- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Trading Strategies, Psychology

- Navigating the Curve: Backwardation and Contango in Futures Markets

- Home

- News & Analysis

- Trading Strategies, Psychology

- Navigating the Curve: Backwardation and Contango in Futures Markets

- Underlying Asset: The specific commodity, currency, or financial instrument being bought or sold.

- Quantity: The amount or size of the underlying asset in the contract.

- Price: The price agreed upon today for the asset’s delivery at a future date.

- Delivery Date: The future date on which the asset will be delivered or settled.

- Delivery Location (if applicable): The place where the physical asset will be delivered if the contract involves physical delivery.

- Hedgers: Futures contracts can be used to mitigate the risk of adverse price movements in an underlying asset. For example, airline companies, which use a lot of fuel and are sensitive to changes in oil prices, can buy oil futures to lock in current prices and protect themselves against future price hikes. If oil prices increase, the gains from the futures contract can offset the increase in fuel costs.

- Speculators: These are traders who seek profits by predicting market movements and opening positions accordingly. For example, a forex trader might think that the EUR/USD currency pair is going to rise in the next week based on economic indicators. The trader buys a futures contract on EUR/USD with the expectation of selling it later at a higher price.

- Arbitrageurs: These individuals aim to profit from price discrepancies in different markets or times. For instance, if natural gas is trading at $3.00 per million BTU in the U.S. market and at $3.10 in the European market, an arbitrageur could buy natural gas futures in the U.S. market and simultaneously sell in the European market, profiting from the price difference.

- Supply Concerns: If there are expectations of a supply disruption or scarcity of the underlying asset in the near term, the immediate futures contracts might be bid up in price relative to those further out.

- Storage Costs: For commodities with carrying costs, such as storage costs for physical delivery, backwardation can occur when the convenience of holding the physical asset immediately outweighs the cost of holding it for delivery in the future.

- Immediate Demand: If there is strong demand for the physical asset in the current period, futures contracts that reflect this demand might trade at a premium.

- Storage and Carrying Costs: If the cost of storing the physical asset for delivery in the future is higher, it can result in contango, as later contracts would need to compensate for these costs.

- Interest Rates: In some cases, the yield curve and interest rates might influence contango. If the cost of borrowing to buy the physical asset is lower than the expected gains from holding it, contango can occur.

- Market Sentiment: Contango can also emerge from market sentiment indicating that the current supply-demand balance is sufficient, but future uncertainties might lead to a higher price expectation.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisNavigating the Curve: Backwardation and Contango in Futures Markets

21 August 2023 By Mike SmithBackwardation and contango are terms used in the context of futures markets to describe the relationship between the prices of futures contracts with different expiration dates for a specific underlying asset, such as commodities, currencies, or financial instruments. In this article, we aim to explain these terms within the context of futures contracts.

Futures Contracts Revised

Let’s start with a brief overview of futures contracts. A futures contract is an agreement to buy or sell an asset at a predetermined price at a specified time in the future. These contracts are traded on organized futures exchanges and can relate to a wide variety of underlying assets, including commodities, currencies, stock indices, interest rates, and more.

Futures contracts can be settled in two ways: either through physical delivery, where the underlying asset is physically delivered on the specified date, or through cash settlement, where the difference between the contract price and the market price on the settlement date is paid in cash.

Each futures contract expires on the third business day prior to the 25th calendar day of the month preceding the delivery month.

There are five key components of a futures contract namely:

Futures contract participants are generally of three types

What are Backwardation and Contango?

Backwardation and contango describe the relationship between the spot price of an asset and the prices of multiple futures contracts for that same underlying asset with different expiration dates. Simply put, these states are determined by more than one price level.

Backwardation

Backwardation occurs when the futures prices for contracts with near-term expiration dates are higher than the prices for contracts with later expiration dates. This situation suggests that the market anticipates a shortage of the underlying asset in the near future.

