- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Zoom reports Q2 results – the stock dips

- 1 month -8.60%

- 3 months +8.56%

- Year-to-date -47.27%

- 1 year -71.59%

- Citigroup $91

- Bernstein $122

- Piper Sandler $115

- Goldman Sachs $142

- Stifel $120

- Benchmark $128

- Deutsche Bank $105

News & AnalysisZoom Video Communications Inc. (ZM) reported its latest financial results after the market close on Wall Street on Monday.

The US communications technology company reported revenue of $1.10 billion for the second quarter (up by 8% year-over-year), falling short of $1.117 billion expected.

Earnings per share reported at $1.05 per share vs. $0.94 per share estimate.

”In Q2, we continued to gain traction as the platform of choice for enterprises looking to deliver flexible, productive solutions for collaboration and customer engagement,” Founder and CEO of Zoom, Eric S. Yuan said in a statement following the results.

”Businesses are drawn to the Zoom platform because of our innovation and modern architecture. Our recently launched Zoom Contact Center and Zoom IQ for Sales products saw some great early wins while Zoom Phone delivered milestone results, hitting a record number of licenses sold in the quarter and reaching nearly 4 million seats, up more than 100% year over year,” Yuan added.

”In Q2, we delivered our fifth straight quarter with revenue of over one billion dollars. While we saw continued momentum with our Enterprise customers and our non-GAAP operating income came in meaningfully higher than our outlook, our revenue was impacted by the strengthening of the U.S. dollar, performance of the online business, and to a lesser extent sales weighted to the backend of the quarter,” said Kelly Steckelberg, CFO of the US company.

”Consequently, we are now expecting to deliver FY23 revenue in the range of $4.385 billion to $4.395 billion. We remain focused on operational discipline, and continue to expect non-GAAP operating margin of approximately 33%,” Steckelberg looked ahead.

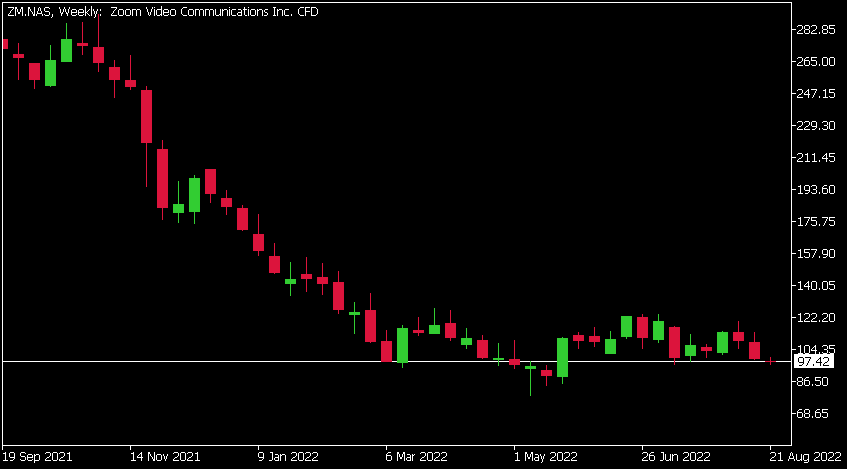

Zoom Video Communications Inc. (ZM) chart

The stock was down by 2.07% at the end of Monday at $97.42 a share. Shares were down by around 8% in the after-hours trading.

Here is how the stock has performed in the past year:

Zoom price targets

Zoom is the 603rd largest company in the world with a market cap of $28.97 billion.

You can trade Zoom Video Communications Inc. (ZM) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Zoom Video Communications Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

XPeng results are here – the stock price is falling

XPeng Inc. (XPEV) reported its unaudited Q2 financial results on Tuesday. The Chinese electric vehicle company reported revenue of $1.11 billion for Q2 (up by 97.7% from Q2 2021) vs. $1.09 billion expected. World’s 27th largest automaker reported a bigger loss per share than expected at -$0.47 loss per share for the quarter vs. -$...

August 24, 2022Read More >Previous Article

Deere & Co. results announced

Deere & Co. (DE) reported its financial results on Friday for the third quarter ended July 31, 2022. The American manufacturer of farm machiner...

August 22, 2022Read More >