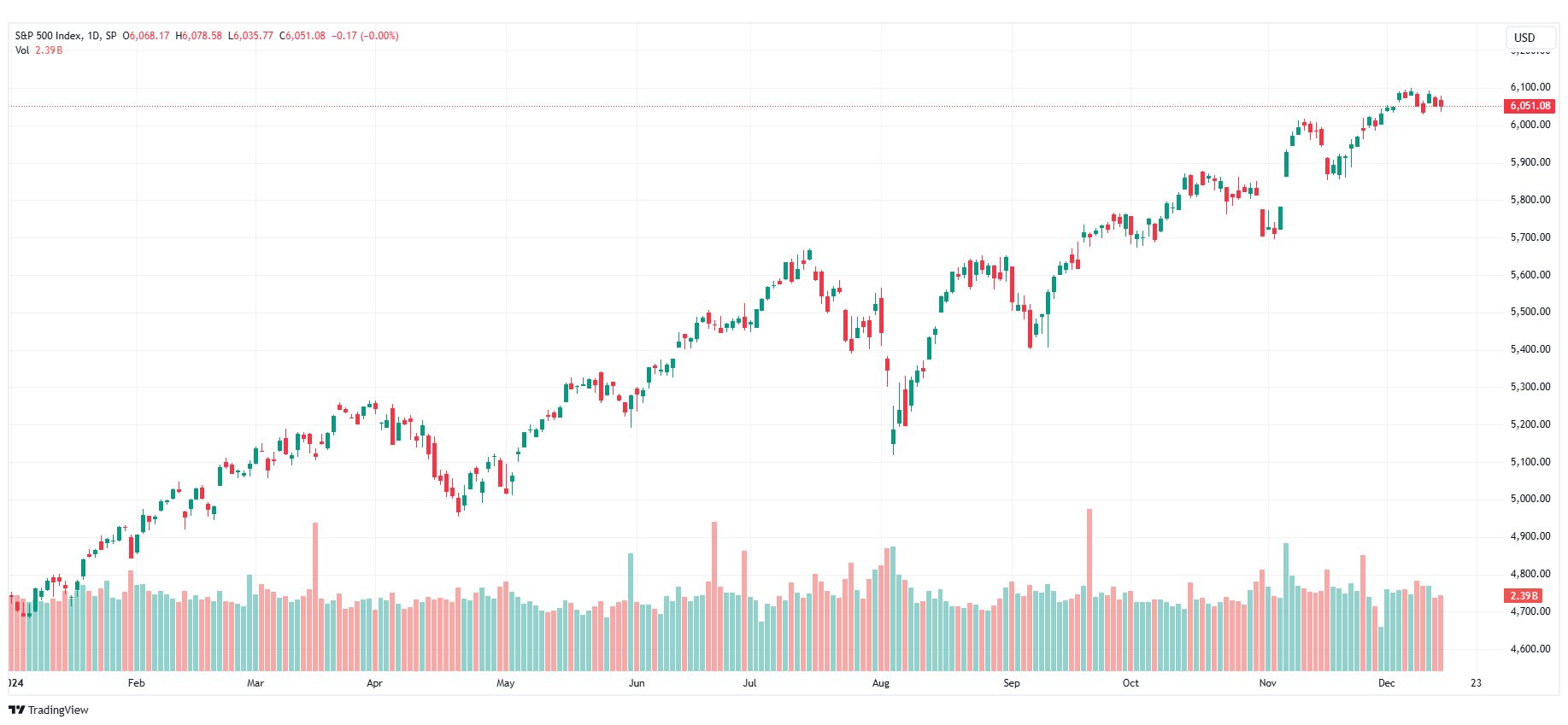

Since the global pandemic and subsequent hyperinflation, equity markets have had a tumultuous few years, Add to that the continued influence of geopolitical tensions, many leading economists and arguably most market participant the reality is that al always, “the market, does what the market does” and as of late 2024, major indices such as the S&P 500 and the MSCI World Index are trading near record highs.

In the U.S., the S&P 500 to date in 2024 is up a very impressive 26%, buoyed by continued earnings growth, the “artificial intelligence (AI) factor, and softening Federal Reserve, European equities lagged the US, but still gained with the FTSE hitting record highs in May and up around 8% year to date, and in Australia, an all-time high of 8514.50 in December of 2024, and showing a gain of close to 10% in 2024.

Resilience in the U.S. economy, a much “softer landing” (and avoidance of recession) than many had predicted in a high-interest rate environment, and very strong corporate earnings evidenced recently have all seen buying pressure predominate in stocks.

There are potential headwinds looming, with some uncertainty obvious as we get close to the end of the year. Some central banks remain reluctant to cut rates (e.g. The Reserve bank of Australia), and continued Chinese fiscal stimulus is perceived by markets to be a necessity rather than a luxury in terms of retaining a reasonable level of growth.Key Drivers for Equity Markets in 2025

Sector Opportunities for 2025

Global Trends and Regional Insights

10 Stocks to Watch in 2025

The following could benefit from some of the tailwinds discussed above, may outperform the market as a whole, and may prove resilient if the economy is not quite as robust as many think

All of the following are tradable on GO Markets MT5 platform as Share CFDs.

FIVE U.S. Stocks:

FIVE ASX Stocks:

Summary: Navigating Equity Markets in 2025

The equity markets in 2025 will likely be shaped by a delicate balance of macroeconomic, sectoral, and geopolitical forces. Investors should remain agile and open to potentially quick changes in market sentiment and be prepared for some form of sector rotation throughout 2025.

The potential impacts of U.S. presidential policies add another layer of complexity, requiring vigilance and adaptability.

Diversification across regions and industries, as well arguably similar diversification of approaches (i.e. some short-term, others medium-long term), may also be prudent,

As always, our education through Inner circle and daily updates with charts of the day, could be a good place to be not only to be informed but also assist in assessing risk and opportunity throughout the coming year.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

2024 and 2025 what happend and what will

2024 – Where did that go? As we sit here and review the last weeks of 2024, it has dawned on us that 2024 was the year of wanting everything and getting nothing. Now that might sound like a ridiculous statement considering equities across the MSCI world are averaging double digit returns for 2024. In fact in the US they are on track for two...

December 20, 2024Read More >Previous Article

Gold in 2025: Trends, Opportunities, and Challenges Ahead

As we examine what may happen in the new year, it is clear that gold continues to be of interest for investors seeking stability, diversification, and...

December 13, 2024Read More >