Reasons for backwardation include:

Contango

Contango refers to a situation in which the futures prices for contracts with later expiration dates are higher than the prices for contracts with nearer expiration dates. Contango suggests that the market expects the supply and demand dynamics of the underlying asset to be more balanced in the near term and potentially oversupplied in the future.

Reasons for contango include:

The Futures Curve

Backwardation and contango are often illustrated through the use of a futures curve, which shows how the prices of futures contracts change over different time horizons.

This curve begins with the current spot price and includes the prices of futures contracts with various expiration dates. By connecting these points, the curve’s shape—whether in backwardation or contango—reveals market expectations about future supply and demand, the cost of carry, interest rates, and other factors.

Oil futures Example

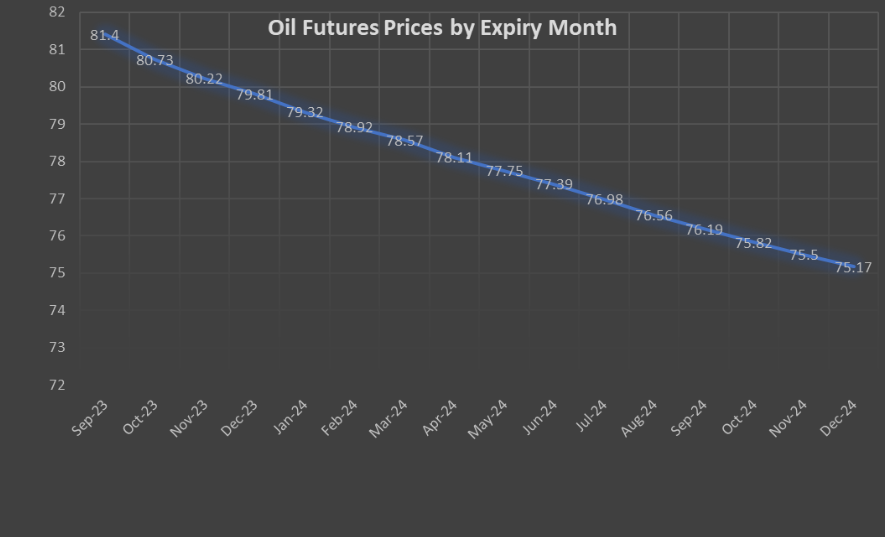

The following table below shows a snapshot of oil futures prices from August 2023.

Expiry Month Futures Prices by Expiry Month Sep-23 81.4 Oct-23 80.73 Nov-23 80.22 Dec-23 79.81 Jan-24 79.32 Feb-24 78.92 Mar-24 78.57 Apr-24 78.11 May-24 77.75 Jun-24 77.39 Jul-24 76.98 Aug-24 76.56 Sep-24 76.19 Oct-24 75.82 Nov-24 75.5 Dec-24 75.17 Although this is useful, the picture is far clearer when these prices are plotted on a graph (See below)

As you can see the slope is downwards and so would be described as in backwardation.

Where Can I Get Information on the Curve?

Most major financial exchanges that trade commodity futures, such as CME Group and Intercontinental Exchange (ICE), provide information on current futures curves.

Conclusion

Contango and backwardation are relevant to a wide spectrum of market participants, from speculative traders to long-term investors and from individual investors to companies and institutional entities. Understanding these market conditions is valuable for decision-making, risk management, and identifying potential opportunities.

GO Markets offers a wide range of CFD futures contracts that you can trade on platforms like MT4 and MT5, and we would be delighted to assist you with any questions you may have.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Money in Motion: The Factors Influencing Currency Appreciation and Depreciation

Currency appreciation refers to the increase in value of one currency relative to another currency or basket of currencies. Depreciation refers to the opposite scenario where a currency loses value against another. When a currency appreciates, it takes more units of other currencies to purchase one unit of the appreciating currency, and of cours...

August 21, 2023Read More >Previous Article

Averaging down: A Risky Move or a Smart Strategy?

Averaging down is an investment strategy in which an investor purchases additional shares or other assets at a lower price than their initial purchase...

August 21, 2023Read More >